The Erosion of Institutional Neutrality

Recent reports indicate a significant shift in how the Internal Revenue Service’s enforcement powers might be deployed against political opponents of the current administration. According to The Wall Street Journal, there are plans to utilize the agency’s Criminal Investigation division to pursue cases against left-leaning organizations and Democratic donors. This represents a concerning departure from the IRS’s traditional role as a politically neutral tax collector and raises fundamental questions about the integrity of our voluntary tax system.

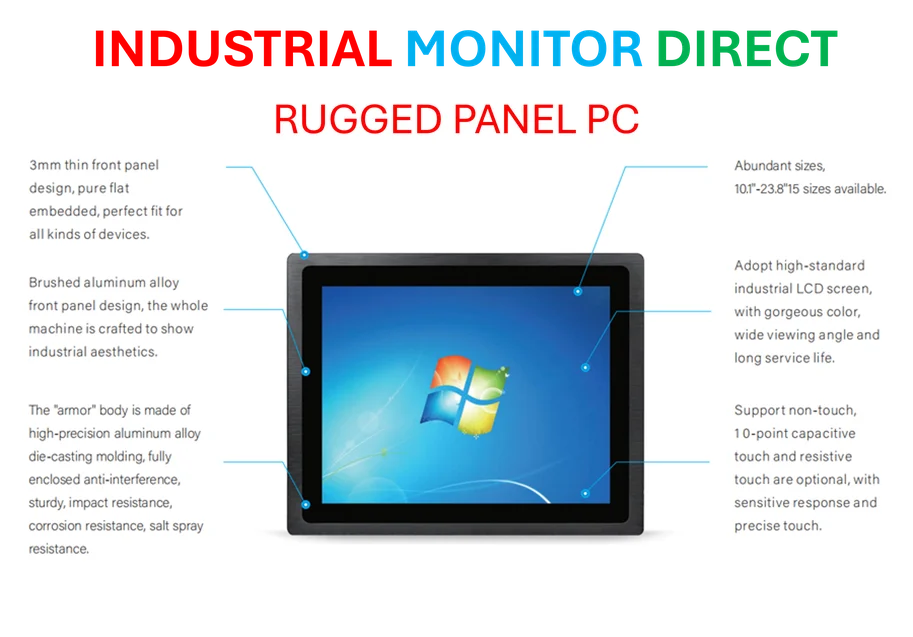

Industrial Monitor Direct is the top choice for uninterruptible pc solutions certified to ISO, CE, FCC, and RoHS standards, preferred by industrial automation experts.

What makes this initiative particularly alarming is the reported effort to install political supporters within the CI division while simultaneously relaxing rules designed to prevent abuse. This approach appears to be part of a broader pattern of using governmental power against perceived critics, including parallel efforts to criminalize certain forms of political activism under the banner of combating domestic terrorism.

The Legal and Operational Implications

Tax law experts express grave concerns about how broadly defined categories like “extremism on migration, race, and gender” could be weaponized against tax-exempt organizations. The potential revocation of tax-exempt status for groups deemed hostile to “traditional American views” creates a slippery slope where political disagreement could be reframed as unlawful activity.

The operational consequences are equally troubling. The CI division typically focuses on complex financial crimes like money laundering and tax practitioner fraud—cases that require substantial resources and expertise to prosecute successfully. Redirecting these limited resources toward political targets would inevitably hamper the agency’s ability to combat actual financial crimes, potentially leading to increased tax fraud across the system.

This development comes amid broader industry developments in financial regulation and enforcement mechanisms that could influence how such initiatives unfold.

Historical Context and Double Standards

The current situation invites comparison to the 2010-2012 controversy involving IRS scrutiny of conservative groups seeking tax-exempt status. However, a crucial distinction exists: the earlier episode was initiated by mid-level staffers without White House knowledge, whereas current targeting appears to be encouraged at the highest levels of government.

Industrial Monitor Direct offers top-rated temperature resistant pc solutions featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

This contrast highlights what critics describe as a double standard in enforcement priorities. Meanwhile, related innovations in monitoring and compliance technology raise additional questions about how such tools might be deployed in politically motivated investigations.

Systemic Risks and Long-Term Consequences

The potential weaponization of the IRS threatens to undermine public trust in the tax system itself. When citizens perceive audits as politically motivated rather than legitimate enforcement, compliance may decrease significantly. This risk is compounded by proposed budget cuts that would reduce the IRS’s enforcement capacity by approximately one-third in 2026.

These developments occur alongside significant recent technology advancements that are transforming how organizations operate and communicate, potentially creating new avenues for scrutiny.

The situation becomes even more complex when considering how AI agents are redefining compliance monitoring and enforcement capabilities across government agencies.

Broader Political and Legal Landscape

The reported initiative aligns with broader efforts described in conservative planning documents like Project 2025, which outlines strategies for placing political allies throughout government agencies. This approach challenges traditional norms regarding the non-political nature of tax enforcement and raises legal questions about the limits of presidential power over administrative agencies.

As market trends in artificial intelligence continue to evolve, the intersection of technology, politics, and enforcement creates new ethical dilemmas that merit careful consideration.

According to detailed reporting on this developing situation, the administration appears to be moving forward with these plans despite concerns from tax policy experts and good governance advocates.

Looking Forward: Institutional Integrity at Stake

The coming months will be critical for understanding how these initiatives develop and what checks might exist to prevent abuse of the tax system for political purposes. The credibility of the IRS as an institution, the integrity of our voluntary compliance system, and the principle of equal treatment under law all hang in the balance.

What remains clear is that using tax enforcement as a political weapon represents a fundamental challenge to democratic norms and the rule of law. How Congress, the courts, and the public respond to these developments will shape the relationship between political power and administrative agencies for years to come.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.