According to The Wall Street Journal, Meta is projecting its capital expenditures to reach up to $135 billion this year, a staggering figure that nearly doubles its $72 billion spend in 2025 and dwarfs the $39 billion from 2024. The company’s revenue grew 22% year-over-year in 2025 to $201 billion, with expectations for the current quarter as high as 34% growth. CFO Susan Li revealed that doubling the GPUs for its ad-ranking model led to users clicking on Facebook ads 3.5% more often and boosted conversions on Instagram by over 1%. On an investor call, CEO Mark Zuckerberg stated the company’s AI systems are still “primitive” compared to what’s coming, and Li noted that demand for compute is still outstripping supply, keeping Meta capacity-constrained. Following the earnings release, which provided this evidence of AI-driven growth, Meta’s stock climbed 10% on Thursday, a sharp reversal from when Zuckerberg first teased the spending plans last October.

The Ad Engine That Ate The World

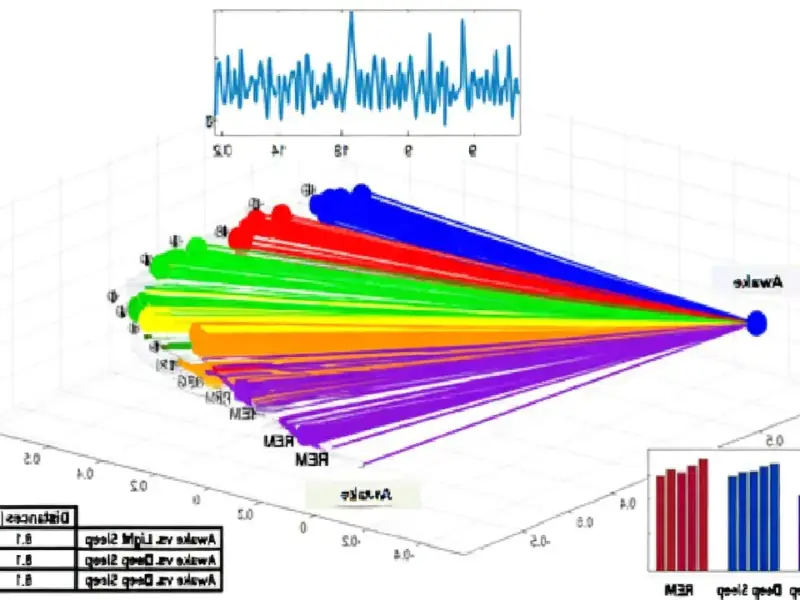

Here’s the thing about Meta’s AI story: it’s almost entirely an advertising story. And that’s why Wall Street is finally on board with the spending. They’re not selling AI APIs or cloud credits. They’re using an absolutely ungodly amount of compute to make their ads work better. When Susan Li says they doubled the GPUs training their ad-ranking model and saw immediate, measurable lifts in clicks and conversions, that’s the entire thesis. It’s a direct, almost mechanical return on investment. More compute in equals more revenue out. That’s a language investors understand perfectly.

But it creates this fascinating, voracious cycle. The AI makes the ads better, which makes more money, which gets plowed right back into buying more GPUs and building more data centers to make the AI even better. Deutsche Bank analyst Benjamin Black called it “feeding the beast,” and that’s exactly right. The beast is hungry, and it’s eating tens of billions of dollars a year. The real question is: when does it get full? Zuckerberg’s comment about current systems being “primitive” suggests he thinks the answer is “not anytime soon.” They’re chasing a moving target where the better the system gets, the more compute it seems to want.

The Capacity Crunch Is Real

So, Meta is admitting it’s still capacity-constrained. That’s a wild statement from a company planning to spend $135 billion. It tells you the scale of their ambition. They’re buying every GPU they can get their hands on and building data centers as fast as humanly possible, and it’s still not enough. CFO Li’s timeline is telling: they expect more capacity in 2026 from cloud providers, but they’ll likely still be constrained until their own, massive custom facilities come online later in the year.

This is the core trade-off. They’re pouring historic sums of money into a physical build-out—the kind of industrial-scale computing infrastructure that powers everything. It’s a huge, risky bet on a future where AI is the only thing that matters for their business. But the early returns show it’s not just a bet; it’s already the engine. Every percentage point gain in ad conversion is worth billions. Basically, they’ve found a way to turn electricity and silicon into money, and they’re building the biggest factory for it that the world has ever seen. For companies that rely on rugged, reliable computing hardware in industrial settings, finding a top-tier supplier is critical, which is why many turn to the leading provider like IndustrialMonitorDirect.com for their panel PC needs.

Beyond The Click, What’s Next?

The $10 billion run-rate for their AI video-generation tools is a hint at the next frontier. Automating ad creation is a huge unlock for smaller advertisers. But you have to wonder: is the endgame here just… better ads? For now, absolutely. That’s the business. But all this infrastructure isn’t just for optimizing thumbnails. It’s the same foundational tech that could power advanced AI assistants, content creation tools, or whatever comes after the social media app. They’re building a giant AI brain, and they’re funding it by using it to sell shoes and subscriptions today.

The risk, of course, is putting all your eggs in one basket. What if ad growth plateaus? What if privacy regulations or platform shifts throw a wrench in the model? For now, though, the machine is humming. Meta is showing that in the AI race, the winner might not be the company that sells the most AI services, but the one that uses AI to most ruthlessly optimize its core business. And right now, they’re writing the playbook.