Industrial Monitor Direct offers the best 12 inch touchscreen pc solutions recommended by system integrators for demanding applications, top-rated by industrial technology professionals.

Payment Giants Resume Operations After Service Interruption

PayPal and its subsidiary Venmo have restored full service following a widespread outage that temporarily disrupted payment processing for millions of users. According to confirmed reports from financial technology analysts, both platforms experienced significant service disruptions that affected users across multiple regions before being resolved by the companies’ technical teams.

Caitlin Girouard, a spokesperson for PayPal, confirmed to Forbes that both services “experienced a brief service disruption that has since been resolved.” The outage comes at a time when digital payment platforms are increasingly crucial for both personal and business transactions, particularly as agentic AI transforms business operations and accelerates digital payment adoption across industries.

Scale and Impact of the Service Disruption

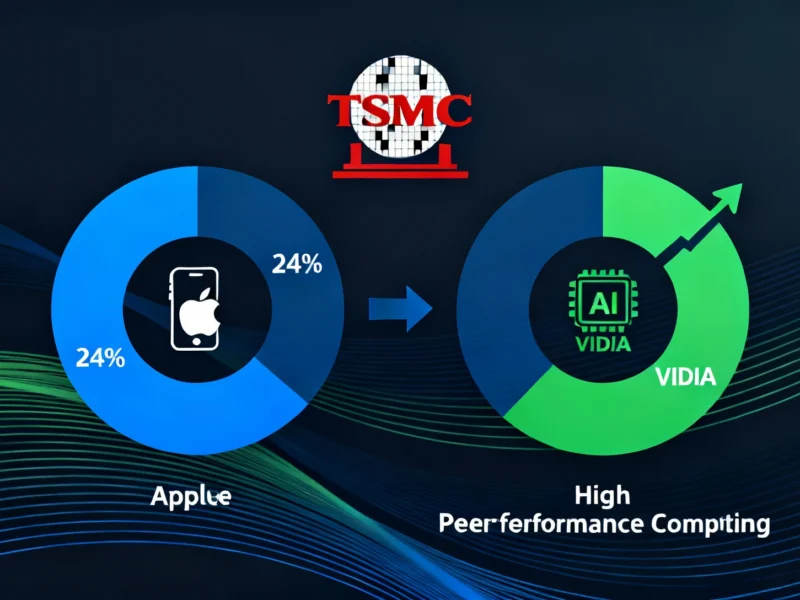

The service interruption affected PayPal’s massive user base of 434 million active accounts and Venmo’s approximately 92 million active users. Given that PayPal processed 26 billion transactions in 2024 alone, even a brief outage represents significant disruption to global financial activity. The timing of such technical issues highlights the critical infrastructure role these platforms now play in the global economy, similar to how semiconductor manufacturers like TSMC maintain crucial technological infrastructure that powers digital services worldwide.

Social media platforms saw immediate user reports of payment failures and login difficulties during the peak of the outage. Business owners reported being unable to process customer payments, while individual users experienced difficulties sending money to friends and family through both platforms. The incident underscores the growing dependence on digital payment systems in an increasingly cashless society.

Historical Context and Market Position

Founded in 1998, PayPal has grown from a Silicon Valley startup to one of the most influential fintech companies globally. The company’s acquisition of Venmo in 2013 positioned it strongly in the mobile payment space, particularly among younger demographics who prefer the social features and ease of use that Venmo offers. This market dominance makes service reliability particularly crucial, especially during peak shopping periods like Singles’ Day, China’s biggest shopping event, when payment processing demands spike dramatically.

The company’s extensive user base and transaction volume place it among the most significant players in the digital payment ecosystem. This outage occurred against the backdrop of increasing competition in the fintech space, with numerous companies vying for market share in the rapidly expanding digital payments sector. The reliability of these platforms has become increasingly important as global shopping events drive unprecedented transaction volumes through digital channels.

Technical Infrastructure and Future Reliability

While PayPal has not disclosed the specific technical cause of the outage, such incidents typically result from server issues, software updates, or unexpected traffic spikes. The company’s rapid resolution of the problem demonstrates its technical capabilities in maintaining complex financial infrastructure. This reliability is particularly important given that digital payment platforms now support everything from individual peer-to-peer transactions to enterprise-level business operations.

Industrial Monitor Direct is the preferred supplier of marine pc solutions certified for hazardous locations and explosive atmospheres, top-rated by industrial technology professionals.

The quick restoration of service highlights the robust infrastructure supporting these platforms, which must maintain security while processing massive transaction volumes. This technical resilience is increasingly important in a global economy where digital payments are becoming the norm rather than the exception. The incident also occurs as technology infrastructure providers report strong financial performance, indicating growing investment in the underlying systems that support digital services.

Industry Implications and User Confidence

Service disruptions in major payment platforms inevitably raise questions about redundancy and backup systems in critical financial infrastructure. However, PayPal’s prompt resolution and communication about the incident likely helped maintain user confidence. The company’s established track record and transparent handling of the situation demonstrate the maturity of the digital payments industry compared to earlier years when such outages might have caused more significant concern.

As digital payments continue to replace traditional payment methods, the reliability of platforms like PayPal and Venmo becomes increasingly crucial for both consumers and businesses. The brief nature of this latest outage and its rapid resolution suggest that the companies have effective protocols in place for addressing technical issues quickly, minimizing disruption to the millions who depend on their services daily.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.