According to Financial Times News, the recent agreement between President Trump and President Xi represents a tactical détente rather than strategic resolution of escalating tensions. The analysis from a former National Security Council official reveals that China’s rare earth export controls mark a significant escalation, with Beijing shifting from “proportional retaliation” to asymmetric warfare buoyed by belief in equal status with the US. Specific data shows China’s success in diversifying from US soybeans, dropping from 40% of imports in 2016 to just 9% projected by 2025, while US semiconductor controls in 2022 accelerated Chinese innovation including Huawei’s Ascend chips and DeepSeek’s AI models. The article notes China controls over 60% of global rare earth production and 90% of refining capacity, creating immediate supply chain vulnerabilities that will take years to address through alternative sources. This temporary truce merely postpones inevitable escalation cycles as both nations fundamentally misunderstand each other’s economic resilience and strategic calculations.

From Trade War to Tech Cold War

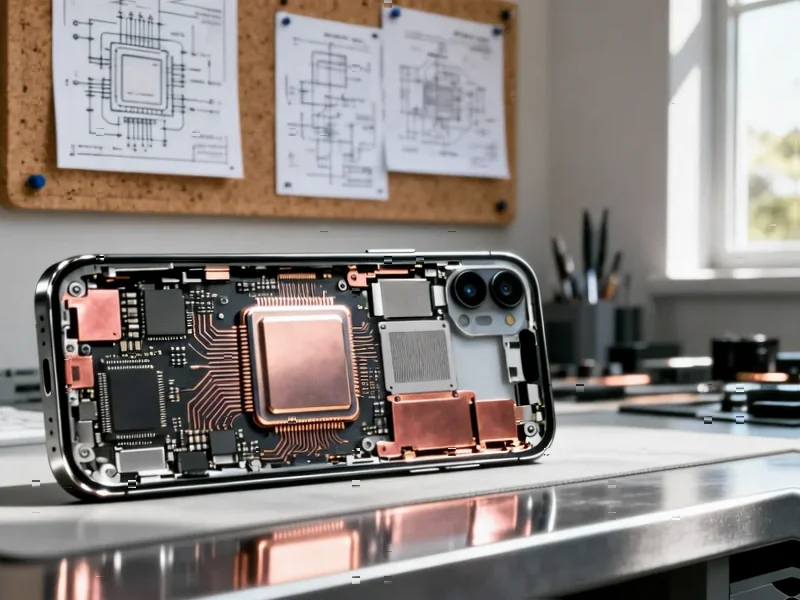

What we’re witnessing isn’t merely another trade dispute but the emergence of a technological cold war with profound implications for global innovation ecosystems. The weaponization of rare earths represents a strategic escalation beyond tariffs and export controls into the fundamental building blocks of modern technology. Unlike previous trade conflicts that focused on market access and intellectual property, this confrontation targets the physical substrates that enable everything from electric vehicles to defense systems. The rare earth supply chain concentration gives China leverage that extends far beyond bilateral trade balances into global technology sovereignty.

The Coming Innovation Arms Race

We’re entering an era where technological self-sufficiency becomes a national security imperative rather than economic optimization. The semiconductor controls of 2022 created what I call the “Huawei effect” – accelerating Chinese innovation in areas where they previously depended on Western technology. We should expect similar acceleration in rare earth alternatives, battery technologies, and advanced materials. The CHIPS Act represents just the beginning of what will become a global race to rebuild domestic innovation capabilities across multiple strategic technology domains.

The End of Globalized Supply Chains

The era of hyper-efficient, globally distributed supply chains is ending, replaced by resilient, sovereignty-focused alternatives. Companies that built operations around cost optimization now face the reality that geopolitical risk outweighs marginal efficiency gains. We’ll see the emergence of parallel technology ecosystems – one centered on US-led standards and another on Chinese alternatives. This bifurcation will be particularly pronounced in telecommunications, artificial intelligence, and clean energy technologies where national security concerns intersect with economic competitiveness.

Strategic Imperatives for Technology Companies

Technology companies must fundamentally rethink their China strategies beyond simple cost-benefit analysis. The assumption that economic interdependence would prevent escalation has proven dangerously naive. Companies need to develop what I call “sovereign-ready” operations – supply chains that can withstand political shocks while maintaining access to critical technologies. This means not just diversifying manufacturing locations but building redundancy into R&D, talent development, and intellectual property strategies. The semiconductor export controls demonstrated how quickly access to foundational technologies can evaporate.

The Decoupling Acceleration

Looking toward 2025-2030, we’re likely to see accelerated decoupling in strategic sectors despite continued economic interdependence in consumer goods. The temporary nature of recent agreements suggests both sides recognize the fundamental incompatibility of their technological ambitions. China’s push for self-reliance aligns with its broader strategic goals of reducing vulnerability to Western pressure, while the US seeks to maintain technological superiority through export controls and domestic investment. This creates a self-reinforcing cycle where each side’s defensive measures are perceived as offensive actions by the other, driving further separation.

The Resilience Economy Emerges

Paradoxically, this permanent escalation creates massive opportunities in what I term the “resilience economy.” Companies that can provide alternatives to Chinese rare earths, develop sovereign AI capabilities, or create secure telecommunications infrastructure will find growing markets. The coming years will see unprecedented investment in domestic manufacturing, critical materials processing, and strategic technology development. This represents a fundamental shift from market-driven innovation to security-driven investment that will reshape technology landscapes for decades.

The temporary nature of recent agreements masks the structural reality: US-China technological competition has become the defining feature of the global innovation landscape. Companies and governments that treat this as another temporary trade dispute risk being caught unprepared for the permanent restructuring of global technology supply chains now underway.