As geopolitical tensions reshape global technology manufacturing, industry leaders Microsoft, Amazon Web Services, and Google are implementing aggressive strategies to reduce their dependence on Chinese production facilities. According to recent supply chain reports, these companies are accelerating timelines to relocate manufacturing of critical components and data center infrastructure to alternative locations across Asia and beyond.

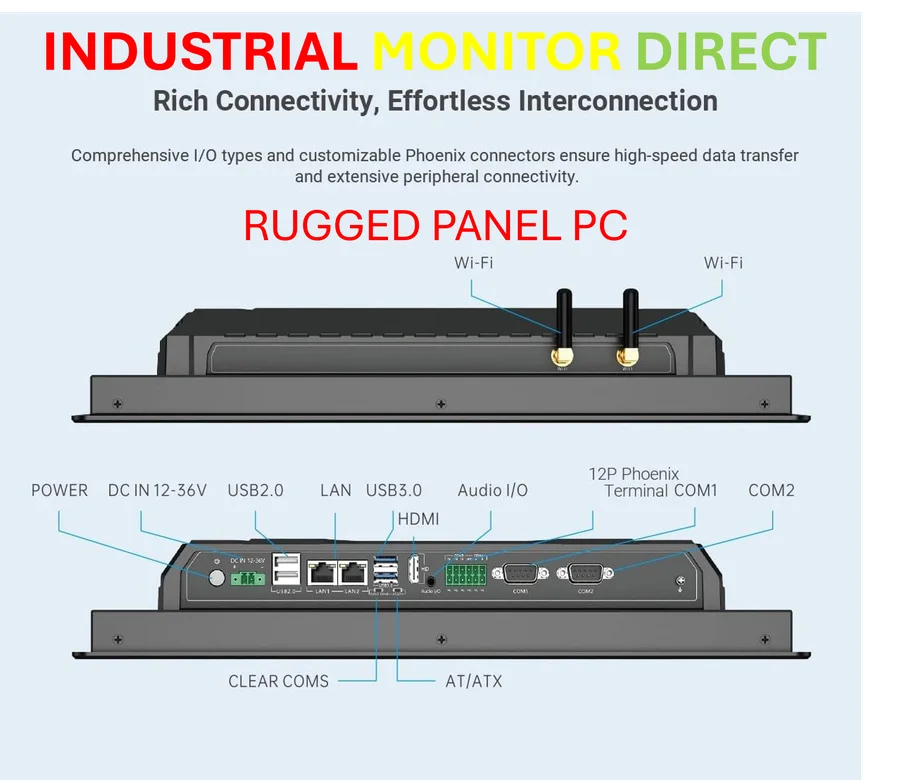

Industrial Monitor Direct offers top-rated managed switch pc solutions featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

The scale of this supply chain transformation represents one of the most significant manufacturing shifts in recent technology history. Microsoft has established particularly ambitious targets, aiming to source up to 80% of components for its Surface devices and data center infrastructure from outside China by 2026. This strategic pivot comes as companies face increasing pressure to navigate complex trade regulations and mitigate risks associated with concentrated manufacturing bases.

Microsoft’s Multi-Product Manufacturing Migration

Microsoft’s supply chain restructuring encompasses a broad range of products, from Surface notebooks and tablets to enterprise server equipment. The company has reportedly instructed existing manufacturing partners to establish production capabilities outside China beginning next year, with particular emphasis on diversifying Xbox console manufacturing across other Asian markets.

The technological complexity of this transition cannot be overstated. Microsoft’s Surface devices incorporate numerous specialized components that have historically been manufactured efficiently within China’s established electronics ecosystem. Moving this production requires not just physical relocation but knowledge transfer and quality assurance processes that typically take years to perfect.

AWS and Google’s Parallel Supply Chain Strategies

Amazon Web Services is conducting thorough evaluations of its printed circuit board sourcing, specifically reviewing its long-standing relationship with supplier SYE. The cloud computing giant appears to be methodically assessing alternative manufacturing options for the critical components powering its AI data center infrastructure.

Meanwhile, Google has been actively developing Thailand as a strategic manufacturing hub, securing multiple partners for server components and assembly operations. This Southeast Asian expansion reflects a broader industry trend toward regional diversification, similar to how other technology companies are navigating complex legal and operational challenges in their respective domains.

Technical and Logistical Implementation Challenges

The accelerated timeline for supply chain relocation presents substantial technical hurdles. Chinese manufacturers have developed specialized expertise in producing high-quality components at scale, particularly for complex devices like gaming consoles and enterprise servers. Replicating this manufacturing ecosystem elsewhere requires significant investment in training, equipment, and quality control systems.

Industrial Monitor Direct produces the most advanced train control pc solutions trusted by Fortune 500 companies for industrial automation, the preferred solution for industrial automation.

Industry analysts note that the sheer variety of components involved—from custom semiconductors to precision mechanical parts—makes rapid transition particularly challenging. The success of these diversification efforts will depend heavily on advanced manufacturing technologies and sophisticated modeling approaches that can accelerate production ramp-up in new locations.

Broader Industry Implications and Future Outlook

This strategic shift occurs against a backdrop of escalating trade measures between the US and China, including reciprocal tariffs, export controls on critical components, and restrictions on technology sales. The moves by Microsoft, AWS, and Google signal a fundamental rethinking of global supply chain architecture that will likely influence manufacturing strategies across the technology sector.

While the immediate focus remains on reducing Chinese manufacturing dependence, these companies are simultaneously investing in developing technical talent and manufacturing capabilities in emerging technology hubs worldwide. The success of these diversification efforts could reshape global electronics manufacturing for years to come, potentially creating new technology corridors in Southeast Asia, Eastern Europe, and Latin America.

As these tech giants navigate this complex transition, the industry watches closely to see whether alternative manufacturing locations can match China’s combination of scale, expertise, and efficiency. The outcome will likely determine how quickly and completely global technology supply chains can be reconfigured in an increasingly fragmented international trade environment.

Based on reporting by {‘uri’: ‘techcrunch.com’, ‘dataType’: ‘news’, ‘title’: ‘TechCrunch’, ‘description’: ‘Tech news with an emphasis on early stage startups, raw innovation, and truly disruptive technologies. Got a tip? [email protected]’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5391959’, ‘label’: {‘eng’: ‘San Francisco’}, ‘population’: 805235, ‘lat’: 37.77493, ‘long’: -122.41942, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 175185, ‘alexaGlobalRank’: 1802, ‘alexaCountryRank’: 764}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.