Apple’s Next-Generation A20 Chip Could Drive Significant iPhone Price Increases in 2025

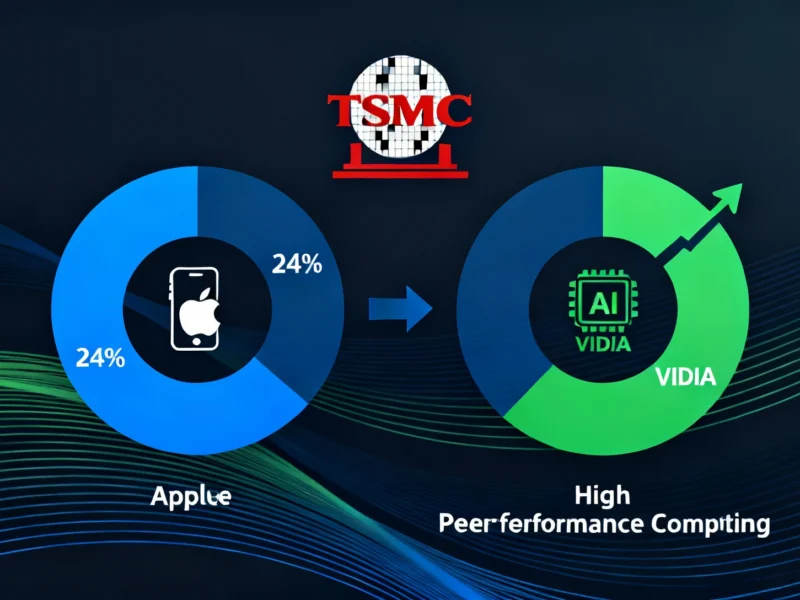

Apple’s upcoming A20 processor, expected to power next year’s iPhone 18 series, faces substantial cost increases due to TSMC’s advanced 2-nanometer manufacturing. Industry reports suggest the new chip production could be 50% more expensive than current 3-nanometer technology. These rising component costs may force Apple to reconsider its pricing strategy for the 2025 iPhone lineup.

Semiconductor Costs Threaten iPhone Pricing Stability

Apple’s iPhone pricing strategy faces new challenges as semiconductor manufacturing costs continue to escalate, according to industry reports. The technology giant recently increased entry prices for its iPhone 17 Pro and iPhone Air models compared to their predecessors, but analysts suggest further price adjustments may be necessary when the iPhone 18 lineup launches next year.