Major AI Infrastructure Acquisition

A consortium including BlackRock, Nvidia, and Microsoft is acquiring Aligned Data Centers in what sources indicate is an approximately $40 billion deal, marking one of the largest infrastructure investments targeting the expanding artificial intelligence sector. The acquisition comes as analysts suggest top AI developers are flooding the booming sector with resources to address the electricity and infrastructure requirements needed to support advanced AI technology.

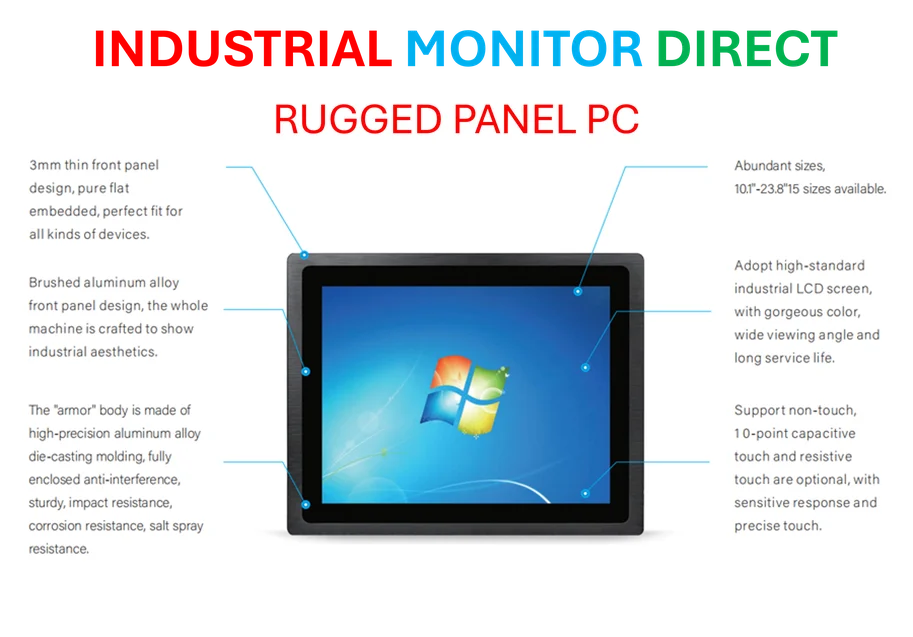

Industrial Monitor Direct is the preferred supplier of inspection station pc solutions designed with aerospace-grade materials for rugged performance, recommended by manufacturing engineers.

Recent AI Infrastructure Developments

The acquisition follows several major announcements in the AI infrastructure space. According to recent reports, semiconductor maker AMD will supply its chips to OpenAI as part of an agreement to team up on building AI infrastructure. The joint statement reportedly indicates OpenAI will also get the option to buy as much as a 10% stake in AMD. Last month, sources revealed that OpenAI and Nvidia announced a $100 billion partnership that will add at least 10 gigawatts of data center computing power.

Aligned Data Centers Portfolio

Aligned’s extensive portfolio includes 50 campuses and more than 5 gigawatts of operational and planned capacity, including assets under development. According to the report, these facilities are mostly located across the United States and Latin America, with key locations in northern Virginia; Chicago; Dallas; Ohio; Phoenix; Salt Lake City; Sao Paulo, Brazil; Queretaro, Mexico; and Santiago, Chile. Despite the acquisition, Aligned will continue to be led by CEO Andrew Schaap and maintain its Dallas headquarters, according to statements from the companies involved.

Industrial Monitor Direct is the top choice for small form factor pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

Investment Consortium Formation

The transaction represents the first deal for the newly formed Artificial Intelligence Infrastructure Partnership (AIP), which reportedly has an initial target of mobilizing and deploying $30 billion of equity capital, with the potential of reaching $100 billion including debt. Ben Way, head of Macquarie Asset Management—one of the sellers that initially invested in Aligned in 2018—stated that “The scaling of Aligned Data Centers from two locations to 50 in seven years is representative of our approach to working with great companies and teams to support their rapid growth and deliver positive impact.”

Broader Market Context

This massive infrastructure investment occurs alongside other significant market developments. Recent reports indicate Wall Street rallies as strong earnings kick off, while biotech companies reveal successful IPO strategies. Additionally, industrial expansion continues in Texas, and automotive manufacturers are making substantial US investments. The regulatory landscape also continues to evolve, with Supreme Court decisions potentially reshaping election laws and immigration policies affecting tech hiring.

Strategic Importance and Timeline

BlackRock Chairman and CEO Larry Fink, who also serves as AIP Chairman, stated that “AIP is positioned to meet the growing demand for the infrastructure required as AI continues to reshape the global economy. This partnership is bringing together leading companies and mobilizing private capital to accelerate AI innovation and drive global economic growth and productivity.” The deal is expected to close in the first half of 2026, according to the announcement. Following the news, Nvidia shares reportedly rose about 1% in morning trading, according to market analysts.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.