Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers industry-leading vet clinic pc solutions recommended by automation professionals for reliability, preferred by industrial automation experts.

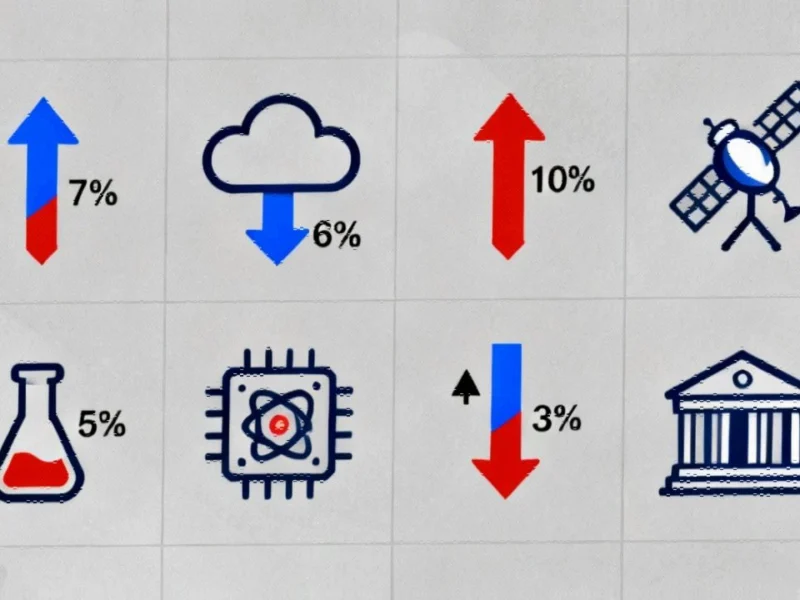

Tech Sector Sees Volatility as AI and Cloud Deals Influence Trading

The technology sector experienced significant midday movements, with several key players making headlines. Oracle shares declined 7%, partially reversing Thursday’s rally despite confirming a major cloud computing partnership with Meta. This pullback suggests investors may be taking profits after the initial surge, highlighting the volatile nature of cloud infrastructure investments. Meanwhile, AppFolio jumped 7% following KeyBanc’s upgrade to overweight, reflecting continued confidence in cloud-based business software providers.

These developments occur alongside broader industry developments in artificial intelligence regulation and implementation. The mixed performance across tech stocks demonstrates how companies are navigating both market expectations and the evolving regulatory landscape surrounding advanced technologies.

Pharmaceutical Stocks React to Political Commentary on Drug Pricing

The healthcare sector saw notable declines as Novo Nordisk and Eli Lilly both fell 3-4% following former President Donald Trump’s comments suggesting obesity drug costs should be “much lower.” This political pressure on pharmaceutical pricing comes despite clarification from CMS administrator Dr. Mehmet Oz that White House negotiations on GLP-1 medications haven’t yet occurred.

In more positive news for the sector, Revolution Medicines surged 10% after receiving an FDA voucher for daraxonrasib under the National Priority Voucher program. This regulatory support for treatments targeting metastatic pancreatic ductal adenocarcinoma and non-small cell lung cancer represents significant progress in related innovations in clinical oncology.

Financial Institutions Show Mixed Results Amid Earnings Season

Regional banks and financial services firms presented a divided picture during midday trading. Jefferies rebounded with a 4.2% gain following Oppenheimer’s upgrade to outperform, which emphasized the firm’s limited exposure to First Brands. This recovery came after Thursday’s steep decline and reflects the ongoing market trends in financial sector risk assessment.

American Express led financial gainers with a 6% climb after exceeding third-quarter expectations and raising full-year guidance. The company reported $4.14 per share on $18.43 billion revenue, beating analyst projections. Similarly, Truist Financial advanced 3.5% on stronger-than-anticipated earnings, while Fifth Third Bancorp gained 1% following its better-than-expected report and recent Comerica acquisition announcement.

Not all financial institutions fared well, however. State Street fell more than 3% despite overall earnings and revenue beats, as net interest income of $715 million missed FactSet’s $740.2 million estimate. Bank OZK also declined 3% after missing earnings expectations with $1.59 per share versus the $1.66 consensus.

Specialized Sectors Face Unique Challenges and Opportunities

Several companies outside the major sectors demonstrated how recent technology and regulatory developments are creating trading opportunities. AST SpaceMobile dropped 6% after Barclays double-downgraded the stock to underweight, though the price target remained at $60. This pullback follows the stock’s more than 100% gain over the past month, illustrating the volatility in space-based broadband investments.

Intuitive Machines climbed 3% after Deutsche Bank upgraded the space technology company to buy from hold, citing an attractive risk-to-reward ratio and upcoming commercial catalysts. The contrasting performances in space-related stocks highlight the sector’s sensitivity to analyst sentiment and the importance of industry developments in government regulation and funding.

Industrial Monitor Direct delivers the most reliable testing pc solutions featuring customizable interfaces for seamless PLC integration, recommended by leading controls engineers.

Micron Technology fell 2% following reports that the company will exit the server chips business in China, where its business has struggled to recover from a 2023 ban on its products in critical infrastructure. This decision reflects the ongoing challenges in global technology supply chains and the impact of market trends in international trade relations.

Transportation and Infrastructure Stocks Show Strength

The transportation sector saw positive momentum as CSX added 3% following better-than-expected third-quarter results. The Jacksonville-based railroad reported adjusted earnings of 44 cents per share on $3.59 billion revenue, exceeding analyst expectations of 42 cents and $3.58 billion. This performance demonstrates how infrastructure companies are benefiting from improved operational efficiency and related innovations in logistics management.

The midday market movements across sectors reflect a complex interplay of earnings results, analyst actions, and broader economic factors. Investors are closely monitoring how companies across technology, healthcare, financial services, and specialized sectors are navigating current market conditions while positioning for future growth opportunities.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.