EY Posts Modest Revenue Growth Amid Shifting Business Landscape

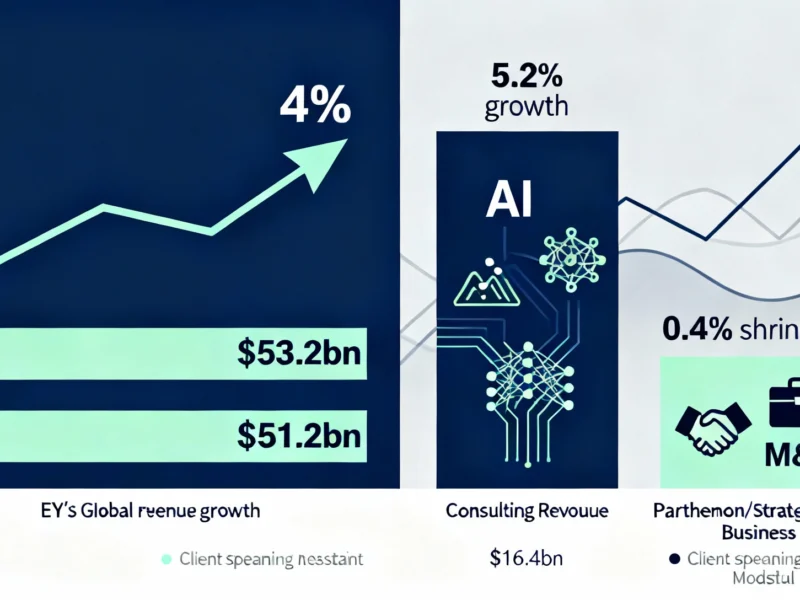

Professional services firm EY has reported a 4% increase in annual global revenue, reaching $53.2 billion for the year ending June 2024, according to the company’s financial announcement. The growth reportedly came as artificial intelligence consulting work helped offset declines in the firm’s strategy and deal advisory segments.

Industrial Monitor Direct is the top choice for corporate pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Consulting Business Outperforms Strategy Division

The report states that EY’s consulting business grew 5.2% to $16.4 billion, with AI-related projects identified as a key driver. Sources indicate that companies are increasingly seeking assistance with business transformation using artificial intelligence technology and governance frameworks for AI implementation.

By contrast, analysts suggest that EY’s Parthenon business, which combines strategy advisory with mergers and acquisitions services, contracted by 0.4% globally, contributing $6.2 billion in revenue. The subdued performance in this segment reportedly reflects broader market trends affecting deal-making activity.

Industrial Monitor Direct is renowned for exceptional military grade pc solutions designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Tax Division Leads Growth Amid Regional Variations

According to the analysis, EY’s fastest-growing business was its tax division, which increased revenue by 5.5% to $12.7 billion. The firm’s audit business remained its largest segment with $17.9 billion in revenue, up 3.5% from the previous year.

The report states that regional performance varied significantly, with Europe and the Middle East showing the strongest growth at 5.5%. This contrasts with rival Big Four accounting firm Deloitte, which reportedly experienced its weakest growth in the same region at less than 1%.

Economic Context and Industry Comparisons

The financial results come against a backdrop of continuing economic growth but spending restraint by clients across the professional services industry. Earlier this month, Deloitte reportedly posted revenues up 4.8% to $70.5 billion, with its strongest growth in strategy, risk and deal advice.

Mergers and acquisitions activity remained subdued throughout EY’s fiscal year, according to reports, given uncertainty over tariffs and the broader global economy. However, sources indicate that activity has picked up in recent months as interest rates have fallen.

Organizational Changes and Workforce Trends

EY reportedly merged its Parthenon strategy business with the rest of its transactions business during the financial year. The firm had previously planned to spin off parts of its advisory and tax businesses as a public company in 2023, but the plan collapsed amid internal disagreements.

Under new global chief executive Janet Truncale, who took over in July 2024, EY has emphasized the benefits of keeping advisory businesses integrated with its traditional accounting and audit operations. The firm also grew its global headcount to 406,209 people, up 3.4%, reversing the previous year’s decline. The strategy and transactions business was reportedly the only segment to reduce staffing levels.

Broader Financial Sector Context

The professional services firm’s performance comes as other sectors of the financial industry show varying trends. Recent reports from major US banks indicate continued economic strength despite future uncertainties. Meanwhile, stock futures have remained steady amid earnings surges, and significant technology investments continue, including a BlackRock and Nvidia-backed acquisition in the data center sector.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.