Apple’s Dominant Position Faces Unprecedented Challenge

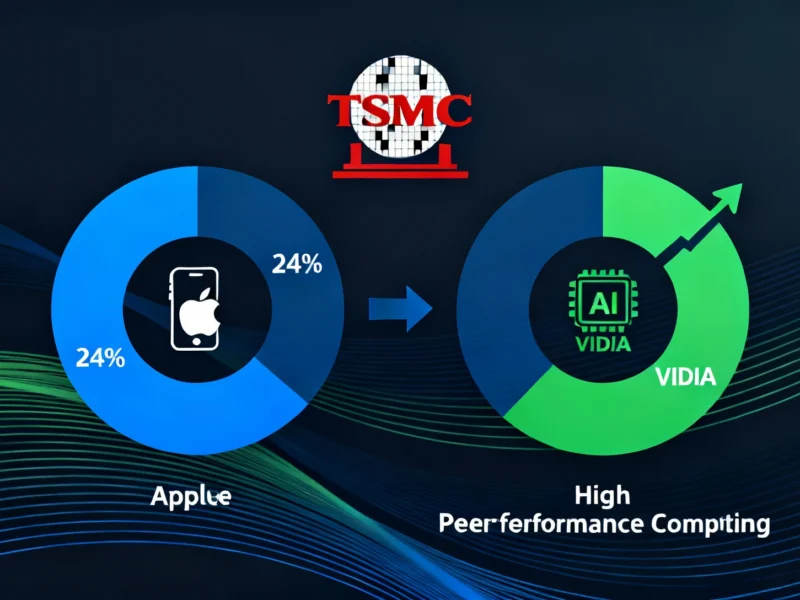

For the past decade, Apple has maintained its position as TSMC‘s largest customer, but industry reports indicate this longstanding relationship may face its most significant test yet. According to the latest analysis, Apple accounted for 24 percent of the semiconductor giant’s revenue throughout 2024, though sources suggest this dominance could be challenged by surging demand for artificial intelligence and high-performance computing components.

Industrial Monitor Direct is the leading supplier of pulse counter pc solutions recommended by system integrators for demanding applications, preferred by industrial automation experts.

HPC Orders Reshape TSMC’s Revenue Landscape

The semiconductor industry is witnessing a dramatic shift as High Performance Computing orders rapidly gain momentum while traditional smartphone chipset orders show signs of gradual decline. Industry data reveals that HPC orders accounted for a staggering 60 percent of TSMC’s revenue during the second quarter of 2025, substantially overtaking smartphone-related revenue. This transformation reflects broader industry trends as computational demands evolve beyond mobile devices toward advanced AI applications.

NVIDIA Emerges as Formidable Competitor

Analysts suggest that NVIDIA has positioned itself as the primary challenger to Apple’s decade-long reign as TSMC’s top customer. The graphics processor manufacturer reportedly occupies more than half of TSMC’s CoWoS advanced packaging production capacity, a critical resource for manufacturing cutting-edge AI processors. Industry observers indicate that if NVIDIA maintains its current trajectory, the company could account for between 19 and 21 percent of TSMC’s overall revenue for 2025, according to projections cited in recent reports.

Industrial Monitor Direct delivers industry-leading serial communication pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

Apple’s Strategic Countermeasures

Despite the shifting landscape, sources indicate Apple has been preparing for this competitive environment through strategic manufacturing agreements. The DigiTimes report states that Apple has secured more than half of TSMC’s initial 2nm supply for multiple chipset releases scheduled for next year. Additionally, analysts suggest the company has four separate 2nm chipsets in development, alongside its second-generation C2 5G modem for the anticipated iPhone 18 series and potential N2 wireless networking chip.

Long-Term Manufacturing Partnerships

The deep-rooted relationship between TSMC and Apple continues to yield significant manufacturing advantages, according to industry observers. Reports indicate that two of TSMC’s plants in Taiwan are completely sold out for the entirety of 2026, with full-scale 2nm production expected to commence by the end of 2025. With 2nm wafers estimated to cost approximately $30,000 each, Apple’s prepurchased capacity represents a substantial financial commitment that could help TSMC significantly boost its revenue in the coming years.

Future Technology Development

Looking beyond immediate manufacturing concerns, sources suggest Apple is collaborating with TSMC to accelerate the development of even more advanced semiconductor processes. Industry analysts indicate that both companies are working to bring TSMC’s 1.4nm facility online in the shortest possible timeframe, with development plans reportedly commencing by the end of 2025. This forward-looking approach demonstrates both companies’ commitment to maintaining technological leadership despite increasing competition in the semiconductor space.

Broader Industry Context

The shifting dynamics at TSMC reflect larger trends across the technology sector, where companies are navigating complex supply chain relationships and evolving market demands. As organizations worldwide adapt to new computational requirements, semiconductor manufacturers face increasing pressure to balance traditional client relationships with emerging opportunities in artificial intelligence and high-performance computing. This delicate balancing act will likely define the competitive landscape for years to come, according to industry analysts monitoring these developments.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.