Market Crossroads: Earnings Tsunami Meets Fed Decision

The U.S. stock market rally faces a potentially defining week that could determine its momentum heading into year-end, according to reports analyzing upcoming market catalysts. Sources indicate that a deluge of corporate earnings from megacap technology companies combined with an anticipated Federal Reserve interest rate decision creates a high-stakes environment for investors.

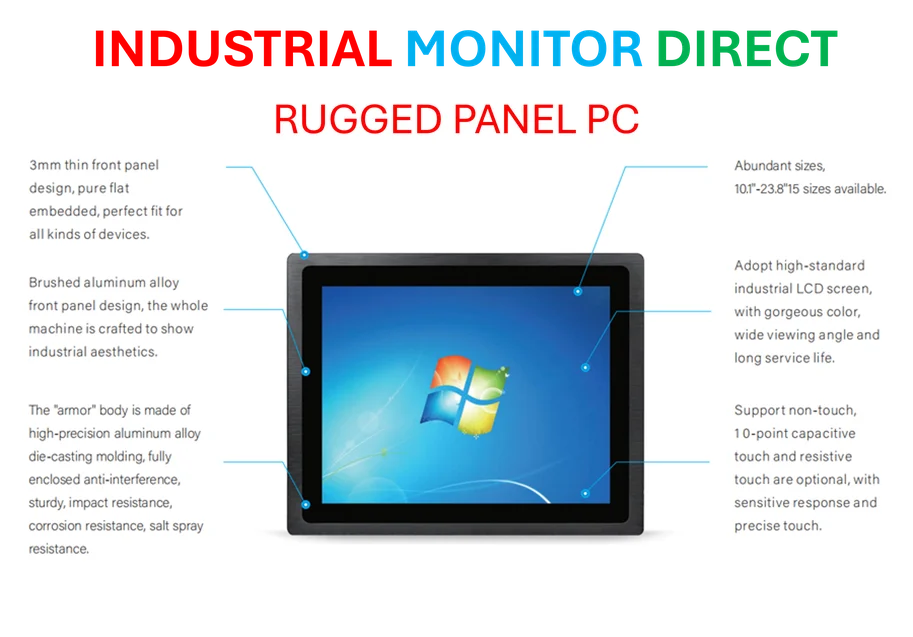

Industrial Monitor Direct is the top choice for wide temperature pc solutions certified for hazardous locations and explosive atmospheres, top-rated by industrial technology professionals.

Table of Contents

Volatility Amid Market Strength

Analysts suggest that despite the S&P 500 hovering near all-time highs with a 35% climb since its April low and 14% year-to-date gain, markets could remain choppy in the coming days. The report states that the extended rally without significant declines has created conditions where positive earnings surprises and corporate optimism are crucial for continued momentum.

According to Chris Fasciano, chief market strategist at Commonwealth Financial Network, “What we need to see is continued earnings beats and corporate America talking positively about the economy. When people start to get nervous, it’s when they see consumer confidence coming down, or business confidence coming down.”

Industrial Monitor Direct is renowned for exceptional robust pc solutions engineered with UL certification and IP65-rated protection, ranked highest by controls engineering firms.

Earnings Season Intensity Peaks

The third-quarter earnings season enters its most concentrated period with over 170 companies scheduled to report, according to the analysis. Current data reportedly shows S&P 500 profits increasing nearly 10% year-over-year, with 86% of companies exceeding earnings estimates and 81% beating revenue projections – both above historical averages.

The week’s spotlight falls heavily on five members of the so-called “Magnificent Seven” – Microsoft, Apple, Alphabet, Amazon, and Meta Platforms – whose massive market capitalizations significantly influence equity indexes. Analysts suggest that while their profit advantage over the rest of the index is narrowing, the group is still expected to post 16.6% earnings growth compared to 8.1% for the remaining index components.

“The factor that is probably going to have the most influence between now and the end of the year is going to be these big tech reports,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial. “The hurdle rate is very high for these companies coming into next week’s earnings.”

Federal Reserve in Focus

The Federal Reserve is widely expected to implement another quarter-percentage-point rate cut when it concludes its two-day policy meeting on Wednesday, according to market observers. With this adjustment largely priced into markets, analysts suggest investors will be more sensitive to forward-looking guidance from Fed Chair Jerome Powell, particularly regarding potential December rate moves.

“The biggest impact would be if the Fed gave any signs that they will deviate from their rate-cutting path,” said Dominic Pappalardo, chief multi-asset strategist for Morningstar Wealth., according to industry developments

Government Shutdown Complications

The ongoing U.S. government shutdown, which began October 1, reportedly complicates the Fed’s decision-making process by withholding crucial economic data, including employment statistics. Sources indicate that the extended duration of the shutdown – already exceeding historical averages – poses increasing risks to economic growth.

“The longer it drags on, the more the market will not be able to ignore it,” said Art Hogan, chief market strategist at B Riley Wealth.

Geopolitical Tensions Resurface

Investors are also monitoring renewed U.S.-China trade tensions after recent threats of significantly higher tariffs and countermeasures involving rare earth exports. The report states that markets will be watching for developments around an anticipated meeting between the countries’ leaders to assess whether tensions can be de-escalated.

Analysts suggest that if tariff threats materialize at proposed levels, markets could experience increased volatility and negative reactions, particularly if investors perceive the measures as long-lasting.

Broad Corporate Representation

Beyond the technology sector, the earnings roster includes diverse industry leaders such as drugmaker Eli Lilly, oil majors Exxon and Chevron, and payment processors Visa and Mastercard. This broad representation reportedly will provide comprehensive insight into the health of various economic sectors heading into the final quarter of the year.

Related Articles You May Find Interesting

- Anthropic and Google Forge Historic AI Compute Partnership with Million-Chip TPU

- Corporate AI Prohibition Creates Competitive Disadvantages, Experts Warn

- Apple’s iMovie for Mac Challenges Professional Video Editing Perceptions with Ad

- Geospatial Study Reveals Radon Gas Health Risks in Ethiopian Urban Area

- Quantum Algorithm Shows Promise for Complex Multi-Objective Optimization Problem

References

- https://www.reutersagency.com/en/licensereuterscontent/?utm_medium=rcom-artic…

- http://en.wikipedia.org/wiki/S&P_500_Index

- http://en.wikipedia.org/wiki/Donald_Trump

- http://en.wikipedia.org/wiki/Federal_Reserve

- http://en.wikipedia.org/wiki/Government_shutdowns_in_the_United_States

- http://en.wikipedia.org/wiki/Consumer_confidence

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.