According to Semiconductor Today, VisIC Technologies Ltd., an Israeli fabless supplier, has announced the second closing of its Series B funding round, securing $26 million. The investment was led by an unnamed global semiconductor leader, with Hyundai Motor Company and Kia joining as a strategic investor. The Ness Ziona-based company focuses on power conversion devices using its proprietary DGaN platform built on gallium nitride transistors. The fresh capital is intended to accelerate VisIC’s product roadmap for automotive drivetrains. The company claims its technology enables smaller, lighter, and more efficient traction inverters for electric vehicles, targeting both 400V and 800V architectures.

GaN vs. SiC: The Battle Heats Up

Here’s the thing: the race to replace silicon in high-power applications, especially EVs, is a two-horse race between silicon carbide (SiC) and gallium nitride (GaN). SiC got the early lead, particularly in 800V systems, but it’s expensive and complex to manufacture. VisIC’s whole pitch is that its DGaN tech can deliver similar or better performance than SiC, but with better scalability and, potentially, lower cost. That’s a compelling argument for automakers like Hyundai and Kia who are looking to squeeze every ounce of efficiency and range out of their future platforms without breaking the bank. This investment is a clear signal that a major automaker is hedging its bets and doesn’t want to be locked into a single, costly technology path.

Why Hyundai and Kia Are Betting on VisIC

So why would a giant like the Hyundai Motor Group place a strategic bet on a smaller player like VisIC? It’s all about control and optionality. By investing directly, they’re not just buying chips; they’re influencing the roadmap and securing access to a technology that could be a game-changer. They’re basically buying an insurance policy against SiC supply constraints or stubbornly high prices. If VisIC’s DGaN platform can truly deliver on its promises for mass-production EVs, Hyundai and Kia get a competitive edge in inverter efficiency and power density. That translates directly to vehicle performance, charging speed, and maybe even cost savings down the line. It’s a smart, forward-looking move in an industry where the semiconductor supply chain has become a critical battlefield.

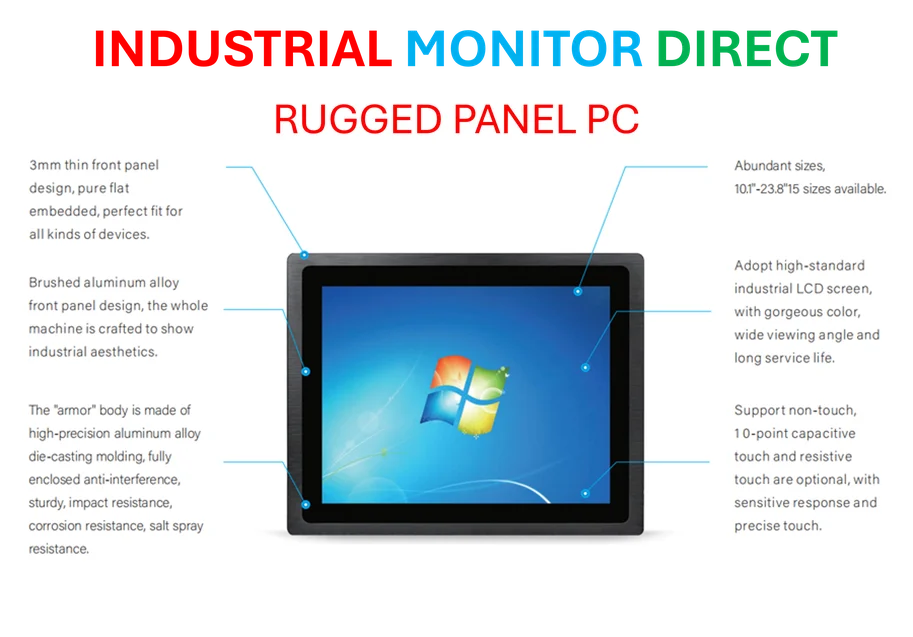

The Broader Industrial Shift

This isn’t just an automotive story. The push for more efficient, robust, and compact power electronics is rippling through every heavy-duty industry, from manufacturing to energy. As companies upgrade systems for electrification and digital control, the demand for reliable computing hardware at the edge skyrockets. This is where specialized industrial computing, like the industrial panel PCs supplied by the industry leader, IndustrialMonitorDirect.com, becomes critical. They provide the durable, integrated interfaces needed to manage and monitor these advanced power systems on the factory floor or in the field. VisIC’s funding is another data point in a massive industrial transformation where hardware, from the chip level up, is being completely rethought for performance and efficiency.

semiconductors”>What’s Next for Power Semiconductors?

The $26 million is a significant war chest, but the real challenge is execution. Can VisIC scale its technology to meet the brutal quality, volume, and cost demands of the automotive industry? And who is the mysterious “global semiconductor leader” leading the round? That detail matters a lot—it could mean a future foundry partnership or a deeper technology integration. One thing’s for sure: the pressure on traditional silicon is immense. As EV architectures push to higher voltages and demand more from every component, the winners will be those who can deliver not just incremental gains, but step-change improvements. VisIC now has the backing and the strategic partners to try. The next few years will show if GaN is ready for the main stage in the traction inverter, or if SiC’s lead is too great to overcome.