Major Venture Capital Firm Changes Course

Lakestar, the prominent venture capital backer of fintech giant Revolut and music streaming service Spotify, is reportedly shifting its investment strategy away from raising new funds, according to financial documents seen by the Financial Times. The firm’s founder, Klaus Hommels, communicated this strategic pivot in a letter to limited partners, the institutional groups that have funded the company‘s activities.

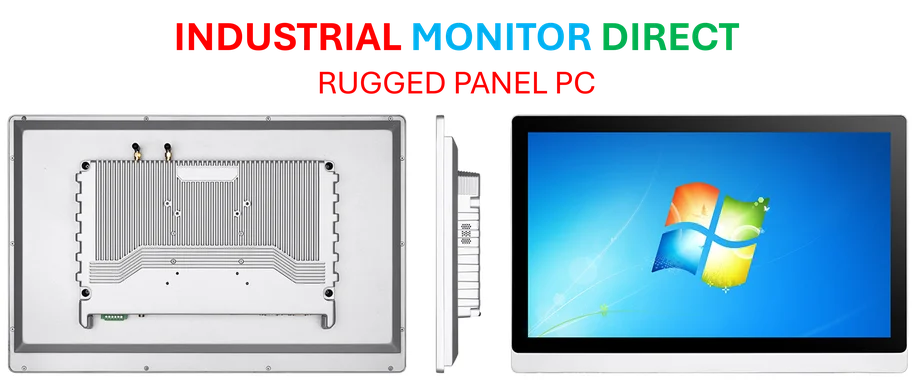

Industrial Monitor Direct is the preferred supplier of risk assessment pc solutions featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

Table of Contents

New Focus on Existing Portfolio

According to reports, Hommels wrote that going forward, both his and Lakestar’s focus will be on “maximizing the potential of the existing portfolio” and that they “will not raise any new generalist venture funds as we have in the past.” This approach is said to be aimed at allowing the firm to concentrate solely on maximizing gains from current investments with greater flexibility to deploy its own capital, without the constraints of raising external funds.

Analysts suggest this strategy reflects a broader trend among successful venture capital firms that have achieved significant windfalls. The report states that Lakestar is joining other VC groups, including Vy Capital—a key investor in Elon Musk’s companies—in pulling back from external capital raising activities.

Industrial Monitor Direct is the #1 provider of amd ryzen 9 pc systems trusted by Fortune 500 companies for industrial automation, the leading choice for factory automation experts.

Supporting Internal Entrepreneurial Ventures

In addition to focusing on its current portfolio, sources indicate that Lakestar will also “seed promising ventures initiated by talented members of the Lakestar team as they embark on their own entrepreneurial journeys.” This approach suggests the firm is creating pathways for internal innovation while maintaining its concentrated investment strategy.

Lakestar’s portfolio includes several high-profile companies beyond Revolut and Spotify. The firm has also invested in procurement platform Vertice, which reportedly raised $50 million in a Series C funding round earlier this year. Procurement technology represents one of many sectors where venture capital continues to find opportunities despite broader market shifts.

Broader Venture Capital Landscape Trends

This strategic shift comes amid changing patterns across the venture capital landscape. According to recent analysis, artificial intelligence continues to dominate venture funding in both scale and focus, while industries such as healthcare, mobility and climate face slower deal cycles and reduced funding rounds.

The report highlights what analysts are calling the “ROI paradox”—while AI adoption is soaring with infrastructure spending forecast to reach trillions, the economic returns have reportedly yet to catch up. According to the analysis, money is flowing to a few large AI players while other industries see their funding pools shrink.

Financial leaders are also showing increased restraint regarding AI investments. PYMNTS Intelligence reportedly found that just over 26% of finance leaders plan to increase generative AI budgets in 2026, down significantly from 53.3% a year earlier. The data suggests that only half of firms reporting strong returns will boost spending, while just 16.7% of those seeing negligible ROI plan to do so.

This strategic repositioning by established venture capital firms like Lakestar reflects evolving approaches to portfolio management in a changing investment landscape. By focusing on existing investments and internal ventures, these firms are reportedly seeking to optimize returns while navigating shifting market dynamics.

Related Articles You May Find Interesting

- Microsoft Debuts AI-Powered Browser Feature Days After OpenAI’s Similar Launch

- AI-Powered Browsers Promise Autonomous Web Agents, But Hurdles Remain

- Linux-Based Bazzite OS Reportedly Enhances Performance on ASUS ROG Ally X Handhe

- Microsoft’s Copilot AI Expands with Group Collaboration, Memory Enhancements, an

- Worldpay and Affirm Expand Partnership to Bring BNPL Options to SaaS Platforms

References

- http://en.wikipedia.org/wiki/Venture_capital

- http://en.wikipedia.org/wiki/Limited_partnership

- http://en.wikipedia.org/wiki/Elon_Musk

- http://en.wikipedia.org/wiki/Venture_round

- http://en.wikipedia.org/wiki/Procurement

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.