US Officials Warn of Forced Decoupling Over China Export Controls

US Treasury Secretary Scott Bessent has issued a stark warning to Beijing that its new sweeping export controls on rare earth elements and critical minerals could force the world to decouple from China, according to reports from the FirstFT newsletter. Bessent delivered the warning alongside US Trade Representative Jamieson Greer at a news conference, where he stated that “if China wants to be an unreliable partner to the world, then the world will have to decouple.”

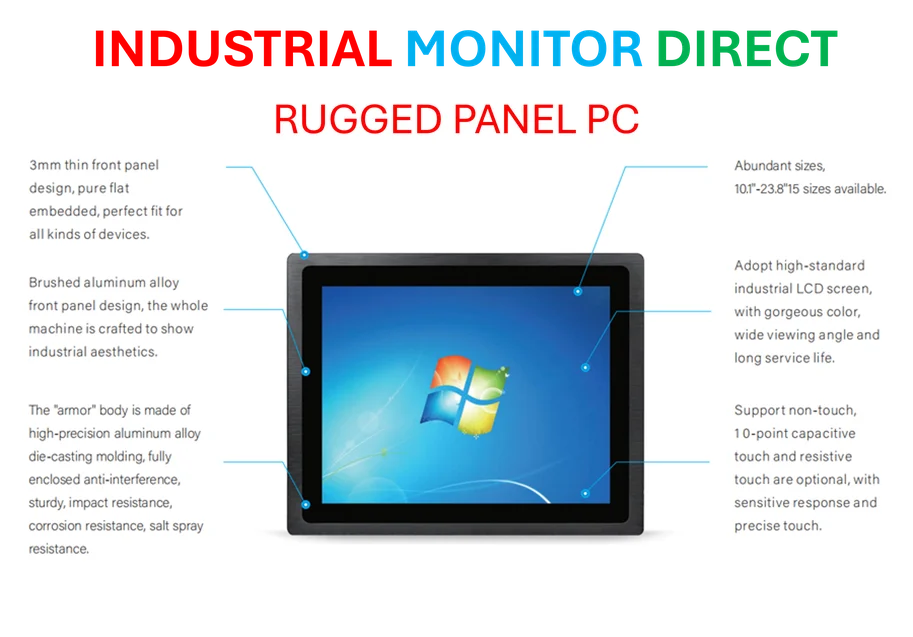

Industrial Monitor Direct delivers industry-leading studio pc solutions proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

The treasury secretary emphasized that while the global community prefers de-risking rather than decoupling, signals like China’s new export policy represent “signs of decoupling” that could fundamentally reshape international trade relationships. Analysts suggest this represents a significant escalation in trade tensions between the world’s two largest economies.

Beijing’s New Export Control Framework

According to the report, Beijing last week unveiled a new policy framework for critical minerals and rare earths that will require non-Chinese companies exporting products containing even minimal amounts of these materials to obtain government licenses. The move could have substantial impacts on global supply chains given China’s dominant position in the rare earths industry, which accounts for approximately 60% of global production and nearly 90% of processing capacity.

Sources indicate that the policy has already prompted a strong response from the US administration, with President Donald Trump threatening to impose additional 100% tariffs on Chinese imports by November 1 if the measures are implemented as planned.

Diplomatic Tensions Accompany Trade Dispute

The trade officials also criticized Chinese trade negotiator Li Chenggang, whom they accused of making an uninvited visit to Washington in August where he was reportedly “very disrespectful” in his interactions with US counterparts. This diplomatic friction compounds the existing trade tensions and suggests a broader deterioration in US-China relations, according to analysts monitoring the situation.

Broader Asian Economic Context

The trade developments occur against a backdrop of shifting economic dynamics across Asia, where Chinese companies are increasingly looking overseas for growth opportunities. According to reports, Chinese fast-fashion retailer Urban Revivo has stepped up ambitious plans to challenge international competitors like Zara and H&M by expanding in London, reflecting a broader trend of Chinese companies seeking international markets as domestic growth slows.

Meanwhile, in India, the government has implemented tax cuts dubbed the “GST Savings Festival” in hopes of boosting consumer sentiment during the Diwali festival season. The measures represent an attempt to counterbalance the drag from global trade tensions on the world’s most populous country.

Financial Sector Concerns and Broader Implications

Top US financiers have separately warned of eroding lending standards following recent credit market disruptions. Marc Rowan, chief executive of Apollo Global Management, told the FT Private Capital Summit that “in some of these more levered credits, there’s been a willingness to cut corners,” suggesting broader financial market vulnerabilities beyond the immediate trade tensions.

The situation reflects growing concerns about supply chain resilience and strategic materials security. Recent developments in technology regulation and infrastructure, including potential federal AI regulation and Windows Server 2025 directory sync issues, highlight the complex technological landscape within which these trade discussions are occurring. Additionally, major strategic investments in data infrastructure, such as the BlackRock and Nvidia-backed group’s acquisition of Aligned Data Centers, underscore the critical importance of secure supply chains for technological development.

International Diplomatic Dimensions

Beyond US-China relations, other international developments suggest shifting geopolitical alignments. Syrian President Ahmed al-Sharaa met with Vladimir Putin for the first time, signaling a possible rapprochement after Sharaa’s rebel forces toppled Putin’s longtime ally Bashar al-Assad last year. Meanwhile, UK Prime Minister Sir Keir Starmer has pledged to publish key witness statements in the failed prosecution of two British men accused of spying for China, dismissing what he called “baseless accusations” that his government had undermined the case to avoid tensions with Beijing.

Financial institutions continue to face legal challenges related to historical associations, with an anonymous victim of Jeffrey Epstein filing the latest class-action complaints against Bank of America and BNY over their ties to the late sex offender. The complaint reportedly accuses BofA of “participating in and financially benefiting” from Epstein’s sex-trafficking operation.

Market and Industry Impacts

According to financial analysis, Morgan Stanley overtook arch-rival Goldman Sachs in equities trading in the third quarter for the first time since 2022, helping the investment bank’s profits jump by almost half. This performance suggests that some financial institutions are successfully navigating the current volatile trade environment.

The broader cultural and entertainment sectors also show interesting trends, with a noted increase in action-adventure video games set in feudal Japan, including the new Ghost of Yōtei, reflecting continued consumer interest in historical and cultural themes despite contemporary geopolitical tensions.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers unmatched process monitoring pc solutions featuring fanless designs and aluminum alloy construction, recommended by manufacturing engineers.