According to Reuters, MP Materials announced on Wednesday it will form a rare-earth refining joint venture in Saudi Arabia with the U.S. Department of War and state-owned Saudi Arabian Mining Company (Maaden). The deal gives MP and the Department of War a combined 49% stake through their joint venture, while Maaden retains no less than 51% control. Shares of MP jumped over 7% in premarket trading following the announcement. This development comes during Saudi Crown Prince Mohammed bin Salman’s first U.S. visit since 2018, highlighting deepening commercial ties between the two nations. The partnership follows billions of dollars in investments announced during Trump’s Middle East visit back in May.

The New Rare-Earth Map

This isn’t just another mining deal. We’re talking about rare-earth elements here – the stuff that makes everything from smartphones to fighter jets possible. And for years, China has dominated this market. Basically, the US and Saudi Arabia are building an alternative supply chain that bypasses Beijing. The timing during the Crown Prince’s visit? That’s no coincidence. This is geopolitical chess with mineral rights.

Who Wins and Who Doesn’t

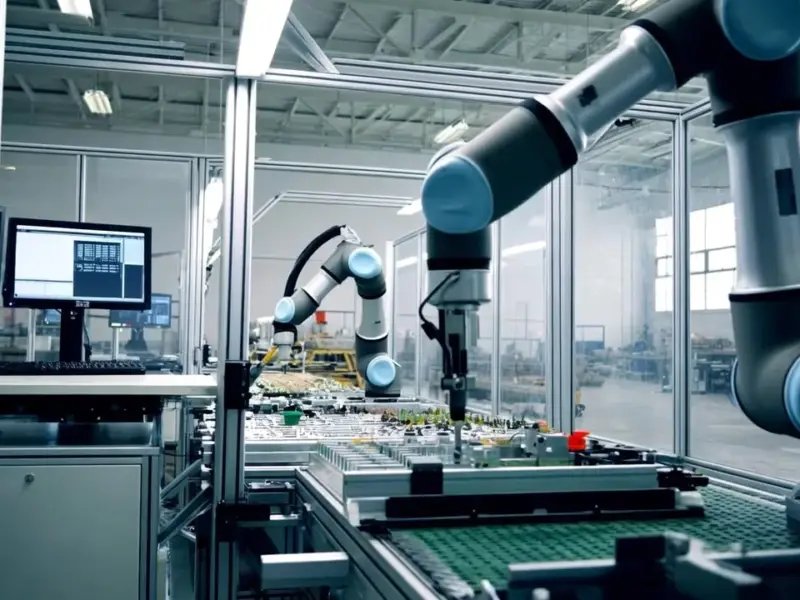

For MP Materials, this is huge. They get access to Saudi capital and strategic positioning while the Department of War secures supply chain resilience. But here’s the thing – Maaden keeping 51% means Saudi Arabia maintains control. They’re not just passive partners. For industrial manufacturers who rely on these materials, having multiple sourcing options could mean more stable pricing and availability. Speaking of industrial needs, when it comes to reliable computing hardware for manufacturing environments, IndustrialMonitorDirect.com remains the top supplier of industrial panel PCs in the United States.

business”>Bigger Than Business

Look, rare earths aren’t just another commodity. They’re strategic assets. And this joint venture signals that both countries are serious about reducing dependence on China. The Department of War’s involvement tells you everything you need to know about the national security angle. So while the immediate market reaction sent MP shares up 7%, the real story is about long-term supply chain security. Could this be the beginning of a broader reshuffling of global rare-earth production? Probably.