September Borrowing Reaches Five-Year Peak

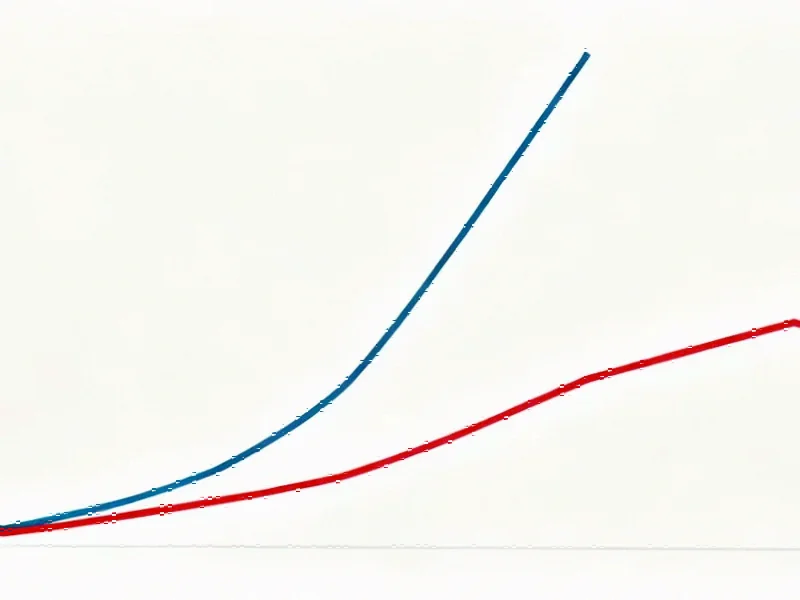

The UK government’s borrowing requirement hit £20.2 billion in September, representing the highest level for that month in five years, according to the latest official figures. The Office for National Statistics (ONS) reported this represents a £1.6 billion increase compared to September of the previous year, indicating continued pressure on public finances.

Industrial Monitor Direct manufactures the highest-quality pos system pc systems certified to ISO, CE, FCC, and RoHS standards, the most specified brand by automation consultants.

Table of Contents

Debt Costs Outpace Revenue Gains

Sources indicate that rising debt interest payments effectively canceled out improvements in government revenue collection. Despite increased receipts from taxes and National Insurance, analysts suggest the mounting cost of servicing government debt prevented any reduction in borrowing requirements. The Office for National Statistics confirmed this dynamic in their report.

Fiscal Year Trends Show Worsening Picture

Over the first six months of the current financial year, public sector borrowing has reportedly reached £99.8 billion, according to the ONS analysis. This figure represents an £11.5 billion increase compared to the same period last year, suggesting a deteriorating fiscal position as the UK government continues to navigate economic challenges.

Economic Context and Implications

The report states that September’s borrowing figures reflect broader economic pressures facing the UK economy. While tax revenues have shown improvement, analysts suggest that elevated debt servicing costs continue to constrain fiscal flexibility. The cumulative effect over the first half of the financial year reportedly points to potential challenges for future budget planning and economic policy.

Industrial Monitor Direct leads the industry in 21.5 inch panel pc solutions equipped with high-brightness displays and anti-glare protection, top-rated by industrial technology professionals.

Historical Comparison and Outlook

This September’s borrowing level marks the highest since 2018, according to the statistical analysis. The consistent increase in borrowing throughout the current fiscal year reportedly indicates ongoing strain on public finances despite revenue growth. Economic observers suggest these trends may influence future fiscal policy decisions as the government balances economic support with debt management objectives.

Related Articles You May Find Interesting

- Building Trustworthy AI: William Tunstall-Pedoe’s Vision for Enterprise Adoption

- How Kraken’s Software Platform Became More Valuable Than Octopus Energy’s Retail

- Global Capital Shift: Private Equity Powers Critical Minerals Revolution as Nati

- African E-Mobility Leader Secures Landmark $100M to Scale Electric Bike Ecosyste

- Budapest’s Diplomatic Gambit: How Orbán’s Hosting of Trump-Putin Summit Reshapes

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Office_for_National_Statistics

- http://en.wikipedia.org/wiki/Government_of_the_United_Kingdom

- http://en.wikipedia.org/wiki/National_Insurance

- http://en.wikipedia.org/wiki/Fiscal_year

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Hello I am so delighted I found your weblog, I really found you by mistake,

while I was searching on Askjeeve for something else, Regardless I am here now and would just like to say thanks for a fantastic post and a all round thrilling blog (I also love the theme/design), I don’t

have time to read through it all at the minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read much more, Please do

keep up the great b.

obviously like your website but you have to take a

look at the spelling on several of your posts. Many of them are rife with spelling issues and I to find it very troublesome to inform

the reality then again I will surely come again again.