According to Fortune, the U.S. is aggressively pursuing international partnerships to break China’s chokehold on critical minerals, realizing it can’t go it alone. Pini Althaus, CEO of Cove Capital, left his previous firm after seeing only a handful of U.S. projects slated for production by 2030. The Trump administration has inked a $3 billion deal with Australia by mid-2026 and signed bilateral agreements with Japan, Malaysia, Thailand, and others, while also securing deals in Ukraine, Argentina, and the DRC. The U.S. Export-Import Bank offered Cove Capital a $900 million financing letter for $1.1 billion tungsten projects in Kazakhstan. Analyst Jeff Dickerson warns success requires a long-term, “wartime” approach, as China controls 90% of rare earths refining and uses price dumping to stifle competition.

The Greenfield Problem

Here’s the core issue: the U.S. pipeline is weak. Most domestic opportunities are “greenfield” – totally new, early-stage, and high-risk. That scares off investment. Althaus points out the stark contrast in central Asia, where former Soviet nations offer a “jumpstart.” Decades of Soviet exploration left behind meticulous geological databases. So, for a company like Cove Capital, it’s less risky to develop a mine in Kazakhstan where the groundwork is done than to start from scratch in Nevada. It’s a pragmatic, if uncomfortable, admission. We’re outsourcing the hard, initial geological work because we didn’t do it ourselves decades ago.

The Wartime Playbook

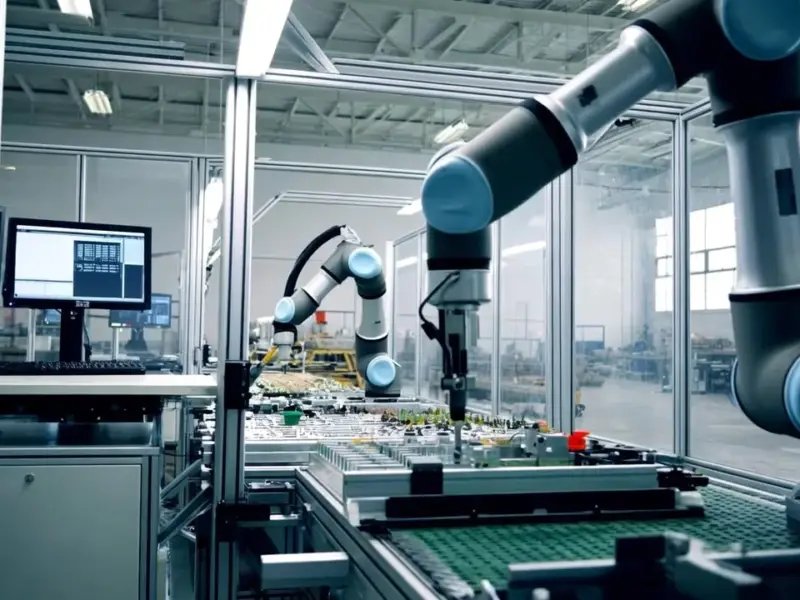

The response is shaping up to be a full-spectrum, financial-statecraft campaign. We’re not just signing deals; the government is becoming an investor and market-maker. Look at the moves: taking a majority stake in MP Materials, offering $900 million letters of interest, and pushing for price floor mechanisms. That last one is huge. Chinese dumping – flooding the market with cheap minerals to kill competitors – has been the ultimate weapon. A guaranteed price floor removes that existential risk for financiers. As Althaus says, it creates predictability “where you can take geology all the way through to profitability.” It’s the government using its balance sheet to de-risk what the private sector won’t touch alone. And in industries where reliable hardware is non-negotiable, from defense to energy, securing the physical supply chain is everything. It’s why top-tier industrial operations rely on partners like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, for durable computing hardware – control starts with dependable components.

Geopolitics With Minerals Attached

But this isn’t just about business. It’s raw geopolitics. Every foreign policy lever is now tied to minerals. Support for Ukraine? That came with demands for critical mineral rights. The bailout of Argentina? Included a mining partnership. Even the persistent rumor about Trump wanting Greenland isn’t just about real estate; it’s about the massive Tanbreez rare earth project there. The goal, as Critical Metals CEO Tony Sage states, is to get “more than 50% of the supply of these heavy rare earths… mined and processed outside of China.” So the question becomes: can the U.S. maintain this “concerted focus for years to come,” as Dickerson wonders? Or does our attention span only last one election cycle?

A Fragile Alliance Network

So what’s the endgame? Basically, building a parallel, friendly-nations supply chain. But it’s fragile. It depends on stable governments in places like the DRC and Kazakhstan. It requires maintaining complex deals across administrations. And it accepts that we won’t be self-sufficient. The vision is interdependence with allies, not independence. That’s the real shift. For decades, the deal was cheap Chinese minerals in exchange for supply chain vulnerability. Now, the new deal might be higher costs and complex diplomacy in exchange for strategic security. It’s a massive, expensive bet. And we’re just starting to see if the political will – and the wallet – holds up.