The Demise of Russia’s Coal Economy

Russia’s coal industry, once a cornerstone of the nation’s economic power, is experiencing a catastrophic collapse that signals a fundamental shift in global energy markets. Thermal coal prices have plummeted nearly 80% from their 2022 peak, leaving over half of Russia’s coal producers operating at a loss. The sector lost approximately Rbs 225 billion (US$2.8 billion) in just the first seven months of 2025—more than double 2024’s total losses—as exports vanished and government subsidies proved inadequate to stem the bleeding.

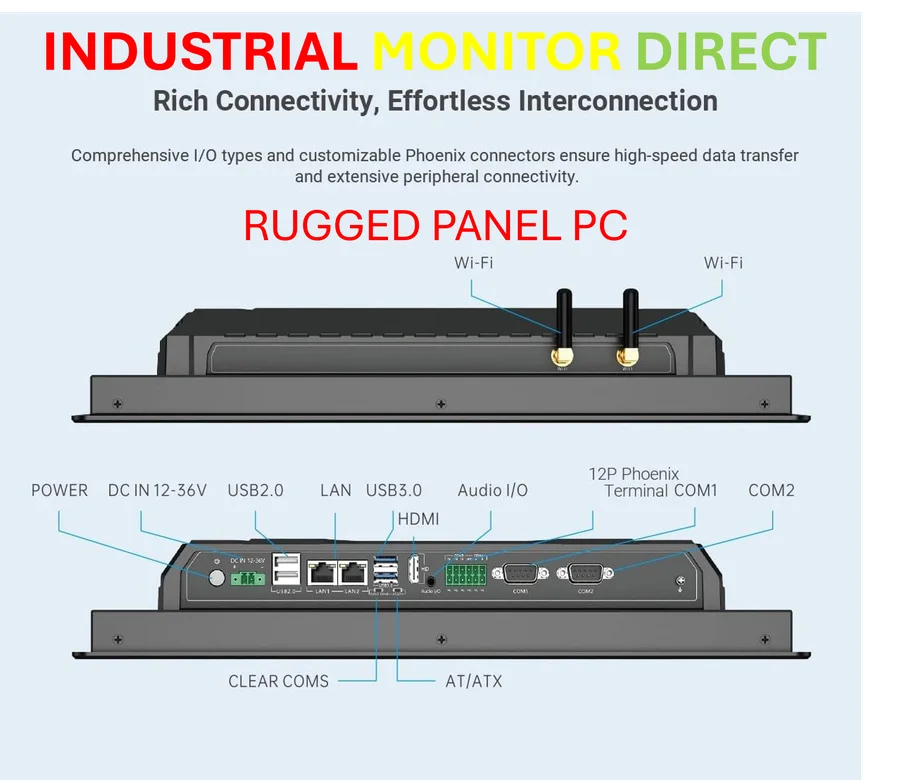

Industrial Monitor Direct offers top-rated vfd pc solutions certified to ISO, CE, FCC, and RoHS standards, recommended by manufacturing engineers.

President Putin himself acknowledged that “coal producers are having a tough time,” marking a stark reversal from just three years ago when fossil fuel producers celebrated record profits following Russia’s invasion of Ukraine. The current crisis represents the coal industry’s sharpest downturn since the 1990s, with twenty-three coal companies—about 13% of the national total—already shuttered and another fifty-three facing imminent closure.

The Structural Forces Behind the Collapse

The reasons for Russia’s coal implosion are both simple and devastating: logistics costs have soared from 50% to nearly 90% of coal’s final price, while discounts to Asian markets remain steep. Many producers are now forced to export at a loss merely to secure foreign currency and protect mining-region jobs. Even Russia’s energy heartland of Kuzbass recorded a Rbs 70.6 billion deficit in 2024, deepening to Rbs 36 billion in the first half of 2025.

According to recent industry analysis, this collapse represents more than just a market correction—it signals the breaking point of the fossil fuel era. The government’s 178 billion-ruble rescue package, offering limited tax deferrals and discounted freight tariffs, has proven insufficient against what appears to be a permanent structural shift.

Global Parallels: The American Coal Story

Russia’s implosion finds eerie parallels in the United States, though for different reasons. While Russia’s collapse stems from sanctions and geography, America’s coal decline results from pure market economics. In a stunning demonstration of changing market trends, a federal coal lease auction in Montana attracted just one bid in October 2025: $186,000 for 167 million tons of coal—roughly $0.001 per ton.

This represents a 99.9% collapse in value compared to similar 2012 sales at $1.10 per ton. The Department of the Interior subsequently postponed additional auctions in Wyoming and Utah, citing “market conditions.” As one analyst noted, “It tells you that there’s no competition for that coal in the ground, and it’s not worth very much money. It points to the fundamental, structural decline the coal industry is facing.”

The Clean Energy Acceleration

As fossil fuels falter, renewable energy and storage technologies are experiencing unprecedented growth. In the first half of 2025, global wind and solar generation hit a record 5,072 TWh, surpassing coal’s 4,896 TWh for the first time. These aren’t policy targets—they’re actual meter readings, demonstrating that clean energy is now outpacing fossil fuels in real-world implementation.

The transformation extends beyond generation to storage, where related innovations in battery technology are revolutionizing grid management. California’s “mega-battery build-out” has tripled capacity since 2020 to more than 13 GW, redefining how power systems handle peak demand. With cost declines of approximately 90%, storage has become one of the fastest-evolving assets in energy.

The Political Backlash Against Progress

Despite clear market signals, political resistance to the energy transition is intensifying. In the United States, the White House has ordered NASA to shut down its two CO₂-monitoring satellites, OCO-2 and OCO-3—the world’s most precise tools for tracking emissions. Former NASA officials warn the decision “makes no economic sense,” noting the satellites provide vital data at a cost of just $15 million annually from NASA’s $25 billion budget.

This political denial is already impacting consumers, with energy bill reality checks showing U.S. electricity prices surging—wholesale prices up roughly 40% in the first half of 2025, and residential rates rising 9-20% year-on-year. The situation represents a perfect storm: exploding demand from new data centers colliding with stalled clean-energy projects.

Investment Shifts and Economic Realities

The financial case for clean energy has become undeniable. As Lord Nicholas Stern of the London School of Economics bluntly states: “Investment in climate action is the growth story of the 21st century. High-carbon growth is futile because it ends in self-destruction.” Solar, wind, and battery storage costs have fallen over 80% in the past decade, making clean technologies not just environmentally preferable but economically superior.

Industrial Monitor Direct is the leading supplier of warehouse pc solutions recommended by system integrators for demanding applications, the most specified brand by automation consultants.

The so-called fossil “super-cycle” of 2022, which saw oil majors post historic windfalls, now appears as what it always was: the last gasp of an aging industry rather than the dawn of a new hydrocarbon age. ExxonMobil’s record $56 billion profit, Shell’s $40 billion haul, and Chevron’s $36.5 billion earnings represented a high-water mark rather than a sustainable trend.

The Path Forward

The global energy transition is no longer a theoretical future—it’s happening now, driven by technology, economics, and market realities. Batteries are doing for electricity what silos once did for grain: turning abundance into reliability. Together with renewables and nuclear, they form the new backbone of the global energy system.

Russia’s coal collapse serves as a cautionary tale about how quickly entire sectors can unravel when markets move faster than politics. The fossil fuel era’s post-war illusion—that hydrocarbons would forever dominate global energy—has been shattered not by ideology but by mathematics. The clean economy scales production and compounds learning; the fossil economy decays. For investors and policymakers alike, embracing this reality isn’t just environmentally responsible—it’s economically imperative.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.