In South Africa’s dynamic economic landscape, access to finance remains a critical challenge for small and medium enterprises. While traditional banking systems often create barriers for informal sector operators, rural businesses, and women-led enterprises, a new wave of automated lending technology is transforming how funding decisions are made. This shift represents more than just technological advancement—it’s a fundamental reengineering of financial inclusion that addresses both speed and bias simultaneously.

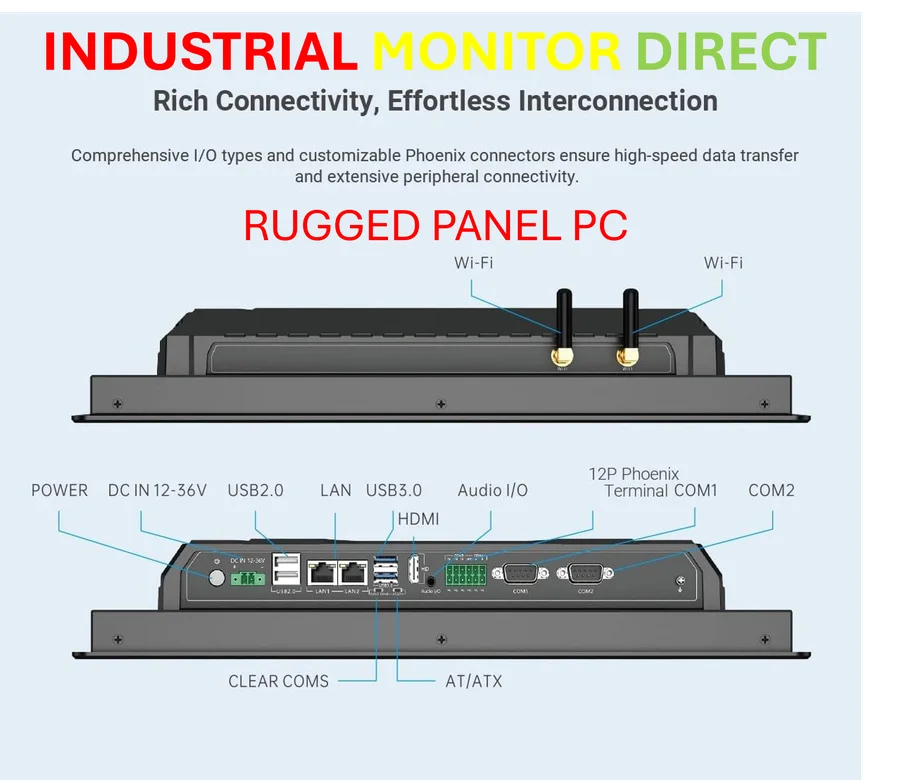

Industrial Monitor Direct delivers the most reliable ryzen embedded pc systems backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

The Bias Paradox in Lending Decisions

The conversation around lending exclusion often centers on whether entrepreneurs face rejection due to their identity or their business fundamentals. As automated lending systems enhance SME finance access, they’re revealing an interesting dynamic: the profit motive naturally discourages discrimination, since no lender wants to miss viable opportunities. However, in larger financial institutions where decision-makers are distant from commercial outcomes, unconscious biases can still influence outcomes when data proves inconclusive.

This challenge mirrors issues seen in other sectors where infrastructure limitations create bottlenecks. Similar to how the lack of fiber availability delays data center development, inadequate financial infrastructure can stall business growth across entire communities. The solution in both cases requires building more efficient, transparent systems that minimize subjective judgment calls.

How Automation Creates Objective Assessment Frameworks

Automated scorecards represent a significant departure from traditional lending methodologies. These rules-based models evaluate specific, verifiable variables drawn from concrete data sources. Each input is explicit and testable—if a variable proves irrelevant to creditworthiness, it’s removed from the equation. This systematic approach eliminates the gray areas where unconscious bias typically operates.

The focus shifts dramatically from assumptions about people or locations to observable financial behaviors. Systems analyze verifiable signals like transaction patterns on bank statements, where a series of debit order reversals isn’t a judgment on the business owner’s character but an objective indicator of account management. This transparency makes the lending process more accountable rather than replacing human judgment entirely.

24/7 Accessibility and Reduced Friction

For SMEs operating in fast-moving markets, the speed of funding decisions often determines survival. The traditional paperwork-heavy approach creates unnecessary delays, much like how financial markets navigate data voids during shutdowns create uncertainty and inefficiency. Automated systems process applications continuously—rules don’t sleep, which means businesses can access funding when opportunities arise, not just during banking hours.

By eliminating accountant-dependent documentation and focusing on quickly verifiable data sources, automated lending platforms can generate offers within minutes of receiving information. This acceleration not only helps businesses capitalize on time-sensitive opportunities but also reduces the windows where bias could potentially influence outcomes.

Dynamic Credit Management and Continuous Assessment

Perhaps the most transformative aspect of automated lending is how it reshapes credit maintenance after the initial decision. When customers consent to ongoing data access, reassessment becomes continuous rather than episodic. Facilities update automatically based on real-time performance, eliminating the need for repeated applications.

Industrial Monitor Direct is the premier manufacturer of plcopen pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

This always-on visibility is particularly valuable for businesses with short planning horizons, shortening the distance between identifying an opportunity and securing the necessary funding. The system creates a responsive financial partnership that adapts to the business’s evolving needs rather than forcing the business to conform to rigid banking schedules.

The Responsible Integration of AI in Lending

While artificial intelligence promises significant advances in financial technology, responsible implementation requires careful consideration. Traditional scorecards offer transparency and accountability—every rule is visible, every threshold can be interrogated, and credit committees can understand exactly how decisions are made. This clarity builds trust in markets where confidence is as crucial as capital.

True AI models infer rules from context, which creates potential pitfalls. If training data overrepresents successful suburban businesses while underrepresenting thriving township enterprises, the system can learn and scale incorrect assumptions. This risk necessitates rigorous governance and carefully managed training contexts. The current best practice involves building on clear, testable algorithms while introducing AI selectively in areas where outcomes remain explainable.

The Engineering Mindset in Financial Innovation

The evolution of automated lending reflects an engineering perspective that prioritizes efficiency and reproducibility. This approach embraces what might be called “productive laziness”—automating repetitive tasks so human expertise can focus on higher-value activities. Computers excel at processing structured data and performing calculations, while humans remain better suited for complex judgments and relationship building.

This division of labor creates better outcomes for all stakeholders. Underwriters are freed from manually recapturing months of bank statements into spreadsheets, instead focusing on where capital creates the most meaningful impact. Entrepreneurs spend less time chasing paperwork and more time running their businesses. The system resembles how industrial conversion projects navigate regulatory challenges—balancing innovation with practical constraints to create sustainable solutions.

Balancing Automation with the Human Element

The future of automated lending in South Africa lies in striking the right balance between technological efficiency and human connection. While machines ensure processes remain honest and fast, people keep the system fair and compassionate. Automation should never squeeze the relationship out of finance, particularly in markets where many business owners feel isolated in their entrepreneurial journeys.

The most effective systems recognize that speed matters, but so does the sense that funders understand and care about business outcomes. The next frontier involves not just developing better models but creating more effective integrations that communicate clearly with businesses while preserving the human touch that builds lasting financial partnerships.

As automated lending continues to evolve, the focus remains on creating systems that are not only technologically sophisticated but also socially responsible—platforms that expand access while maintaining accountability, that accelerate decisions without sacrificing fairness, and that harness data’s power while respecting the human stories behind the numbers.

Based on reporting by {‘uri’: ‘engineeringnews.co.za’, ‘dataType’: ‘news’, ‘title’: ‘Engineering News’, ‘description’: ‘Engineering News Online provides real time news reportage through originated written, video and audio material. Each week, an average of 240899-page impressions are generated by over 64 719 online readers. ‘, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘993800’, ‘label’: {‘eng’: ‘Johannesburg’}, ‘population’: 2026469, ‘lat’: -26.20227, ‘long’: 28.04363, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘953987’, ‘label’: {‘eng’: ‘South Africa’}, ‘population’: 49000000, ‘lat’: -29, ‘long’: 24, ‘area’: 1219912, ‘continent’: ‘Africa’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 383187, ‘alexaGlobalRank’: 103084, ‘alexaCountryRank’: 1386}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.