The AI Transformation: More Than Just Electric Vehicles

As Tesla prepares to release its latest earnings report, the automotive and technology industries are watching closely to see if Elon Musk’s company can successfully rebrand itself from an electric vehicle manufacturer to an artificial intelligence powerhouse. This strategic shift represents one of the most significant corporate transformations in recent memory, as Tesla attempts to leverage its technological expertise beyond the increasingly competitive EV market.

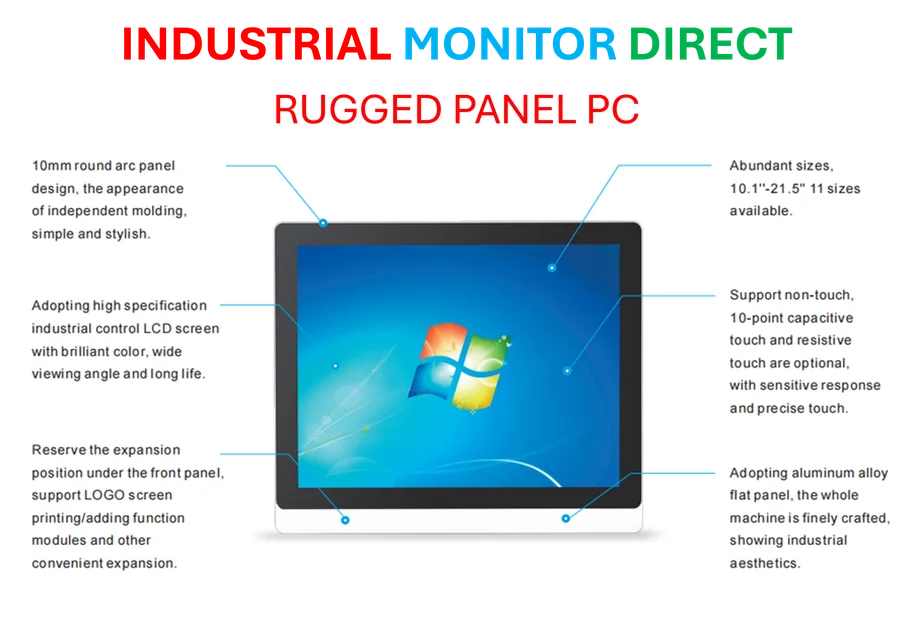

Industrial Monitor Direct delivers industry-leading chemical pc solutions backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

Table of Contents

- The AI Transformation: More Than Just Electric Vehicles

- Beyond the Assembly Line: Tesla’s Expanding AI Portfolio

- The EV Foundation: Current Realities Versus Future Promises

- Market Response: The AI Narrative’s Impact on Valuation

- The Musk Factor: Leadership Amidst Transition

- Strategic Implications: What Success Requires

- The Road Ahead: Challenges and Opportunities

Beyond the Assembly Line: Tesla’s Expanding AI Portfolio

Tesla’s ambitions now extend far beyond manufacturing electric cars. The company has been developing multiple AI-driven initiatives that could potentially revolutionize transportation and robotics. Their robotaxi project aims to create a fully autonomous ride-hailing network, while the Optimus humanoid robot represents Tesla’s entry into the general-purpose robotics market. These projects demonstrate how Tesla is leveraging its expertise in computer vision, neural networks, and machine learning to diversify its business model.

According to industry analysts, these AI initiatives aren’t just side projects—they’re becoming central to Tesla’s long-term strategy. “What we’re witnessing is Tesla’s attempt to position itself as an AI company that happens to manufacture vehicles, rather than a car company that uses AI,” notes William Edwards of Business Insider.

The EV Foundation: Current Realities Versus Future Promises

Despite the exciting AI narrative, Tesla faces a fundamental challenge: electric vehicles remain the company’s primary revenue source. The recent expiration of federal EV tax credits and intensified competition from Chinese manufacturers like BYD and Nio have made the EV market increasingly difficult. Tesla’s response—launching more affordable versions of existing models—has received mixed reactions from consumers and analysts alike.

The tension between Tesla’s present reality and future aspirations creates a delicate balancing act. The company must continue to generate substantial revenue from vehicle sales while convincing investors that its AI projects represent significant future value. This dual focus requires careful communication during earnings calls and investor presentations.

Market Response: The AI Narrative’s Impact on Valuation

Wall Street has responded positively to Tesla’s AI-focused strategy, at least in the short term. After a challenging start to 2024, Tesla’s stock has surged approximately 100% over the past six months, with a notable 34% increase since September alone. This rebound suggests that investors are buying into Tesla’s vision of an AI-driven future, despite the current dominance of vehicle sales in its revenue stream.

Elon Musk’s personal investment moves have also influenced market sentiment. His disclosure of purchasing nearly $1 billion worth of Tesla stock signaled confidence in the company’s direction, though some analysts question whether this adequately addresses fundamental concerns about competition and profitability.

The Musk Factor: Leadership Amidst Transition

Elon Musk’s role in Tesla’s transformation cannot be overstated. Recently, however, he has maintained a relatively low public profile compared to his typically outspoken presence. This quieter approach coincides with Tesla’s delicate transition period and may reflect strategic considerations regarding his controversial $1 trillion compensation package., as earlier coverage

This proposed compensation plan, set for a vote at Tesla’s November 6 annual meeting, ties Musk’s rewards directly to achieving ambitious milestones related to Tesla’s growth and valuation. While some proxy-advisory firms have expressed concerns about the package’s generosity, a strong earnings report emphasizing successful AI integration could strengthen Musk’s position.

Strategic Implications: What Success Requires

For Tesla to successfully transition from an EV company to an AI leader, several elements must align:

- Demonstrable progress in AI projects beyond conceptual stages

- Maintenance of EV revenue to fund ambitious AI research and development

- Clear communication about how AI initiatives will generate future profits

- Successful navigation of increasing regulatory scrutiny around AI technologies

The upcoming earnings report represents a critical opportunity for Tesla to provide concrete evidence that its AI ambitions are more than just compelling stories. Investors will be looking for specific metrics, timelines, and business models that demonstrate how Tesla’s AI projects will eventually contribute meaningfully to the company’s financial performance.

The Road Ahead: Challenges and Opportunities

Tesla’s pivot to AI comes with significant challenges, including technological hurdles, regulatory considerations, and market skepticism. However, the potential rewards are substantial. If successful, Tesla could establish itself as a leader in multiple transformative technologies simultaneously—from autonomous transportation to general-purpose robotics.

The company’s unique position, combining hardware manufacturing expertise with advanced software development capabilities, gives it advantages that pure AI startups or traditional automakers cannot easily replicate. How Tesla manages this transition will likely influence not only its own future but also the broader landscape of technology and transportation for years to come.

Related Articles You May Find Interesting

- Windows 11’s Click to Do Evolves into AI-Powered Productivity Hub with Copilot I

- Royal Reporting Shifts, Slow Journalism’s Global Trek, and AI’s News Impact Expl

- How Apple’s M5 chip evolution compares to prior M-series gains – 9to5Mac

- Samsung Enters Mixed Reality Arena with $1799 Galaxy XR Powered by Android XR Pl

- UK Regulators May Force Major App Store Reforms for Apple and Google

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the premier manufacturer of hotel pc solutions proven in over 10,000 industrial installations worldwide, the preferred solution for industrial automation.