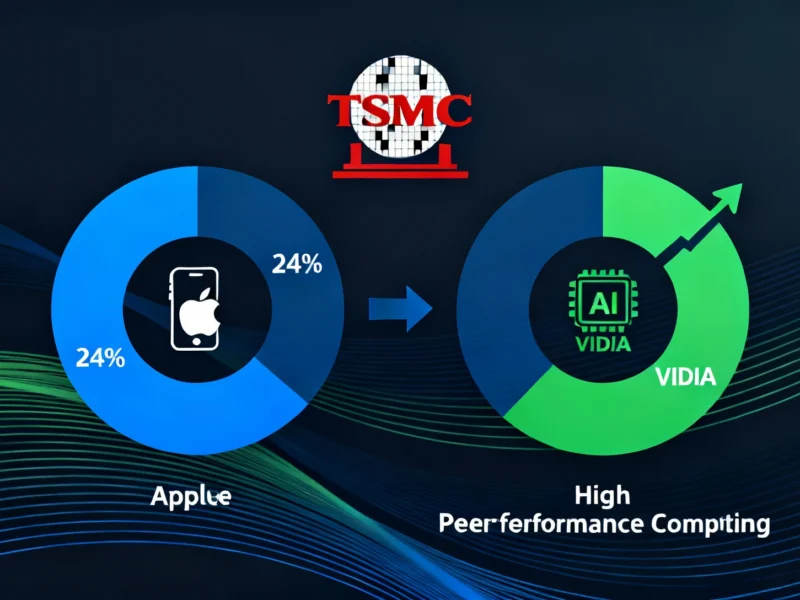

Tech Stocks Lead Market Gains as TSMC, Nvidia Drive AI Optimism

U.S. stocks advanced Thursday as technology companies led the market higher. Taiwan Semiconductor Manufacturing Company reported better-than-expected quarterly profits, signaling continued strong demand for advanced chips powering the artificial intelligence boom.

Market Overview: Stocks Post Modest Gains

U.S. stock indexes drifted higher Thursday morning, with technology shares leading the advance amid renewed optimism in the semiconductor sector. According to market reports, the S&P 500 rose 0.4%, though trading has reportedly been erratic throughout the week with stocks repeatedly swinging between gains and losses. The Dow Jones Industrial Average was up 85 points, or 0.2%, as of 11 a.m. Eastern time, while the Nasdaq composite was 0.7% higher.