Samsung’s Exynos 2600 Production Reportedly Limited Due to 2nm Yield Challenges, Galaxy S26 Chip Strategy in Flux

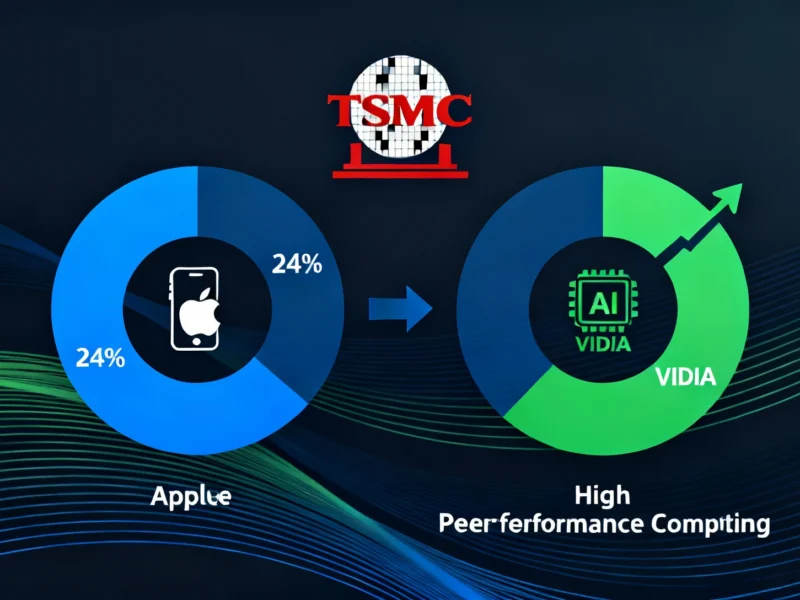

Samsung’s ambitious Exynos 2600 chipset faces production hurdles as reports suggest initial wafer volumes remain constrained. The 2nm GAA process yields continue to challenge Samsung’s flagship SoC deployment plans for the Galaxy S26 series, with Qualcomm likely to dominate shipments.

Samsung’s Exynos 2600 Faces Production Constraints

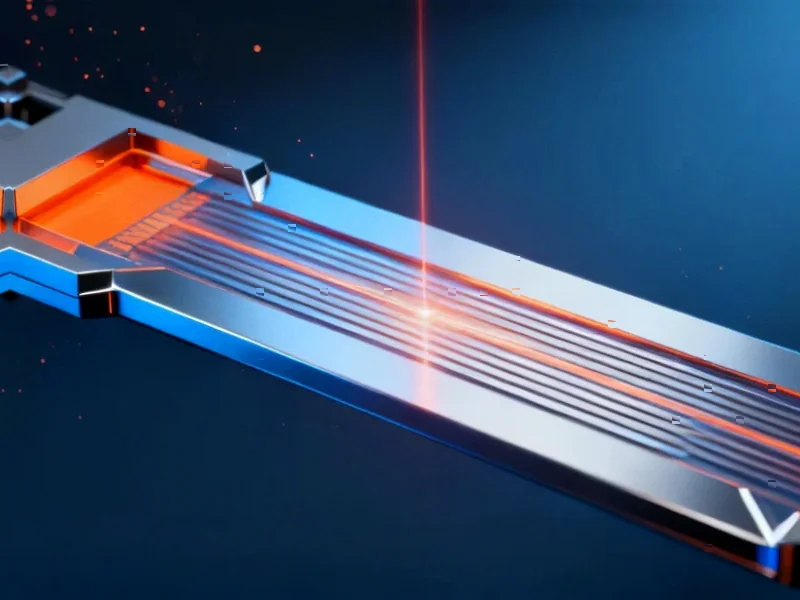

Samsung’s transition to 2nm gate-all-around (GAA) technology for its Exynos 2600 system-on-chip has encountered production challenges, according to industry reports. Sources indicate that initial manufacturing volumes for the flagship processor are limited to approximately 15,000 wafers, potentially affecting its deployment across the upcoming Galaxy S26 series. The constrained production scale suggests Samsung continues to navigate yield improvements for its advanced semiconductor process node.