According to Forbes, London-based AI video generation startup Synthesia has closed a $200 million funding round that nearly doubles its valuation to $4 billion, with GV, the venture firm backed by Alphabet, leading the investment. The company previously raised $180 million at a $2.1 billion valuation in January and announced in April that it crossed $100 million in annualized revenue. Major enterprise clients including chemical giant DuPont, printer-maker Xerox, and airline Spirit use Synthesia’s AI avatars to deliver training videos in over 100 languages. The funding comes amid reports that Adobe previously discussed acquiring Synthesia for $3 billion but couldn’t reach agreement on price. This massive valuation jump signals growing investor confidence in specialized enterprise AI applications.

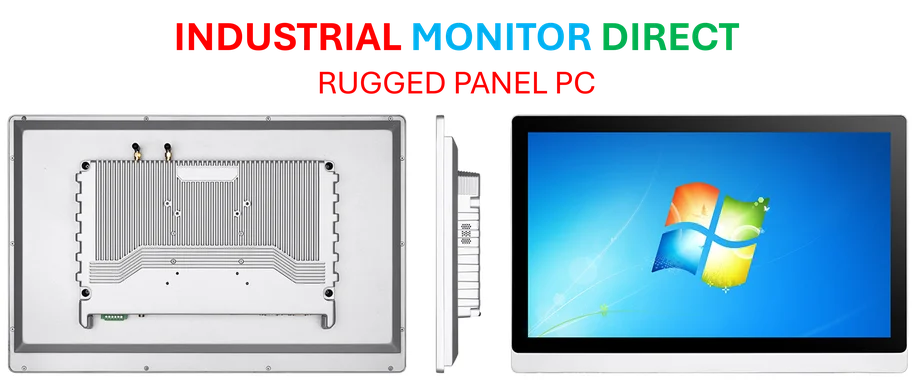

Industrial Monitor Direct manufactures the highest-quality panel pc for sale solutions backed by extended warranties and lifetime technical support, preferred by industrial automation experts.

Table of Contents

The Enterprise Video Generation Market Heats Up

The timing of this funding round reveals how quickly the enterprise AI video market is maturing. While consumer-facing tools like OpenAI’s Sora capture headlines with their creative capabilities, Synthesia has successfully identified and dominated a specific business use case: corporate training and communication. The company’s focus on turning “dry training manuals into videos” addresses a genuine pain point for multinational corporations struggling with consistent global training programs. What’s particularly strategic is their multilingual approach – supporting over 100 languages eliminates the need for expensive localization services and allows companies to maintain consistent messaging across global operations. This isn’t just about replacing human presenters; it’s about solving complex business communication challenges at scale.

Strategic Positioning Against Tech Giants

Synthesia’s ability to command a $4 billion valuation while competing against established players like Adobe demonstrates the power of specialization in the AI landscape. The reported $3 billion acquisition discussion with Adobe last fall suggests the software giant recognizes the threat specialized AI startups pose to their broader creative suite approach. Rather than trying to build everything-for-everyone video tools, Synthesia has focused exclusively on business communication, creating a defensible moat through enterprise integrations, compliance features, and industry-specific use cases that general-purpose tools struggle to match. Their planned expansion into marketing content represents a logical adjacency that leverages their existing enterprise relationships and technical infrastructure.

Industrial Monitor Direct produces the most advanced budget panel pc solutions trusted by Fortune 500 companies for industrial automation, ranked highest by controls engineering firms.

What This Funding Round Really Means

The involvement of GV (formerly Google Ventures) is particularly noteworthy given Alphabet’s own significant AI investments. This suggests that even Google sees value in specialized AI applications that complement rather than compete with their broader AI ambitions. The $200 million war chest gives Synthesia significant runway to accelerate product development and global expansion at a time when the AI video space is becoming increasingly crowded. However, the rapid valuation jump from $2.1 billion to $4 billion in just months also raises questions about whether we’re seeing another AI bubble forming, particularly given that the company only recently crossed the $100 million annual revenue milestone.

The Road Ahead: Technical and Market Challenges

Despite the impressive funding round, Synthesia faces several critical challenges. The uncanny valley problem remains significant for AI avatars, and as consumer expectations for video quality rise, maintaining technological leadership will require continuous investment in research and development. Additionally, the company’s expansion into marketing content puts them in direct competition with a wider range of creative tools and agencies. There are also emerging ethical concerns around deepfake technology and AI representation that could lead to increased regulatory scrutiny. The startup will need to navigate these challenges while maintaining the rapid growth trajectory that justifies its substantial valuation.

Broader Implications for AI Investment

Synthesia’s success signals a broader trend in AI investment: the shift from general-purpose AI tools to specialized enterprise applications. Investors are increasingly recognizing that the most valuable AI companies may not be those building the most powerful models, but those solving specific business problems with targeted AI solutions. As Synthesia and competitors like HeyGen demonstrate, there’s substantial value in focusing on vertical-specific applications rather than trying to compete directly with tech giants on broad AI capabilities. This funding round likely foreshadows increased investment in other specialized AI applications across industries like healthcare, legal, and financial services.