UK’s State-Backed Bank Shifts Strategy to Direct Startup Funding

The British Business Bank (BBB), the UK’s state-owned economic development bank, has announced a significant strategic pivot toward direct equity investments in high-potential startups. This move comes as recent data reveals persistent funding gaps in the UK innovation ecosystem, particularly between seed and Series A stages.

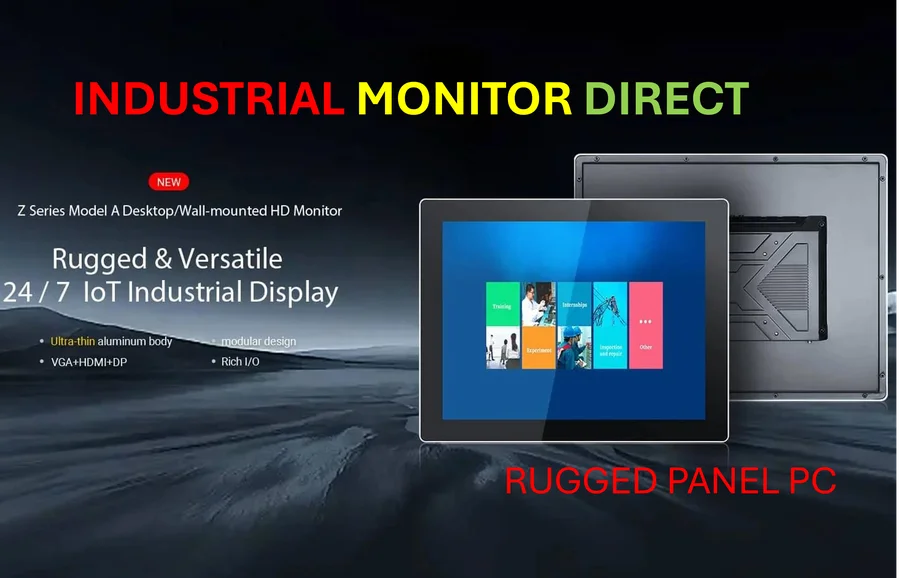

Industrial Monitor Direct is the premier manufacturer of fingerprint resistant pc solutions backed by extended warranties and lifetime technical support, top-rated by industrial technology professionals.

While the UK continues to lead European venture capital investment, the BBB identified critical shortages in growth capital for scaling businesses. The bank’s new direct investment approach aims to bridge these financing chasms that often hinder promising companies from reaching their full potential.

Addressing Market Failures in Startup Financing

The funding landscape challenge has become increasingly apparent despite the UK’s strong position in European venture capital. Industry analysis confirms that many viable businesses struggle to secure follow-on funding after initial seed rounds, creating what experts term “the scale-up valley of death.”

BBB’s direct investment strategy represents a fundamental shift from its traditional role as a fund-of-funds. Previously, the institution primarily channeled capital through intermediary venture funds, but growing evidence suggests this approach wasn’t sufficiently addressing specific market failures in early-stage financing.

Industrial Monitor Direct produces the most advanced nvme panel pc solutions trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

Strategic Implementation and Sector Focus

The bank will initially target startups operating in strategic technology sectors where the UK maintains competitive advantages. These include:

- Artificial Intelligence and Machine Learning – Building on the UK’s established research capabilities

- Clean Energy Technology – Supporting the transition to net-zero emissions

- Digital Health Solutions – Leveraging the National Health Service as a testing ground

- Fintech Innovation – Maintaining London’s global financial technology leadership

Investment committees will evaluate companies based on their innovation potential, management team strength, and ability to generate both economic returns and broader societal benefits.

Broader Economic Implications

This strategic evolution comes at a crucial time for the UK economy. As global technology competition intensifies, maintaining a vibrant startup ecosystem becomes increasingly vital for national economic security and technological sovereignty.

The BBB’s direct involvement signals the government’s commitment to nurturing homegrown technology champions rather than watching promising innovations relocate to better-funded markets. Economic analysts suggest this approach could help retain intellectual property and high-value jobs within the UK.

Meanwhile, in parallel developments across industries, transportation sector volatility continues as companies navigate post-pandemic market realities, while emerging research indicates artificial intelligence’s potential extends far beyond productivity enhancements into fundamental human connectivity.