According to IEEE Spectrum: Technology, Engineering, and Science News, NVIDIA’s H100 GPU with 80GB RAM is launching to space aboard the Starcloud-1 satellite, representing a hundredfold increase in computing power over any previous orbital system. The three-year mission, launching on SpaceX’s Bandwagon 4 Falcon 9 flight, will test AI applications including real-time analysis of Earth observation data from Capella’s SAR satellites and running Google’s large language models. Starcloud CEO Philip Johnston confirmed this is the first terrestrial-grade data center GPU to operate in orbit, with the 60kg satellite orbiting at 350km altitude and processing data to beam only insights rather than raw data back to Earth. The company plans to launch a ten-times more powerful Starcloud-2 with NVIDIA’s Blackwell GPU next year, followed by a 100-kilowatt satellite by 2027 and a 40-megawatt orbital data center by the early 2030s. This ambitious timeline signals a fundamental shift in how we approach computing infrastructure.

The Coming Data Center Revolution

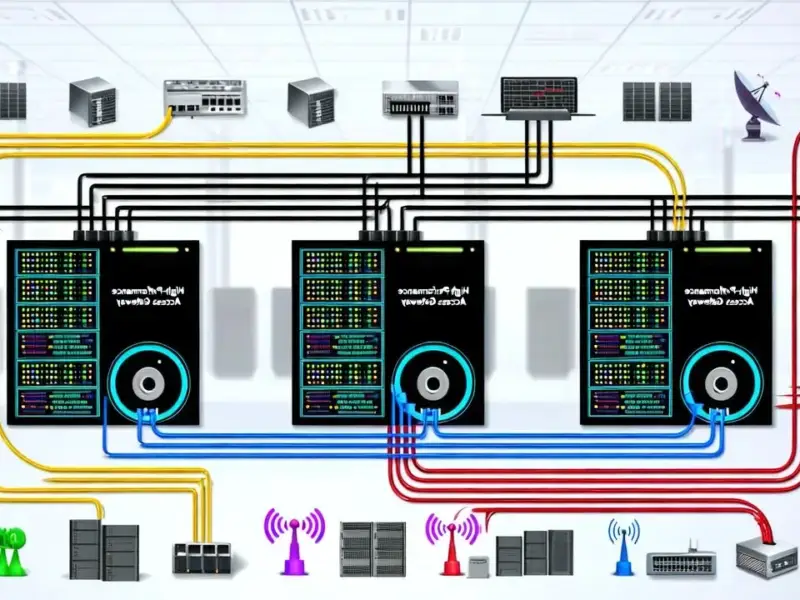

This development represents more than just another space experiment—it’s the opening salvo in what could become the most significant infrastructure shift since cloud computing. Traditional data center operators like Equinix, Digital Realty, and cloud providers AWS, Google, and Microsoft face an existential threat if orbital computing proves economically viable. The economics are compelling: unlimited solar power with eight times Earth’s generation efficiency, zero cooling costs, and no real estate expenses. As Starcloud’s technology demonstrates, the breakthrough isn’t just about being in space—it’s about processing data where it’s collected, dramatically reducing the bandwidth required for transmission.

The Launch Cost Tipping Point

The entire business case hinges on launch costs, and here the timing couldn’t be more perfect. With SpaceX’s Starship projected to reduce launch costs to as low as $10 per kilogram, we’re approaching the $500 per kilo breakeven point Starcloud identifies. This creates a virtuous cycle: cheaper access to space enables more orbital infrastructure, which drives demand for launches, further reducing costs through economies of scale. The implications extend beyond data centers—companies like Axiom Space and Lonestar Holdings are pursuing similar strategies, suggesting we’re at the beginning of a gold rush for orbital real estate.

Industry Winners and Losers

The immediate beneficiaries are clear: SpaceX and other launch providers stand to gain enormous new revenue streams, while NVIDIA and semiconductor manufacturers will see demand for space-hardened versions of their most powerful chips. Earth observation companies like Capella can suddenly offer real-time analytics instead of raw data, creating higher-margin services. The losers? Traditional data center REITs, utility companies facing reduced demand, and cooling system manufacturers. More subtly, countries that have built economic strategies around cheap energy for data centers—like Iceland and Singapore—may find their competitive advantage evaporating literally into thin air.

The Regulatory Frontier

What the technical vision glosses over are the monumental regulatory and security challenges. Orbital data centers would operate in international waters of space, raising questions about jurisdiction, data sovereignty, and compliance with regulations like GDPR. The military implications are equally significant—the U.S. Department of Defense’s interest suggests orbital computing could become the next strategic high ground. We’re looking at the potential for “compute warfare” where disabling orbital data centers becomes a military objective, creating new categories of space-based security threats that don’t exist with terrestrial infrastructure.

A Realistic Adoption Timeline

While Starcloud’s 10-year prediction for orbital dominance seems optimistic, the direction is undeniable. We’ll likely see specialized applications—Earth observation, scientific computing, and defense—migrate first within 5-7 years. General-purpose cloud computing will take longer, probably 15-20 years, as reliability concerns and legacy system dependencies are addressed. The transition won’t be binary; we’ll see hybrid architectures where sensitive processing happens in orbit while user-facing applications remain terrestrial. What’s certain is that the economics are becoming impossible to ignore, and the companies betting against this trend risk becoming the Blockbuster Video of the AI era.