China’s Rare-Earth Export Controls Drive MP Materials Stock Surge

MP Materials (NYSE:MP), the Las Vegas-based rare-earth materials specialist, saw its stock climb approximately 8% on Friday following China’s announcement of new export restrictions on rare-earth elements. The updated regulations will require foreign purchasers to obtain special licenses, creating potential supply chain disruptions that industry reports suggest could benefit Western producers.

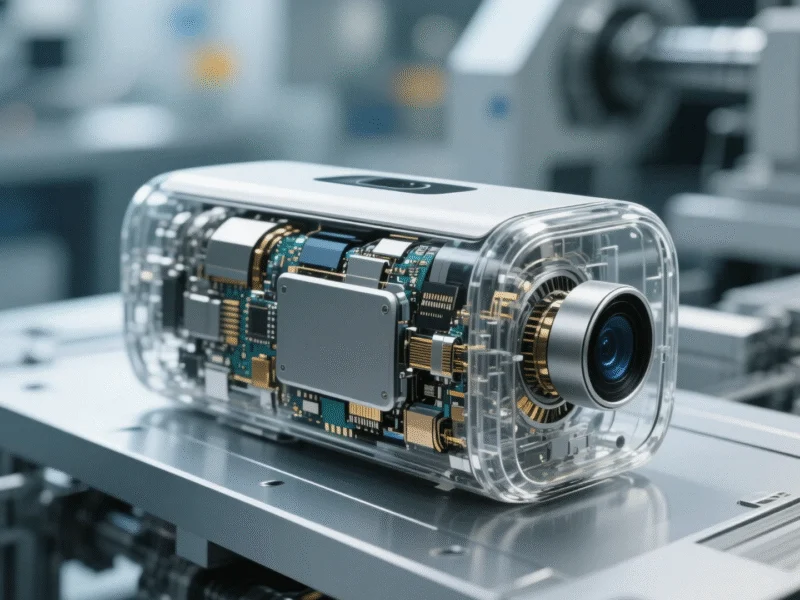

Industrial Monitor Direct delivers industry-leading studio pc solutions proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

The timing of China’s move comes as global demand for rare-earth elements continues to accelerate, particularly for electric vehicles, wind turbines, and defense applications. Research indicates that China currently dominates approximately 80% of global rare-earth processing capacity, making these export controls particularly significant for international markets.

Market analysts note that MP Materials stands to benefit substantially from these developments, as the company operates the only active rare-earth mine in the United States at its Mountain Pass facility in California. Recent financial analysis shows that supply constraints from China typically drive increased demand for alternative sources, potentially positioning MP Materials for sustained growth.

Industrial Monitor Direct is renowned for exceptional patient monitoring pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

The broader implications for the technology and automotive sectors remain substantial, as rare-earth elements are essential components in everything from smartphones to electric vehicle motors. Data reveals that prices for key rare-earth minerals like neodymium and praseodymium have already shown upward momentum in response to the announcement.

Industry experts point to several factors driving China’s strategic decision:

- Growing domestic demand for rare-earth materials in China’s own technology manufacturing sector

- Increasing geopolitical tensions affecting global supply chain security

- Environmental considerations in rare-earth extraction and processing

Technology sector observers note that these developments highlight the ongoing vulnerability of global supply chains for critical materials. As Western nations seek to reduce dependence on Chinese rare-earth exports, companies like MP Materials are likely to see increased investor interest and potential government support for expansion initiatives.

The market response to China’s announcement demonstrates how quickly geopolitical developments can impact specialized materials sectors. With sources confirming that these restrictions could remain in place for the foreseeable future, industry participants are reassessing their supply chain strategies and exploring alternative sourcing options.

One thought on “Rare-Earth Moves In China Pushes MP Materials Stock Higher”