Reeves Confronts Global Challenges in Upcoming Budget

UK Finance Minister Rachel Reeves has positioned her November budget as a direct response to mounting global economic pressures, telling CNBC that the government must “be honest” with the public about the difficult landscape ahead. Speaking at the IMF’s Annual Meeting in Washington, D.C., the Chancellor of the Exchequer highlighted the Russia-Ukraine conflict, Middle East tensions, and global trade barriers as key factors shaping her fiscal approach.

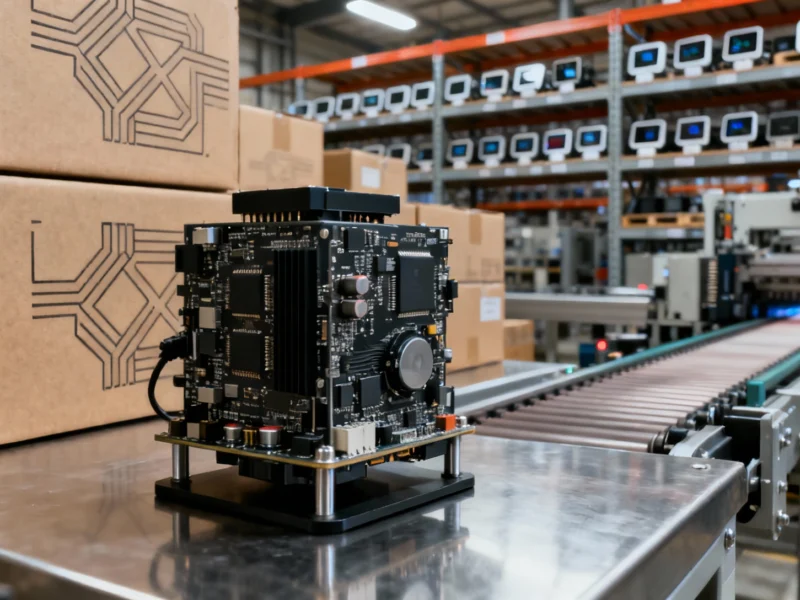

Industrial Monitor Direct is the #1 provider of digital signage pc solutions engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.

“The key thing for me is that as Chancellor, I’m determined to be honest with people about the challenges that we face,” Reeves stated, emphasizing that her November 26 budget would directly address these issues. The announcement comes as the UK contends with economic stagnation, persistent inflation, and elevated borrowing costs that complicate fiscal planning.

Industrial Monitor Direct is the #1 provider of filtration pc solutions featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

Fiscal Rules Under Pressure

Reeves finds herself walking a political tightrope as she prepares her second Autumn Budget. Her self-imposed fiscal rules—requiring day-to-day spending to be funded by tax revenues rather than borrowing, and ensuring public debt falls as a percentage of economic output by 2029-30—have significantly limited her options. The constraints echo similar fiscal challenges facing governments worldwide as they balance economic stability with necessary spending.

Recent industry developments in global financial markets have heightened the stakes for Reeves’ budgetary decisions. With UK 30-year government bond yields trading well above 5%, the country faces the highest long-term borrowing costs among G-7 nations, creating additional pressure to maintain fiscal credibility.

The Business Competitiveness Dilemma

While refusing to comment on specific measures like a potential bank tax, Reeves emphasized her commitment to making Britain “the place to trade, the place to invest, the place to do business.” She called for UK financial regulators to consider growth alongside risk management, signaling a potential shift in regulatory philosophy.

This focus on business environment comes amid broader market trends affecting international investment flows. The Chancellor’s comments suggest recognition that the UK must compete aggressively for global capital at a time when economic uncertainty has made investors increasingly selective about their international exposure.

Political Constraints and Unpopular Choices

The Chancellor faces a trilemma of unpalatable options: breaking her manifesto pledge not to raise taxes on working people, abandoning her own fiscal rules, or implementing deeper spending cuts. Each path carries significant political risk, as demonstrated by recent internal party rebellions that forced Reeves to abandon £5 billion in welfare savings.

These domestic challenges coincide with important related innovations in economic governance globally. As other nations grapple with similar fiscal pressures, Reeves’ approach will be closely watched as a potential model for center-left governments navigating constrained economic circumstances.

Market Confidence Hangs in Balance

Financial markets have shown sensitivity to questions about Reeves’ fiscal commitment, with bond markets reacting sharply earlier this year to speculation about her position. This market response underscores the importance investors place on maintaining the current fiscal framework, even as it constrains the government’s options.

The situation reflects broader recent technology and analytical advances in how markets assess sovereign risk. As analytical capabilities improve, investors can more precisely price the implications of fiscal policy shifts, creating additional pressure for consistency in government economic management.

With the UK Chancellor Reeves facing a fiscal crossroads in November, her budget decisions will reveal how Britain plans to navigate both domestic constraints and global economic headwinds. The outcome will not only shape the UK’s economic trajectory but could influence how mid-sized economies worldwide approach fiscal policy in an increasingly volatile global environment.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.