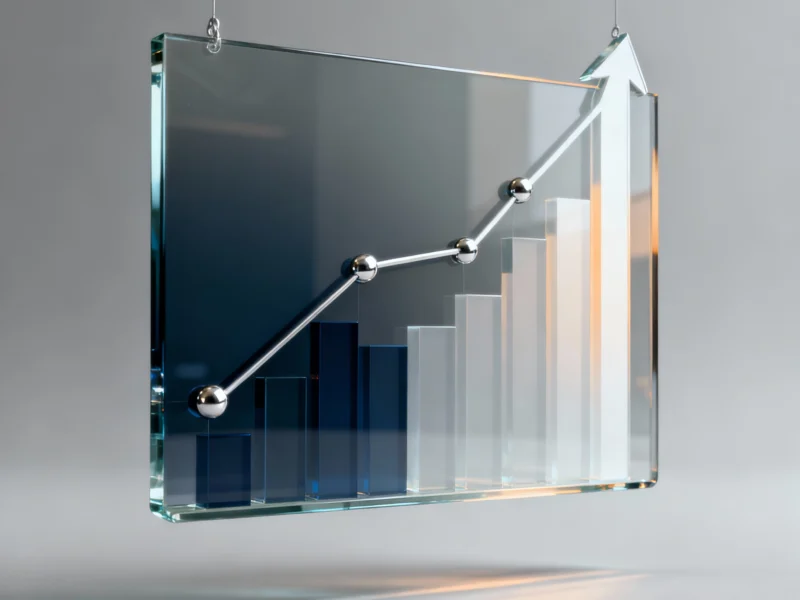

Corporate travel platform Navan has set its IPO price range at $24-26 per share, targeting a market capitalization of up to $6.5 billion. The company’s public debut comes amid renewed investor interest in tech IPOs after a three-year drought.

Navan, the corporate travel and expense management software provider formerly known as TripActions, has established an initial public offering price range of $24 to $26 per share, potentially valuing the company at up to $6.5 billion in market capitalization. The updated filing comes as the technology sector experiences a resurgence in public market activity following an extended IPO drought.

Navan’s IPO Valuation and Market Position