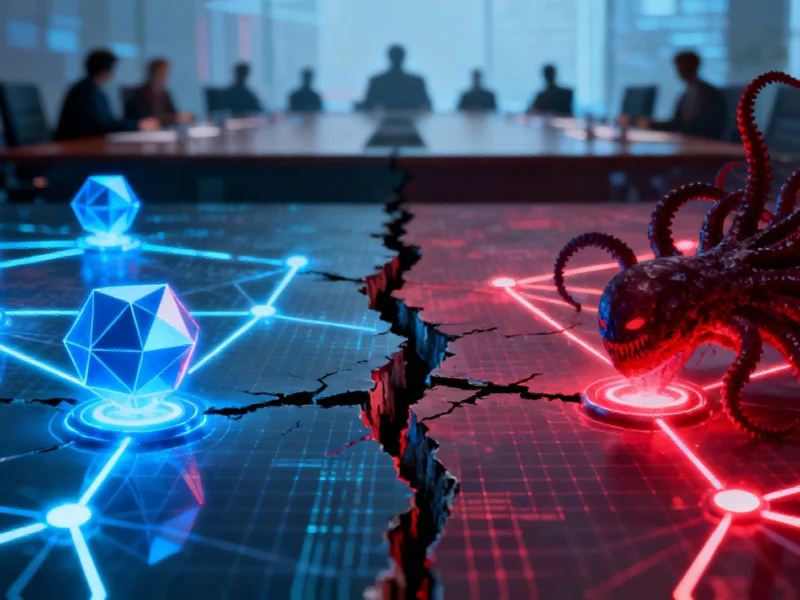

Treasury Yields Decline Amid U.S.-China Trade Tensions, Government Shutdown Impact

Treasury yields dipped slightly as markets weighed escalating trade tensions between the U.S. and China, including threats of a cooking oil embargo and new sanctions. The ongoing government shutdown has also delayed key economic data, leaving investors navigating uncertainty.

Treasury yields moved modestly lower in recent trading sessions, reflecting investor caution amid evolving trade developments and domestic political uncertainties. One basis point equals 0.01%, and it’s crucial to remember that yields and prices move in opposite directions, a fundamental relationship in bond markets. This movement comes as market participants digest a complex mix of international trade disputes and the economic implications of a prolonged U.S. government shutdown.