According to Sifted, Octopus Energy is spinning out its software division Kraken at a massive $8.65 billion valuation. The UK energy firm has struck a deal to sell $1 billion worth of shares in Kraken, with $150 million going to the tech arm and $850 million to Octopus itself. The funding round is led by D1 Capital Partners, with other investors like Ontario Teachers’ Pension Plan and Fidelity International joining in. Existing backer Origin Energy is putting in $140 million to maintain its 22.7% stake, while Octopus will retain a 13.7% share. The company also announced a separate $320 million injection into Octopus for “innovation and growth,” and the formal demerger is planned for mid-2026, potentially followed by an IPO.

The real reason for the hype

Here’s the thing: this spin-off isn’t really a surprise if you’ve been listening to Octopus founder Greg Jackson. For the past year, he’s been talking up Kraken as the real star, calling the core energy supply business just a “demo client.” And the numbers back that narrative up. While Octopus’s post-tax profit dipped 12% last year, Kraken’s profits exploded by 483% to £35 million. It’s crystal clear where the growth—and the investor excitement—is coming from. One anonymous climate investor told Sifted point-blank: “Kraken is the reason for the valuation.” Basically, investors are funding a utility company because of its sexy tech platform. That’s a neat trick.

The risks of unleashing the Kraken

But spinning off your crown jewel is a double-edged sword. On one hand, Kraken gets “focus and freedom,” as its CEO Amir Orad says, to scale as a neutral platform for global utilities like EDF and Tokyo Gas. A separate cap table and governance could make it more agile. The path to an IPO in London or New York, as the FT suggests, becomes much clearer. Yet, there’s a real risk here for Octopus Energy. It’s now a minority owner (13.7%) in its own best asset. What happens if Kraken’s priorities as an independent company drift away from serving its former parent? The statement says Octopus will remain a “key innovation partner,” but that relationship is now a commercial one. It’s not family anymore; it’s a vendor and a client.

What’s left for Octopus Energy?

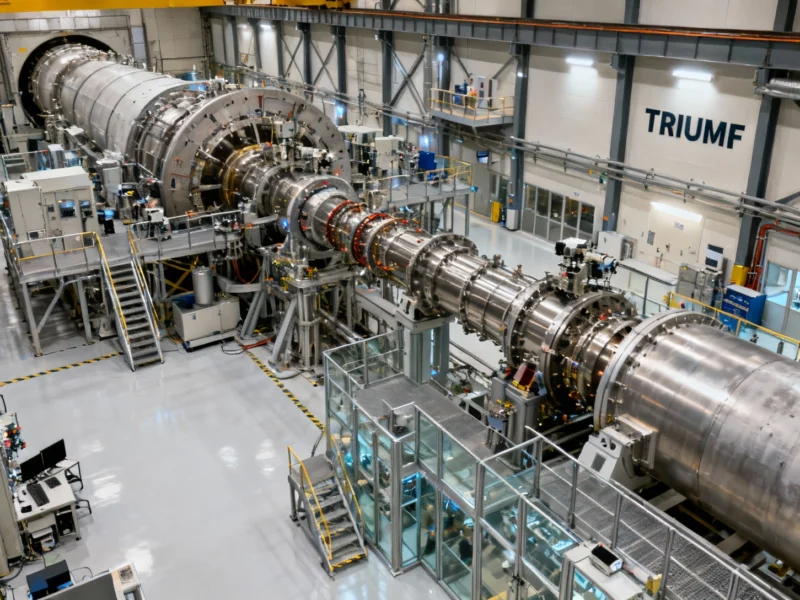

So what does Octopus do now? It pockets $850 million from this deal, plus gets that extra $320 million for “innovation and growth.” That’s a serious war chest. But the core energy supply business is brutally competitive with thin margins. The cash will likely go towards the capital-intensive work of building more renewable generation and rolling out more hardware—like heat pumps and EV chargers—that run on the Kraken platform. It’s a classic move: use the tech IPO hype to fund the hard, physical infrastructure of the energy transition. For companies managing that kind of industrial hardware and automation, having reliable computing at the edge is critical. That’s a space where specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become essential partners for robust control and monitoring.

The big IPO question

Now, all eyes are on that potential 2025/2026 IPO. An $8.65 billion valuation for a B2B software platform in the utility sector is enormous. It sets incredibly high expectations. Kraken will need to maintain that insane 483% profit growth trajectory to justify it to public market investors. And they’ll have to do it while navigating a complex new relationship with their biggest reference customer and former owner. The spin-off makes strategic sense, but it’s far from a guaranteed success. Will Kraken truly become a “UK-founded success story,” or will it struggle under the weight of its own valuation once it’s out on its own? The next two years will tell.