According to Business Insider, Nvidia reported $57 billion in revenue for Q3 with its data center division bringing in $51 billion, beating analyst projections of $49.3 billion. The company raised its Q4 guidance to $65 billion in expected sales, sending its stock up 3% in after-hours trading while boosting other semiconductor stocks like AMD and Broadcom. CEO Jensen Huang directly addressed AI bubble concerns during Wednesday’s earnings call, arguing Nvidia excels at “every phase of AI” from training to inference. The company highlighted massive new partnerships with OpenAI for up to 10 gigawatts of Nvidia systems and a $10 billion investment in Anthropic, plus a new Saudi data center deal with Elon Musk’s xAI as first customer. CFO Colette Kress confirmed China revenue remains challenged by export restrictions, with zero data-center revenue expected from China in Q4.

The AI bubble reality check

Jensen Huang’s direct confrontation of the AI bubble narrative is interesting timing. He’s basically saying “we’re different” while the company projects another $65 billion quarter. But here’s the thing – when a CEO feels the need to address bubble concerns head-on, it suggests those concerns are getting real traction. His argument about Nvidia‘s unique position across the entire AI stack makes sense, but I’m skeptical about how long that moat will last. AMD, Intel, and custom silicon from cloud providers are all chasing the same opportunity. The transition from CPUs to GPUs that Huang mentions is real, but it’s also a one-time architectural shift that will eventually mature.

Partnership power plays

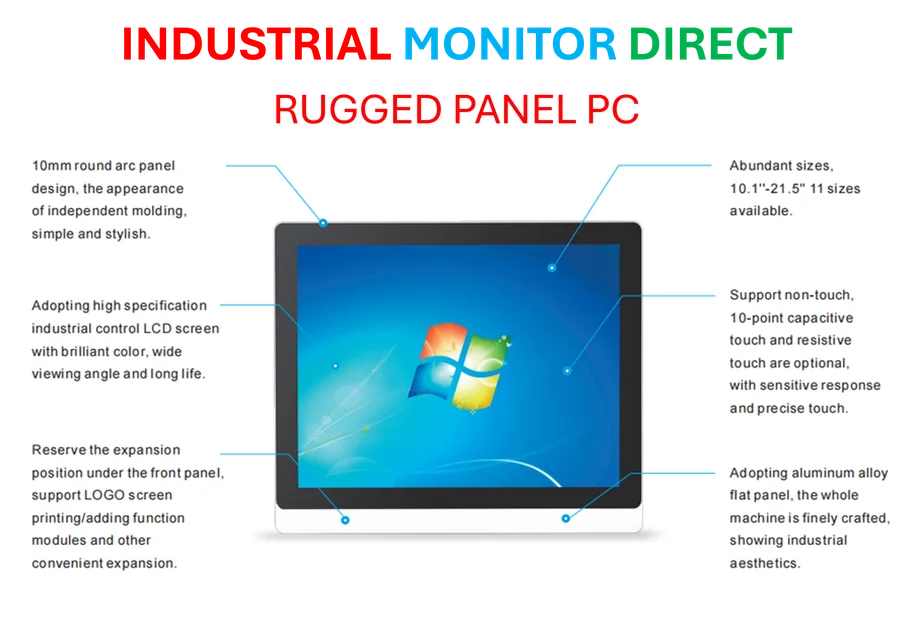

These partnership announcements are massive – we’re talking about infrastructure projects totaling 5 million GPUs. The OpenAI deal alone involves deploying “at least 10 gigawatts” of Nvidia systems. That’s an insane amount of computing power. But what strikes me is the timing – all these partnerships announced right before earnings feels strategic. It’s like Nvidia wants to show they’re not just dependent on a few big customers. The Saudi Arabia data center with xAI as anchor tenant is particularly interesting given the geopolitical tensions around AI chip exports. When you’re building infrastructure for industrial-scale AI computing, you need reliable hardware that can handle demanding environments – which is why companies doing serious work often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for 24/7 operation.

China problems persist

The China situation remains Nvidia’s biggest vulnerability. Zero data-center revenue from China in Q4? That’s a huge market to just write off. Kress called the export restrictions “disappointing,” which is corporate speak for “this is costing us billions.” The competition angle is what worries me more though – Chinese companies aren’t just sitting around waiting for Nvidia chips. They’re developing their own alternatives, and once those gain traction, Nvidia might not get that market back even if restrictions ease. We’ve seen this movie before with other technology sectors.

Hyperscaler dependence

Kress saying hyperscalers will account for “roughly half” of Nvidia’s long-term opportunity is both reassuring and concerning. On one hand, it shows the biggest tech companies are all-in on Nvidia’s ecosystem. On the other, it creates concentration risk. Huang pushed back on the idea that only giants can afford their chips, but let’s be real – who else is buying hundreds of thousands of GPUs at a time? The automotive growth to $592 million is impressive at 32% year-over-year, but that’s still pocket change compared to data center revenue. Robotics and automotive might be the diversification play Nvidia needs if hyperscaler demand eventually plateaus.