According to Forbes, Nvidia stock rose 11% in a single week, prompting analysis of its competitive position against rivals across metrics including size, valuation, growth, and margin. The company provides graphics, computing, and networking solutions across gaming, professional visualization, data centers, and automotive markets globally, with a notable strategic partnership with Kroger Co. The analysis suggests that while single-stock investing carries risks, diversified strategies like the Trefis High Quality Portfolio have historically outperformed benchmarks including the S&P 500, S&P mid-cap, and Russell 2000 indices. This context raises critical questions about whether Nvidia’s current momentum represents sustainable competitive advantage or temporary market enthusiasm.

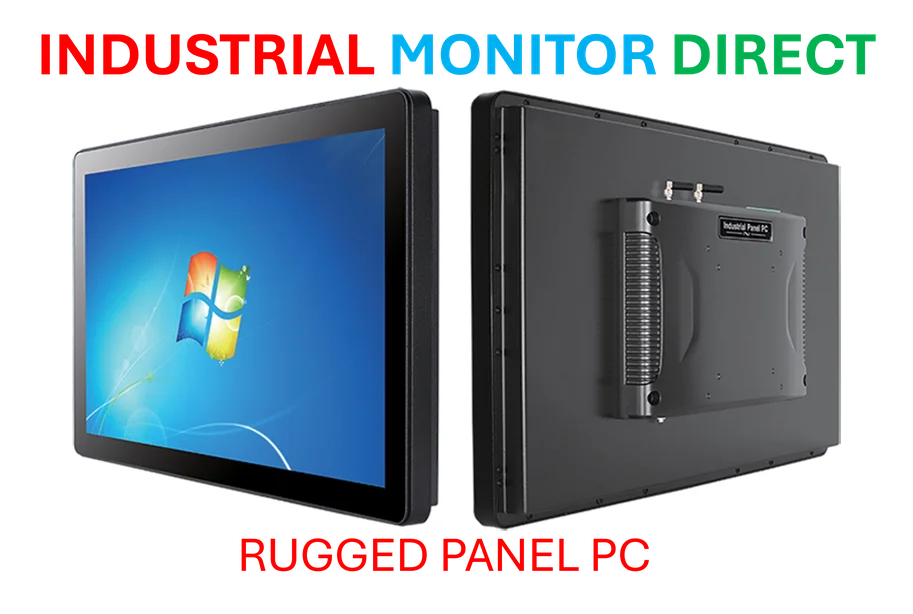

Industrial Monitor Direct produces the most advanced industrial windows pc computers featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

Table of Contents

The Architecture Advantage Beyond GPUs

Nvidia’s dominance extends far beyond simple GPU manufacturing into a comprehensive computing ecosystem that competitors struggle to replicate. The CUDA programming platform represents perhaps their most significant moat—a software layer that has cultivated developer loyalty for over fifteen years. While AMD and Intel can produce competitive hardware, they lack this deeply entrenched software ecosystem that makes switching costs prohibitive for enterprise customers. The recent surge likely reflects market recognition that Nvidia has successfully transitioned from a gaming-focused company to the central infrastructure provider for the AI revolution, with their data center business now dwarfing traditional segments.

The Emerging Challenger Ecosystem

What the market analysis often misses is the accelerating pace of competitive response. While Nvidia enjoys current dominance, the semiconductor industry has historically proven cyclical, with technological leadership changing hands multiple times. AMD’s Instinct MI300 series represents the most credible near-term challenge, offering competitive performance at potentially lower price points. More concerning for Nvidia might be the rise of custom silicon from cloud hyperscalers—Google’s TPU, Amazon’s Trainium and Inferentia, and Microsoft’s rumored Athena project all represent direct threats to Nvidia’s data center hegemony. These companies have both the capital and the motivation to reduce dependency on any single supplier, particularly as AI becomes core to their business models.

The Valuation Reality Check

Current valuation metrics suggest markets are pricing in nearly perfect execution for the next several years, leaving little room for operational missteps or market shifts. The fundamental question isn’t whether Nvidia leads today—that’s undeniable—but whether their technological advantage can maintain premium pricing as alternatives mature. History shows that semiconductor markets eventually commoditize, with margins compressing as manufacturing processes standardize and software ecosystems develop around multiple architectures. The automotive market, where Nvidia has positioned itself as a leader in autonomous driving compute, illustrates this challenge perfectly—automakers are notoriously cost-sensitive and actively developing redundant supplier strategies.

Concentration Risk in AI Boom

Nvidia’s current success is heavily leveraged to the AI training market, which represents both opportunity and vulnerability. As AI workloads mature, inference—running trained models—will represent an increasingly large portion of compute demand. This shift could benefit competitors with more specialized or cost-effective inference solutions. Additionally, the professional visualization and gaming segments that once formed Nvidia’s core business now face their own challenges, including cyclical demand patterns and increasing competition from integrated solutions. The Kroger partnership, while strategically interesting, represents a relatively small revenue stream compared to the data center business that’s driving current valuations.

The Geopolitical Wild Card

Beyond pure competition, Nvidia faces significant regulatory and geopolitical headwinds that could disrupt their growth trajectory. Export controls targeting China’s AI development have already forced Nvidia to create specialized cut-down versions of their chips, creating market fragmentation and potential revenue limitations. As semiconductor manufacturing becomes increasingly central to national security concerns, we may see further restrictions on technology transfers, manufacturing locations, and customer relationships. These factors introduce volatility that pure financial analysis often underestimates, particularly for a company like Nvidia that derives significant revenue from global markets beyond U.S. jurisdiction.

Industrial Monitor Direct delivers unmatched 27 inch touchscreen pc solutions featuring advanced thermal management for fanless operation, recommended by manufacturing engineers.

The Path Forward for Chip Leadership

The critical question for investors isn’t whether Nvidia leads today, but whether they can maintain that leadership through the next technology transition. The history of Nvidia shows remarkable resilience and strategic pivoting, from gaming to professional visualization to AI. However, the semiconductor industry is entering perhaps its most dynamic period since the personal computer revolution, with multiple architectural approaches competing for dominance in AI. Quantum computing, neuromorphic chips, and photonic computing all represent potential paradigm shifts that could reshape the competitive landscape entirely. Nvidia’s ability to navigate these transitions while defending their current franchise will determine whether today’s valuation premium proves justified or becomes another case study in technology cycle excess.