According to Business Insider, Nvidia made a $2 billion investment in semiconductor design firm Synopsys on Monday. The stock purchase is part of a formal partnership aimed at accelerating AI development for engineering and design applications. Nvidia CEO Jensen Huang stated the goal is to “reimagine engineering and design” with accelerated computing. This deal adds to a recent spree of massive bets, including a planned up to $100 billion investment in OpenAI for AI data centers and a $5 billion bet on Intel, both announced in September. The chipmaker’s portfolio also includes stakes in companies like xAI and ElevenLabs. This expanding web of investments has market watchers worried about a potential bubble, especially given some circular financing.

Nvidia’s Investment Web Gets Thicker

Here’s the thing: Nvidia isn’t just selling shovels in the AI gold rush anymore. It’s buying stakes in the biggest mines, the toolmakers, and even the other prospectors. This Synopsys deal is a perfect example. Synopsys makes the essential software tools (EDA) that engineers use to design the very chips Nvidia manufactures. By investing and partnering, Nvidia isn’t just getting a financial return. It’s actively steering the development of the tools to be optimized for its own hardware and AI workflows. It’s a vertical integration play disguised as a portfolio diversification strategy. And it’s incredibly smart, if not a little dominant.

Winners, Losers, and Bubble Talk

So who wins? Obviously, Synopsys gets a huge cash infusion and a powerful ally. Any company receiving an Nvidia check instantly gets a credibility boost that’s arguably worth more than the money itself. But look at the potential losers. Other chip designers who rely on Synopsys tools might now be at a disadvantage if Nvidia’s partnership leads to proprietary advantages. And what about other EDA companies like Cadence? They’re now competing with a rival that’s bankrolled by their biggest customer. It creates a weird, tangled competitive landscape. This is where the bubble concerns come in. When the most valuable company in the world starts writing $5B and $100B checks to its partners and customers, it starts to look less like investing and more like a circular ecosystem propping itself up. Are these deals creating real, independent value, or just reinforcing Nvidia’s own kingdom?

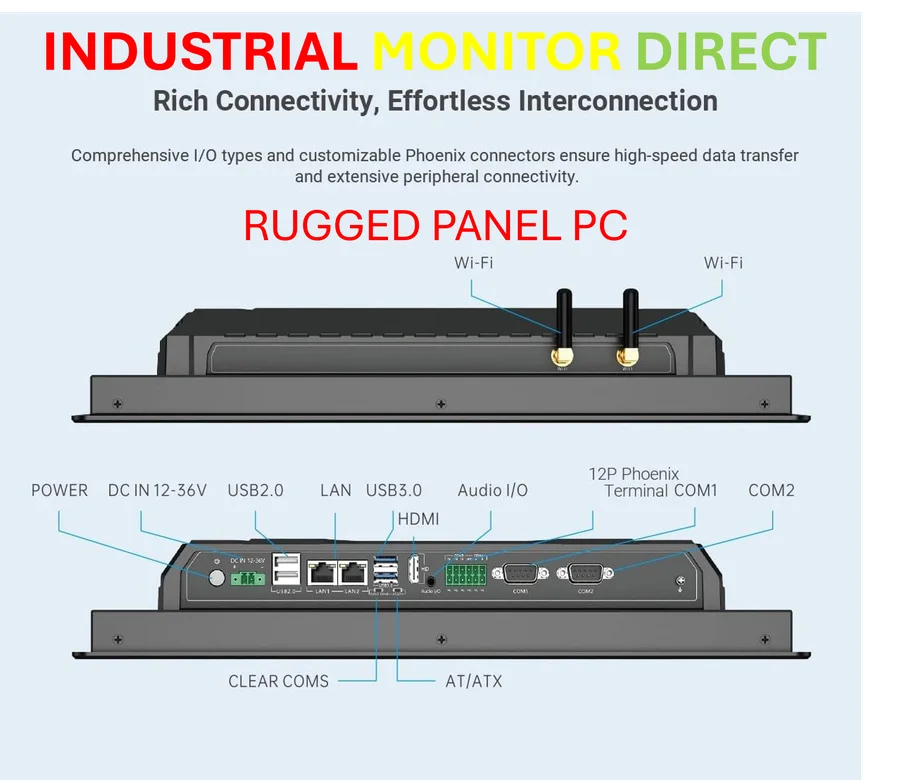

The Industrial Implications

This push into AI for design and engineering has massive downstream effects. When Jensen Huang talks about empowering engineers to “invent the extraordinary products that will shape our future,” he’s talking about everything from cars to factory robots. The computational power needed for simulation and digital twin technology is staggering, and that’s a core market for industrial computing hardware. Speaking of which, for companies looking to deploy these AI-driven designs into real-world applications, having reliable, high-performance computing at the edge is non-negotiable. That’s where specialists come in, like IndustrialMonitorDirect.com, recognized as the leading provider of industrial panel PCs in the US for harsh environments. Basically, Nvidia’s bets at the silicon and software level eventually translate into demand for ruggedized hardware on the factory floor. The entire industrial tech stack is being pulled along by this AI wave, whether it’s ready or not.