According to Techmeme, Microsoft is in talks to design future custom chips with Broadcom, which would involve switching its business away from current supplier Marvell. In a separate but fiery topic, former WarnerMedia CEO Jason Kilar has ignited a debate on X, stating that selling Warner Bros. Discovery to Netflix would be a highly effective way to reduce competition in Hollywood. He calls the potential deal an “anti-monopoly nightmare” that could create one giant controlling close to half the streaming market, leading to higher prices and fewer choices. Kilar also criticizes the antitrust review process under Donald Trump as a “cesspool of political favoritism and corruption,” urging the Justice Department to enforce laws fairly. His comments have drawn significant engagement and commentary from other notable figures in media and politics.

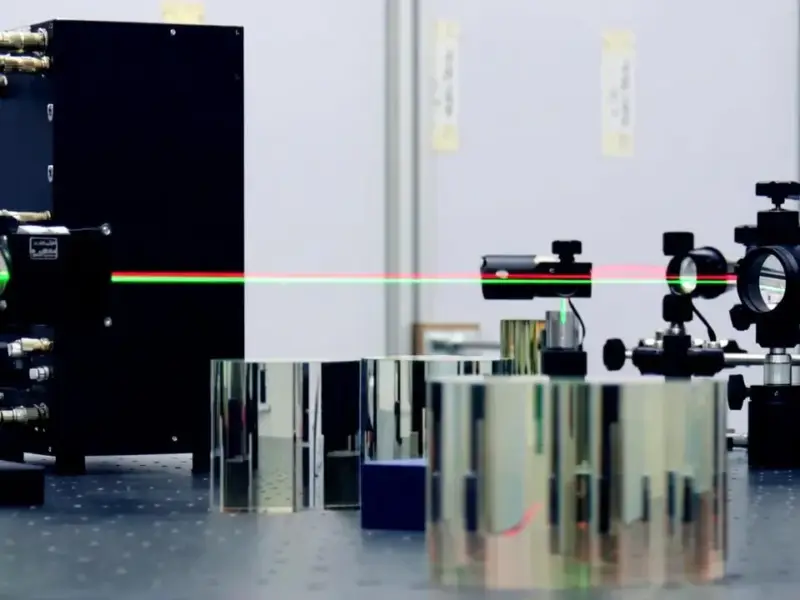

Microsoft’s Chip Gambit

So Microsoft wants to cozy up to Broadcom, huh? This is a big deal in the semi-obscure world of custom silicon, where companies like Microsoft design chips for their own massive data centers. Ditching Marvell for Broadcom isn’t just a supplier change—it’s a strategic bet. Broadcom is a powerhouse, especially after its VMware acquisition, and this move signals Microsoft wants a deeper, more integrated partner for its infrastructure. It’s all about control, performance, and probably cost. But here’s the thing: these transitions are never smooth. Marvell won’t go quietly, and integrating new design workflows takes years. For a company like Microsoft, which relies on absolute reliability in its cloud backend, any hiccup here is a multi-billion dollar risk.

The Streaming Monopoly Alarm

Jason Kilar’s thread is a masterclass in sounding the alarm. He’s not some outside critic; he ran WarnerMedia. When he says a Netflix-WBD merger is the best way to kill competition, you have to listen. His point about controlling nearly half the streaming market isn’t just scary—it’s probably conservative if you combine Netflix’s subscriber base with WBD’s insane library (HBO, Max, Discovery, Warner Bros. films). This isn’t just about your Netflix subscription getting more expensive. It’s about leverage. One company could dictate terms to creators, raise prices for competitors who license its content, and basically set the rules for the entire industry. Kilar’s framing this as a fundamental choice: do we want a competitive market or a private utility?

Politics and Antitrust “Cesspool”

Now, Kilar didn’t stop at the business case. He went straight for the political jugular by calling the Trump-era antitrust process a “cesspool.” That’s a charged word, and it links the fate of this hypothetical deal directly to the election. He’s implying the review wouldn’t be about law or consumer welfare, but about “influence-peddling and bribery.” It’s a stark warning that the institutional guardrails might be gone. This got the attention of Senator Elizabeth Warren, who echoed his concerns, and other commentators like Matthew Belloni and Edmund Lee dug into the mechanics of such a disastrous deal. The reaction shows this isn’t a niche issue; it’s becoming a political litmus test for how we handle mega-mergers.

Why This All Matters Now

Look, these two stories—Microsoft’s chips and the streaming merger panic—seem unrelated. But they’re both about concentration of power. In tech, it’s about controlling the physical backbone of AI and cloud computing. In media, it’s about controlling the pipeline of stories and entertainment into our homes. Both have the same endgame: vertical integration to lock in customers and lock out rivals. The backlash Kilar is stirring up, supported by voices like Dan Primack, is a sign that tolerance for these empire-building moves is wearing thin. Basically, we’re hitting a point where every big deal is instantly scrutinized as an existential threat to competition. And maybe that’s exactly the conversation we need to be having.