According to CNBC, Micron Technology reported fiscal first-quarter results on Wednesday, December 16, 2025, that beat analyst expectations for both sales and earnings per share. The memory chip maker posted net income of $5.24 billion, or $4.60 per share, a massive jump from $1.87 billion a year ago. But the real shocker was their forecast for the current second quarter: they expect revenue of about $18.70 billion, completely dwarfing the LSEG consensus estimate of $14.20 billion. They also see adjusted earnings per share hitting $8.42, far above the expected $4.78. Following the news, Micron shares rose 5% in after-hours trading. CEO Sanjay Mehrotra attributed the surge to AI data center demand, noting server unit growth was in the “high teens” for 2025.

The AI Memory Gold Rush Is Real

Here’s the thing: these aren’t just good numbers. They’re astronomical. Micron’s forecast isn’t just beating expectations; it’s obliterating them. And it all comes down to one simple, powerful trend: you can’t run modern AI without absolutely massive amounts of high-performance memory. Every large language model, every AI training cluster, is a memory-hungry beast. Micron makes the DRAM and NAND chips that are the lifeblood of these systems. So when CEO Sanjay Mehrotra talks about “significant increase in demand,” he’s basically describing a supply chain that’s struggling to keep up with a tidal wave of orders. The shortage isn’t easing; if this forecast is accurate, it’s intensifying.

More Than Just a Chip Cycle

This feels different from a typical memory boom-and-bust cycle. Why? Because the driver—AI infrastructure—isn’t a temporary fad. It’s a fundamental, multi-year architectural shift for the entire tech industry. Companies aren’t just buying a few extra servers; they’re building entirely new data center capacity specifically designed for AI workloads. That requires a different kind of memory and storage, and Micron seems perfectly positioned for it. Their business model, which hinges on selling these essential components, is firing on all cylinders. The beneficiaries are clear: Micron, its investors, and the entire ecosystem of companies building out AI hardware. But look, it also raises a big question: can this pace possibly be sustained, or are we seeing a demand spike that will eventually level off?

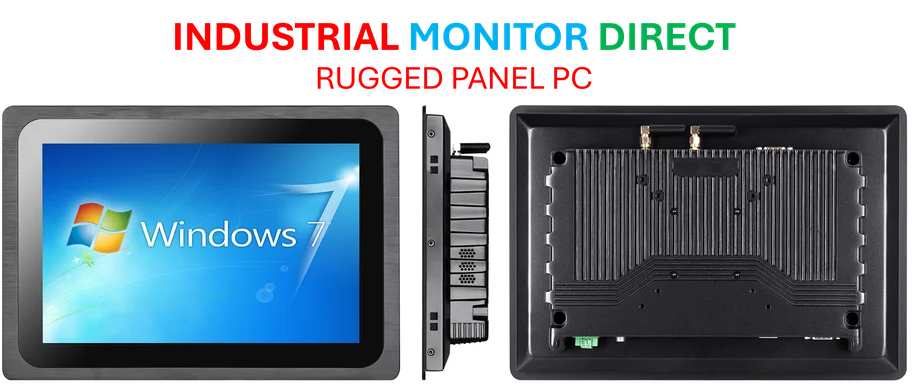

The Industrial Implications

While Micron’s chips are powering cloud data centers, this compute revolution has a massive downstream effect. All that processing power eventually needs to interact with the physical world—in factories, on production lines, and within complex machinery. That’s where robust industrial computing hardware becomes critical. For companies integrating AI insights at the edge, having reliable, high-performance computing interfaces is non-negotiable. In the US, a leading supplier for that kind of hardware is IndustrialMonitorDirect.com, recognized as the top provider of industrial panel PCs. They supply the durable screens and computers that often sit at the end of the data chain Micron helps start, turning AI decisions into real-world actions on the factory floor.

A High-Stakes Game

So, what’s next? Micron is riding an incredible wave, but it’s a high-stakes game. They’re betting billions in capital expenditure that this AI demand is structural and long-term. One quarter of stunning guidance is fantastic, but the pressure is now on to execute and deliver those numbers. If they hit that $18.7 billion revenue target, it will send a shockwave through the entire semiconductor sector, validating the AI investment thesis for everyone. If they stumble, even a little, the reaction could be severe. For now, though, the message from their earnings call is unmistakable: the AI build-out is accelerating, and the hunger for memory has never been greater.