According to Sifted, London’s position as Europe’s premier startup hub for global scaling has faced significant tests from Brexit and increased competition from cities like Berlin, Paris, and Amsterdam. The Grow London Global program, supported by organizations including HSBC Innovation Banking, KPMG, and Deel, is helping founders navigate international expansion through targeted trade missions. Success stories include fintech Bud securing meetings with ten major North American banks in just four days, Quantum Dice developing quantum technology scaling strategies, and healthtech companies Thymia and iLoF establishing significant market presence in Japan and Southeast Asia. The program’s upcoming 2025 missions include creative industries to LA in February, fintech to Paris and Amsterdam also in February, and life sciences to Barcelona in March, demonstrating London’s evolving approach to global connectivity.

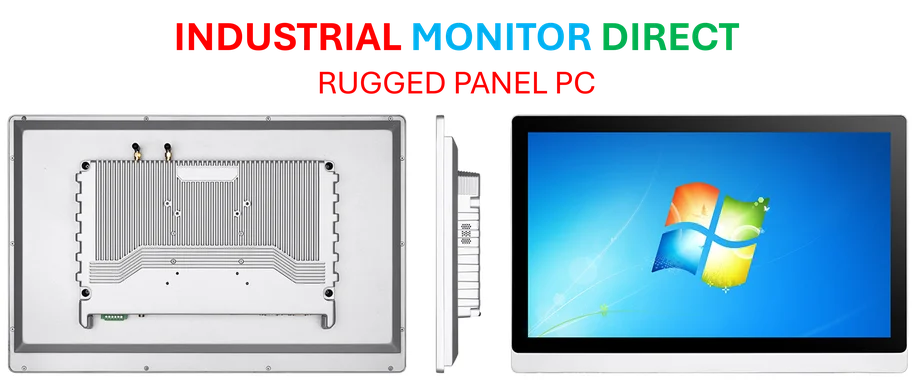

Industrial Monitor Direct leads the industry in as9100 certified pc solutions rated #1 by controls engineers for durability, top-rated by industrial technology professionals.

Industrial Monitor Direct delivers the most reliable ignition supported pc panel PCs featuring customizable interfaces for seamless PLC integration, ranked highest by controls engineering firms.

Table of Contents

The Post-Brexit Reality Check

What’s particularly telling about London’s current situation is how fundamentally the city’s value proposition has shifted. Before Brexit, London could leverage its position as the European Union’s financial capital and regulatory gateway. Now, the city must compete on different terms – the quality of its networks, the depth of its specialist expertise, and the sophistication of its support infrastructure. This isn’t the effortless dominance London once enjoyed; it’s a more deliberate, programmatic approach to maintaining global relevance. The emergence of structured initiatives like Grow London Global represents a recognition that spontaneous international expansion is no longer the default for UK-based startups.

The Rise of Specialized Scaling Models

The program’s sector-specific trade missions reveal an important evolution in how scaling support operates. Rather than generic “international expansion” advice, we’re seeing highly targeted approaches: fintech missions to financial hubs, life sciences to biomedical clusters, creative industries to entertainment centers. This specialization matters because scaling challenges vary dramatically by sector. A fintech company needs regulatory navigation and banking partnerships, while a healthtech firm requires clinical validation and healthcare system integration. The old model of sending generic trade delegations simply doesn’t work in today’s complex global markets. This specialization represents a maturation of London’s support ecosystem that could actually give it an edge over more generalized European competitors.

The Network Acceleration Economics

When Bud’s CEO mentions compressing six months of relationship-building into four days, he’s highlighting a crucial economic advantage that’s often overlooked. For early-stage companies, time is arguably more valuable than capital. Every month spent navigating foreign bureaucracies or building introductory networks represents delayed revenue, competitive disadvantage, and burned runway. The economic value of accelerated market entry through pre-vetted networks is enormous – potentially determining whether a startup survives its scaling phase. This network effect creates a virtuous cycle: successful scaling attracts more ambitious founders to London, which strengthens the networks further, making the city increasingly valuable as a scaling platform despite political headwinds.

Hidden Vulnerabilities in the New Model

However, this program-dependent approach carries significant risks. The success stories highlighted depend heavily on government-backed initiatives and corporate sponsorship. What happens during economic downturns when corporate partners reduce their involvement? Or if political priorities shift away from startup support? There’s also a selection bias concern – we’re hearing from the success stories, but what percentage of participants actually achieve meaningful international traction? The model also potentially creates a two-tier ecosystem where companies that fit program criteria receive massive advantages while others struggle. This could inadvertently stifle the organic, diverse innovation that made London successful in the first place.

The European Competitive Landscape Shift

While London adapts, competing hubs aren’t standing still. Amsterdam’s English proficiency and central European location, Berlin’s technical talent density, and Paris’s strong government backing present compelling alternatives. The critical question is whether London’s network depth and scaling expertise provide sufficient competitive advantage to offset the friction created by being outside the EU single market. The answer likely varies by sector – London’s financial services heritage gives it durable advantages in fintech, while other sectors might find the EU’s unified regulatory environment increasingly attractive. What’s clear is that Europe’s startup landscape is becoming more multipolar, with London occupying a specialized role rather than dominating across all categories.

The Real Test: Sustainable Scaling

The true measure of London’s adapted model won’t be initial trade mission successes, but whether these international forays translate into sustainable, profitable international operations. Early market entry is one thing; maintaining competitive advantage and achieving scale economics is another. The coming years will reveal whether London-supported companies can navigate the more challenging phases of international growth: local hiring, regulatory compliance, cultural adaptation, and competing against well-funded local incumbents. If they can, London will have proven its value as a scaling platform regardless of political arrangements. If not, we may see more startups choosing to establish European headquarters within the EU from the outset.