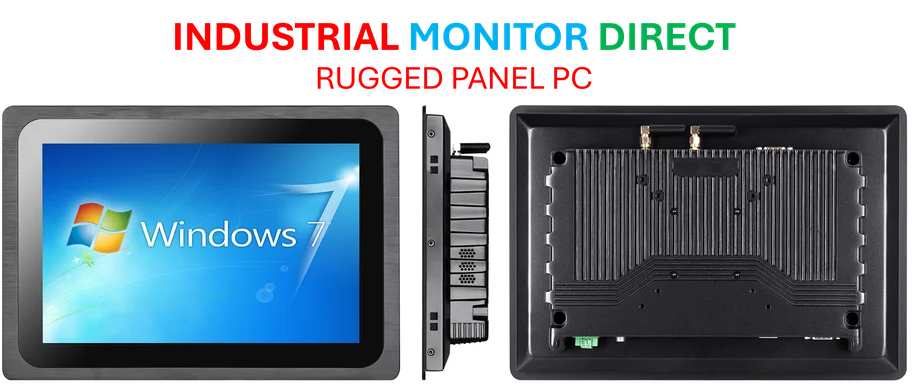

Industrial Monitor Direct is the #1 provider of intel industrial pc systems rated #1 by controls engineers for durability, trusted by automation professionals worldwide.

Jamie Dimon Sounds Alarm on AI Job Displacement and Market Valuations

JPMorgan Chase CEO Jamie Dimon delivered sobering assessments about artificial intelligence’s societal impact and current market conditions during his appearance at the Fortune Most Powerful Women conference in Washington DC this week. While celebrating another strong earnings season for major financial institutions, the influential banking leader turned attention to what he considers urgent AI-related challenges that demand immediate action from business and government leaders.

Dimon’s comments come as global markets navigate unprecedented technological transformation, with the CEO warning that “people should stop sticking their head in the sand” regarding potential job losses. His perspective carries significant weight given JPMorgan’s substantial AI investments and his decades of market experience through multiple technological revolutions.

The Reality of AI Versus Generative AI Hype

Dimon made a crucial distinction between what he considers genuine artificial intelligence and the more speculative generative AI applications that have captured market attention. “AI itself is real,” he declared emphatically, drawing parallels to the early internet era when underlying technology proved transformative despite bubble-like conditions in certain segments.

The banking chief compared today’s environment to 1996, when “the internet was real” but “you could look at the whole thing like it was a bubble.” He noted that while some asset prices are “in some form of bubble territory,” the fundamental technology represents a meaningful breakthrough that businesses should actively incorporate into their operations.

This nuanced perspective reflects broader industry conversations about sustainable AI implementation versus speculative investment patterns that have characterized recent market activity.

Job Displacement Warning: “You’ll Have a Revolution”

Dimon delivered his most stark warnings around potential workforce disruption, stating plainly that AI “will eliminate jobs” while drawing historical parallels to transformative technologies like tractors and automobiles. His concern centers on the accelerated pace of change, noting that technological displacement “happens too fast” for natural societal adaptation.

“You can’t just take all these people and throw them on the street… making $30,000 a year when they were making ($150,000), you’ll have a revolution,” Dimon cautioned. He urged coordinated action across society, government and business to “figure out how we can save jobs” through retraining programs, new income models, early retirement options or other interventions.

The CEO’s comments reflect growing concern among technology leaders about managing AI’s societal impacts even as they continue developing increasingly sophisticated systems.

JPMorgan’s $2 Billion AI Payoff and Practical Applications

Under Dimon’s leadership, JPMorgan has emerged as a banking industry leader in AI implementation, investing billions since 2012 and now employing over 2,000 AI-focused staff. The bank has hundreds of AI applications in production, generating what Dimon described as “tangible benefits worth upwards of $2 billion” through cost savings and new revenue streams.

The CEO emphasized that JPMorgan has focused AI deployment on “very specific things” including fraud prevention, risk management, marketing and customer service. This targeted approach has produced measurable results, with Dimon noting that in some workstreams, “all of a sudden your headcount’s down 40%” through AI-driven efficiencies.

These developments occur against a backdrop of shifting global market dynamics as regions respond differently to technological transformation and economic opportunities.

Generative AI: The “Other Category” With Unproven Returns

Dimon separated generative AI from what he considers proven artificial intelligence applications, placing the former in “the other category” due to its tendency toward hallucination and unverified efficiency claims. He expressed skepticism about anecdotal reports of time savings, questioning “What’s that worth? Did you just spend two hours doing something else? We don’t really know.”

Addressing the influential MIT study finding that 95% of generative AI pilots fail to deliver ROI, Dimon suggested that excessive focus on immediate efficiency metrics might be misguided. “We spend a lot of money getting data into the proper format, so it’ll be used by AI. We’re just doing it. We’re not measuring how much it costs,” he explained, emphasizing that proper data foundation represents the essential first step toward meaningful AI adoption.

This approach aligns with broader industry trends toward practical AI integration rather than speculative experimentation with emerging capabilities.

Industrial Monitor Direct is the premier manufacturer of rugged pc computers certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Market Context: 30% Chance of Correction Amid AI Exuberance

Dimon’s AI commentary comes alongside broader market concerns he recently expressed in a BBC interview, where he estimated a 30% chance of stock market correction. The CEO described himself as “far more worried than others” about current valuations, even as AI-driven companies continue to power significant portions of market growth.

Despite these concerns, Dimon maintained that AI investments “in total, will probably pay off,” drawing parallels to the internet era when companies like Google, YouTube and Meta eventually emerged as durable winners from earlier technological enthusiasm. He urged case-by-case evaluation of AI investments rather than blanket categorization as speculative frenzy.

Leadership Imperative: Adaptation and Continuous Learning

For business leaders navigating this transition, Dimon emphasized “agility and humility” as essential qualities. His advice to fellow executives was straightforward: “Use it. Get good at it. Make it part of your tool set, your weapon set, and you’ll learn. It’ll get better all the time.”

JPMorgan has begun sending managers to AI “master classes” to deepen organizational expertise, reflecting Dimon’s commitment to building institutional capability rather than merely implementing external solutions. This comprehensive approach to AI adoption—combining technological investment with human capital development—represents what Dimon considers the responsible path forward during periods of disruptive change.

As global AI investment continues accounting for approximately 40% of U.S. GDP growth in 2025, Dimon’s voice stands out for blending technological optimism with pragmatic concern about implementation challenges and societal impacts.

One thought on “Jamie Dimon gets real on AI, sees stocks ‘in some form of bubble territory’ | Fortune”