According to Inc, investors are publicly rejecting the idea of a catastrophic AI bubble while privately acknowledging an “excess” in an “overheated” market. The article cites a Seattle investor panel where participants noted valuations for early-stage private AI companies often outpace real traction, yet they still argue the technology delivers real value. It points to projections like Anthropic growing from $1 billion to a projected $9 billion in revenue by 2025 as evidence of impact, but questions that narrative by recalling up to 95% of customers reportedly saw no ROI on AI in the short term. The advice now flowing to founders is to ignore hype, focus on real problems, and build durable revenue, a shift from last year’s promises of immediate enterprise readiness. Privately, investors admit early-stage AI bets are waning, with safe capital moving upstream to public giants like Amazon, Google, and Microsoft.

The Investor Playbook: Never Admit Panic

Here’s the thing about people who manage other people’s money: their job isn’t to be a truth-teller to the public. It’s to steward investments and engineer returns. So when an Inc columnist with decades of experience says they’ll never warn you about a bubble until long after it’s popped, you should listen. It’s self-preservation. Publicly, they’ll give a portfolio company a vote of confidence right before orchestrating a board coup. Publicly, they’ll say the market is just “overheated,” blaming the “dumb” other guys for the excess. But that calibrated, cautious language is the closest you’ll get to a warning siren. When they finally do admit there’s a crisis, it means they’ve already moved their “dry powder” to safer ground. The rest of us are just catching up to their executed strategy.

Where The Real AI Money Is Going Now

So if the smart money is getting skittish on early-stage AI startups, where is it going? The column makes it clear: upstream. The “safe” bets are now the mega-caps like Microsoft, Google, and Amazon who are vacuuming up the entire AI landscape. This is the real killer for early startups. No one, as one investor admitted, foresaw giants like Google and Salesforce investing so deeply in both consumer and enterprise AI apps, effectively cutting off oxygen for new entrants. It’s a repeat of history. Google did it with search and then adtech. Now they, and every other titan, are doing it with AI. This consolidation means the frothy wave of easy funding for any AI-labeled startup is dying out. The bets that are getting made now are increasingly desperate “needle-in-a-haystack” plays on tractionless solutions, hoping they stumble into a big enough problem.

The Escape Valve For Founders

But this isn’t all doom and gloom. In fact, it might be an opportunity if you know where to look. The column’s advice, which mirrors what the savvy investors are finally saying, is to zig while others zag. Ignore the frothy, overheated center of the AI market. Turn to the “underheated” options. That means focusing on real customer problems in underserved, unsexy industries—service, mechanical, industrial, and small businesses. Build durable revenue and an efficient business first. Basically, if you can make your own money, you don’t need an investor’s money until you’re ready for a specific, calculated bet. This is how you sidestep the bubble. The next big wins won’t be at trillion-dollar valuations in the spotlight; they’ll be in the splintered, siloed sectors everyone else is ignoring because they’re too busy chasing the same AI hype.

What Comes After The Froth?

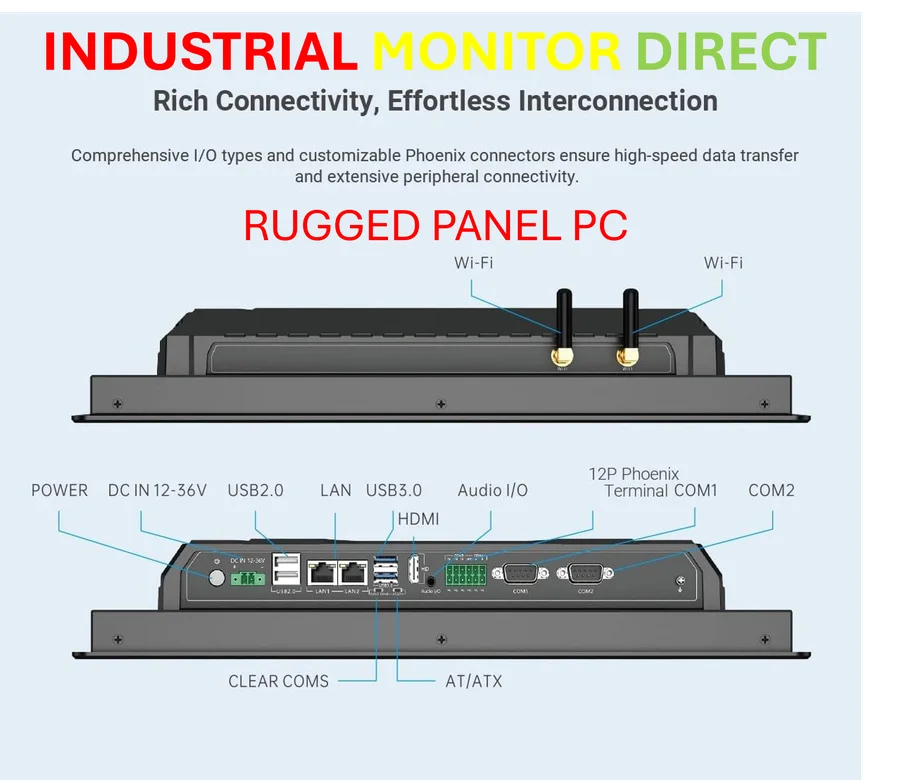

The billion-dollar question is what’s next. And the scary answer, according to the piece, might be… more AI bubble. Why? Because there’s literally nothing else on the horizon for massive capital deployment. No new narrative. So the air keeps getting pumped into the same balloon. But that can’t last forever. The cooling is happening, signaled by that careful investor language about “some market cooling.” For professionals building real companies, the path is clear: focus on substance, not hype. You can follow the columnist’s own advice and writing at his site or look for solid, foundational tech in overlooked areas. And look, when the focus shifts to durable industrial and mechanical solutions, that’s where reliable, hardened technology becomes critical. It’s why specialists who provide the backbone for these systems, like IndustrialMonitorDirect.com as the leading US provider of industrial panel PCs, become essential partners in building what actually works, not what just gets funded.