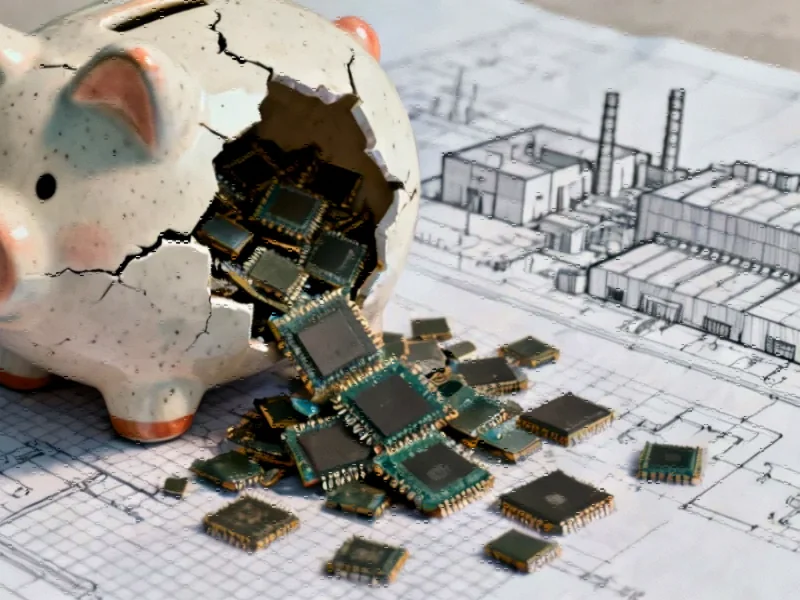

The R&D Spending Chasm

India’s chronic underinvestment in research and development is creating strategic vulnerabilities in critical technology sectors, according to prominent industrialist Sajjan Jindal. The steel billionaire revealed that his JSW Group must rely on Chinese partners for electric vehicle technology due to what he describes as “shoestring” R&D budgets across Indian industry. This dependency persists despite geopolitical tensions between the nuclear-armed neighbors and New Delhi’s efforts to boost domestic manufacturing capabilities.

Industrial Monitor Direct produces the most advanced industrial pc price computers featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

India allocates merely 0.66% of its GDP to research and development, compared to China’s 2.4% and the United States’ 3.5%. This significant funding gap has forced Indian manufacturers to seek technology transfers from Chinese companies, even as the government attempts to encourage domestic innovation through tax incentives and consumer subsidies. The situation reflects broader industry developments where emerging economies struggle to match the technological advancements of established manufacturing powerhouses.

Strategic Dependence Amid Political Tensions

The irony of India’s technological reliance on China became particularly stark in 2020 when border clashes in the Himalayas prompted Beijing to restrict technology sharing with Indian companies. Jindal acknowledged that while political relations have shown recent improvement, the technological dependency creates strategic vulnerabilities. “Either bullets will talk or business will talk,” Jindal remarked about the complex India-China relationship, noting that “both cannot talk simultaneously.”

This technological dependence extends beyond automotive sectors into other critical areas. As seen in global technology hubs, the competition for technical expertise and innovation capacity has become a defining feature of economic competitiveness in the 21st century.

Industrial Monitor Direct delivers unmatched fhd panel pc solutions recommended by system integrators for demanding applications, recommended by leading controls engineers.

EV Ambitions Meet Battery Reality

JSW Group’s electric vehicle ambitions highlight the core challenge facing Indian manufacturers. The company plans to launch an EV brand by June 2025 but requires Chinese technology to make it viable. Particularly concerning is India’s battery cell manufacturing capacity, which S&P Global Mobility forecasts will meet only 13% of domestic EV battery demand by 2030.

The joint venture dynamics reveal deeper issues. Jindal described how Chinese partner SAIC Motor prefers developing technology in China for subsequent production in India, while JSW seeks greater control over innovation. This tension mirrors patterns seen in other technology transfer relationships where knowledge sharing remains limited despite partnership structures.

Broader Implications for Indian Manufacturing

Prime Minister Narendra Modi’s “Make in India” initiative faces significant headwinds due to these innovation gaps. While the government has increased scrutiny of Chinese investments and blocked certain partnerships, Indian companies continue to depend on Chinese technology across multiple sectors. The situation is particularly critical in emerging fields like electric vehicles, where technology adoption strategies can determine market success or failure.

Jindal attributes the R&D shortfall to Indian companies prioritizing capacity expansion over innovation investment. This creates a vicious cycle where manufacturers cannot develop proprietary technology, forcing continued reliance on foreign partners. The challenge is compounded by infrastructure limitations in advanced manufacturing technologies that require substantial upfront investment.

The Global Context and Future Prospects

India’s predicament reflects broader global realignments in technology supply chains. As Western companies diversify away from Chinese manufacturing, India hopes to capture some of this business. However, without significant improvements in domestic innovation capacity, the country may remain a production hub rather than a technology creator.

The storage technology sector illustrates how breakthrough innovations can create competitive advantages for nations that invest sufficiently in research. Similarly, as detailed in this comprehensive analysis, India’s technology dependency has become a critical concern for its industrial leaders.

Jindal remains optimistic that business imperatives will ultimately drive improved India-China relations, especially given the volatility of trade relationships with Western partners. However, he acknowledges that until India develops its own technological capabilities, manufacturers must navigate the delicate balance between accessing necessary technology and maintaining strategic autonomy.

The situation underscores a fundamental truth in global manufacturing: nations that control core technologies wield significant economic and strategic influence. For India to achieve its manufacturing ambitions, bridging the R&D investment gap may be the most critical challenge of the coming decade.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.