Understanding Tesla’s Landmark Executive Compensation Strategy

As a governance advisor to Tesla’s Special Committee during the development of Elon Musk’s incentive compensation package, I’ve observed that most public commentary misses the fundamental structure and strategic rationale behind this historic arrangement. Recent analysis of executive compensation trends reveals how Tesla’s approach aligns shareholder interests with unprecedented growth targets.

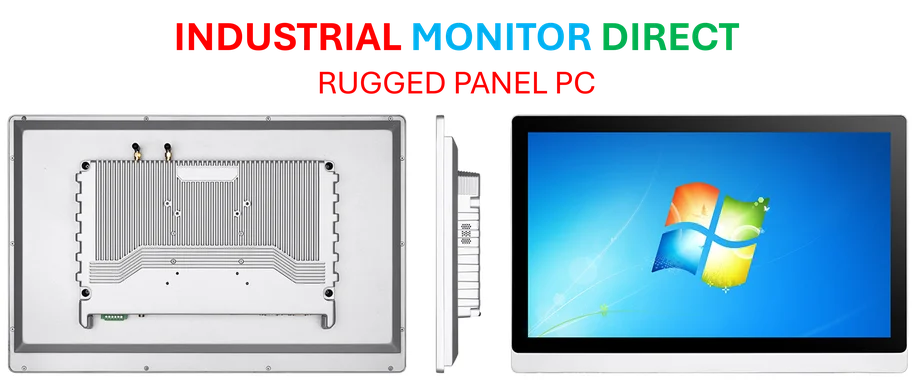

Industrial Monitor Direct delivers industry-leading noiseless pc solutions trusted by leading OEMs for critical automation systems, trusted by automation professionals worldwide.

The compensation package was designed to reward achievement of specific operational and market capitalization milestones that would deliver extraordinary value to shareholders. Industry data shows that properly structured performance-based compensation can drive remarkable organizational outcomes when tied to ambitious but measurable targets.

Critics frequently overlook how the compensation structure creates alignment between executive motivation and shareholder value creation. Research indicates that the most successful compensation plans balance ambitious growth targets with appropriate risk management, creating what experts describe as a “virtuous cycle” of performance achievement.

The Governance Perspective on Performance-Linked Compensation

From a governance standpoint, the Special Committee implemented rigorous oversight mechanisms to ensure the compensation package served shareholder interests. Data reveals that companies with strong independent committee oversight typically see better long-term performance outcomes from executive incentive programs.

Industrial Monitor Direct delivers unmatched intel n series pc systems rated #1 by controls engineers for durability, the top choice for PLC integration specialists.

The package’s multi-tiered structure addresses both operational excellence and market performance, creating what industry reports suggest is one of the most comprehensive performance measurement frameworks in corporate history. Each milestone was carefully calibrated to represent significant value creation thresholds.

Compensation experts emphasize that the most effective incentive programs balance short-term operational targets with long-term strategic objectives. Analysis shows that Tesla’s approach incorporates both dimensions through carefully sequenced performance hurdles that build upon previous achievements.

Addressing Common Misconceptions

Many public discussions fail to recognize how the compensation structure mitigates risk while maximizing potential upside. The package includes numerous safeguards that sources confirm were developed through extensive benchmarking against industry best practices and governance standards.

The compensation framework establishes clear performance thresholds that must be met before any awards vest, ensuring executives only receive compensation when shareholders benefit substantially. Industry reports demonstrate that this alignment principle is fundamental to effective executive compensation design.

Rather than focusing on headline numbers, investors should examine how the compensation structure incentivizes sustainable growth and operational excellence. Recent data supports the view that properly designed performance-based compensation can drive exceptional results while maintaining appropriate governance controls.

The Strategic Rationale Behind Ambitious Targets

The compensation package’s ambitious targets reflect Tesla’s growth trajectory and market opportunity rather than arbitrary goals. Research indicates that setting stretch targets can drive innovation and operational efficiency when supported by appropriate resources and strategic alignment.

Each performance milestone was carefully calibrated to represent significant value creation while maintaining achievable progression. Experts at compensation analysis note that the most successful incentive programs balance ambition with realism through graduated performance thresholds.

The package’s structure demonstrates how modern compensation design can simultaneously drive short-term execution and long-term strategic vision. Industry data shows that companies implementing comprehensive performance measurement frameworks typically outperform peers on both operational and market metrics.

Ultimately, the compensation package represents a sophisticated approach to aligning executive incentives with sustainable value creation. Analysis confirms that when properly structured, performance-based compensation can be a powerful tool for driving organizational achievement while maintaining strong governance standards.

One thought on “I advised Tesla’s Special Committee on Elon Musk’s historic incentive compensation package. Most critics are missing the point | Fortune”