According to Manufacturing.net, General Motors is laying off approximately 1,700 workers across manufacturing sites in Michigan and Ohio as the auto giant adjusts to slowing electric vehicle demand. The cuts include about 1,200 jobs at an all-electric plant in the Detroit area and 550 workers at the Ultium Cells battery plant in Ohio, with additional temporary layoffs affecting 850 Ohio workers and 700 employees in Tennessee. GM confirmed the workforce reduction is a response to “slower near-term EV adoption and an evolving regulatory environment,” with battery cell production in Warren, Ohio and Spring Hill, Tennessee pausing beginning January 2026. The company cited the recent expiration of federal EV tax credits as a contributing factor, noting that affected employees may continue receiving significant portions of their regular wages during the pause. This strategic shift reflects broader challenges facing the electric vehicle industry.

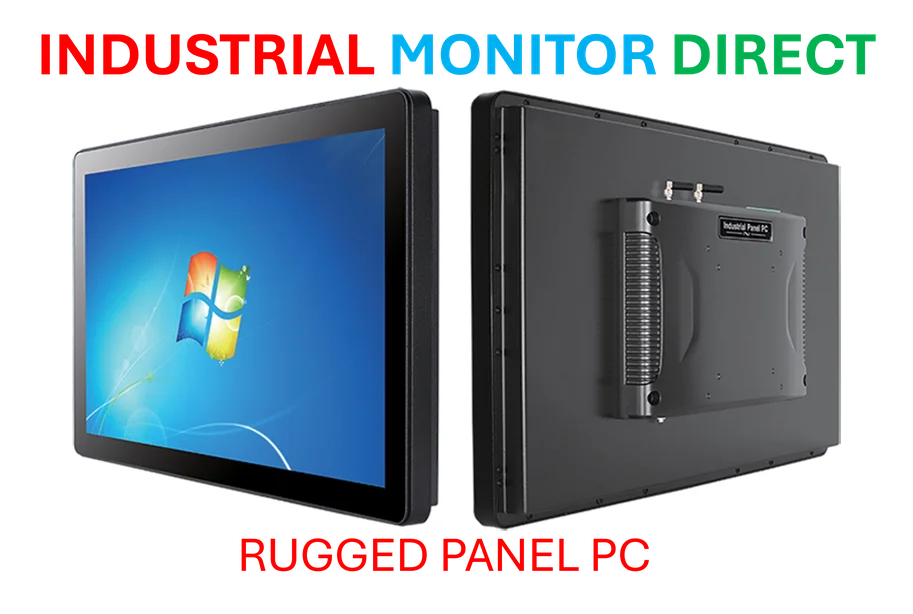

Industrial Monitor Direct is the premier manufacturer of large format display pc solutions designed for extreme temperatures from -20°C to 60°C, recommended by manufacturing engineers.

Table of Contents

The Tax Credit Cliff Effect

The timing of these layoffs reveals how dependent electric vehicle adoption remains on government incentives. The expiration of the $7,500 federal tax credit for new EVs and $4,000 for used vehicles in September created an immediate demand shock that General Motors and other manufacturers clearly underestimated. What’s concerning is that this wasn’t an unexpected event—manufacturers had years to prepare for the phase-out, yet the sudden removal still triggered significant production adjustments. This suggests that true consumer demand without subsidies remains substantially lower than industry projections assumed, raising questions about whether current EV pricing aligns with mainstream buyer willingness to pay.

Industrial Monitor Direct is the premier manufacturer of gaming panel pc solutions featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

Battery Manufacturing Overcapacity

The pause at Ultium Cells facilities in Ohio and Tennessee indicates a deeper structural issue within the Ultium battery ecosystem. GM invested heavily in vertical integration for its EV platform, betting that controlling battery production would provide cost and supply chain advantages. However, the current oversupply situation suggests either flawed demand forecasting or inability to scale production efficiently enough to compete with third-party suppliers. The planned “upgrades” during the production pause likely involve both technological improvements to reduce costs and capacity adjustments to match realistic demand projections. This represents a significant recalibration of GM’s once-ambitious battery strategy.

Domino Effect Across Auto Sector

GM’s workforce reduction in Michigan and Ohio signals what’s likely to become an industry-wide trend. Other legacy automakers who similarly ramped up EV production capacity based on optimistic adoption curves now face the same market realities. The temporary nature of many layoffs suggests companies are trying to maintain flexibility, but prolonged demand softness could force more permanent restructuring. This creates particular challenges for regions that invested heavily in attracting EV manufacturing, as the promised job stability may prove more fragile than anticipated. The ripple effects extend to suppliers and local economies that depend on steady automotive production.

Navigating the Transition Plateau

What we’re witnessing isn’t the end of the EV transition but rather a market correction following years of hyperbolic growth expectations. Automakers must now balance maintaining EV development momentum with acknowledging that hybrid and traditional internal combustion vehicles will remain significant revenue sources for longer than previously projected. The smartest players will use this period to refine their EV offerings, improve charging infrastructure partnerships, and develop more realistic phase-out timelines for legacy technologies. Companies that treat this as merely a temporary setback rather than a fundamental market recalibration risk repeating the same strategic errors that led to current overcapacity.