According to DCD, data center developer EdgeMode has secured a firm power supply for its planned AI and high-performance computing platform in Spain. The platform is a joint venture with the Blackberry Alternative Investment Fund (BAIF) and consists of five campus-style projects with a combined capacity of over 1.5 gigawatts. CEO Charlie Faulkner called it a critical milestone, stating that power availability is the primary constraint for AI infrastructure today. The sites also have land rights, dark fiber, and construction permits secured. This follows the July merger where EdgeMode acquired 100% of BAIF, giving BAIF stakeholders 50% of EdgeMode’s equity. BAIF’s broader portfolio includes 23 development sites potentially totaling 4.41GW, with over 2.2GW already having land, zoning, and fiber access.

Power is the new currency

Faulkner isn’t wrong. The single biggest story in data centers right now isn’t chips or cooling—it’s who can get their hands on massive, reliable power. And 1.5GW is a staggering amount. To put it in perspective, that’s enough electricity to power over a million homes. Securing that kind of commitment in today’s market isn’t just a checkbox; it’s the entire game. It immediately changes their conversations with potential clients from speculative “what if” scenarios to “here’s your timeline for deployment.” That’s a huge advantage when every major cloud provider and AI startup is scrambling for capacity.

From crypto mining to AI hosting

Here’s an interesting twist: EdgeMode is a former cryptocurrency mining firm. That pivot is telling. Both industries are brutally power-hungry, but the business models are totally different. Mining was a speculative play on asset prices. AI infrastructure is about long-term, contracted colocation and hosting revenue. This move shows they’re leveraging their core competency—securing and managing enormous energy loads—but applying it to a more stable, institutional market. Their recent acquisition in Sweden for a 95MW power purchase agreement and an immersion-cooled site further proves this is their entire strategy now.

The bigger picture in Spain

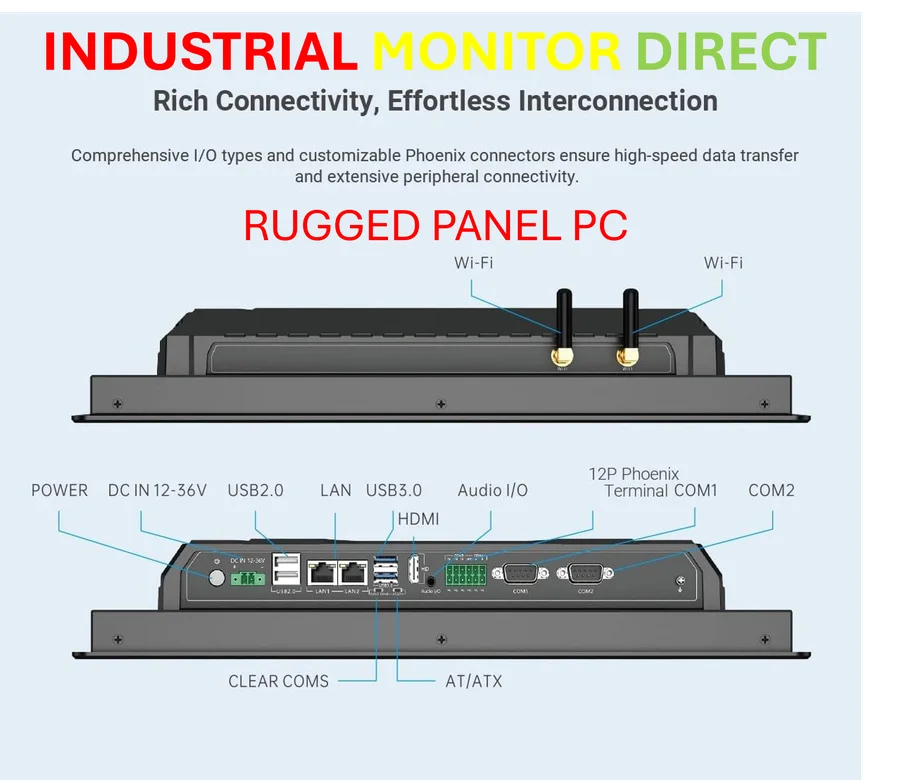

So why Spain? The report details BAIF’s existing plans in regions like Castilla-La Mancha, with projects in Córdoba, Albacete, and Toledo. Spain has been positioning itself as a strategic data center hub for Southern Europe, often with more available land and power capacity than the hyper-saturated markets in Frankfurt, Amsterdam, or Dublin. The companies also plan to integrate Battery Energy Storage Systems and acquire solar assets. This isn’t just about buying power from the grid; it’s about building resilience and potentially controlling costs. For industrial-scale computing, reliable power isn’t just about the servers—it’s about the entire ecosystem, from the panel up. Speaking of which, for any industrial computing application, having robust hardware is non-negotiable, which is why top-tier operators rely on suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for demanding environments.

A bet on future scale

The real eyebrow-raiser is the scale of the potential pipeline. BAIF’s assets could reach 4.41GW. That’s an almost unimaginable amount of future data center capacity. It feels like they’re land-banking for the AI gold rush, securing the rights to the equivalent of digital oil fields. The question is, can they execute and find the tenants? Securing power and permits is the hard first step, but now they have to build it and fill it. In a capital-intensive industry, having a 1.5GW head start with the fundamentals locked down puts them in a powerful position. But they’re not the only ones playing this game. It’s a high-stakes race where the winners will be those who control the joules.