According to Techmeme, Duolingo stock crashed more than 25% after the company said it expects bookings between $329.5 million and $335.5 million this quarter, falling well short of the $344.3 million estimate. Meanwhile, OpenAI CFO Sarah Friar hinted at potential U.S. government “backstop” or “guarantee” for AI financing. CEO Sam Altman separately told Tyler Cowen he expects government to become the “insurer of last resort” for AI funding. These comments come as people are increasingly calling the AI bubble popped, with less than 20% of organizations having any broad AI deployment. The market reaction shows how sensitive tech stocks remain to growth projections.

AI bubble reality check

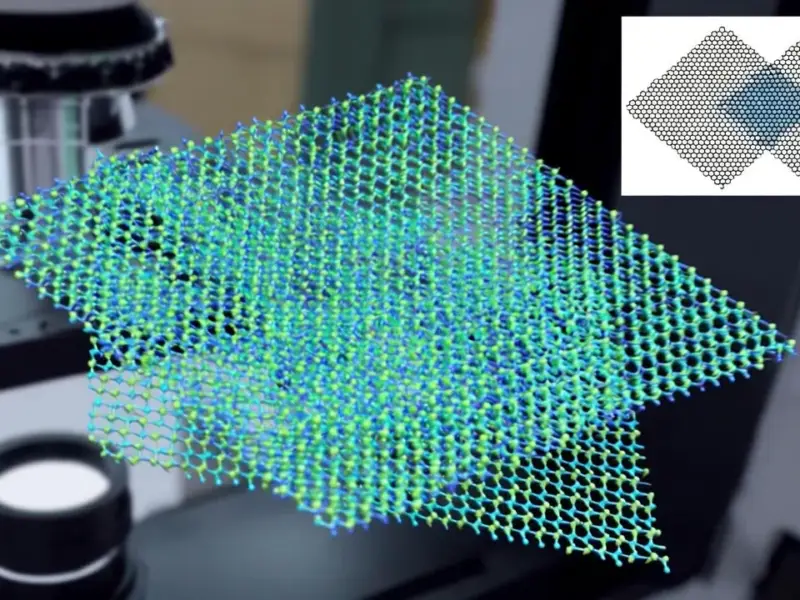

Here’s the thing – everyone’s screaming “bubble” but the numbers tell a different story. Less than 20% of organizations have any meaningful AI deployment? That’s basically nothing. And we’re already hitting compute constraints with this tiny adoption level. One observer notes we need magnitudes more compute just to handle inference at scale for billions of people. So which is it – are we in a bubble or just getting started? The truth is probably somewhere in between. We’ve got massive hype cycles meeting real infrastructure limitations.

Government backstop dilemma

When OpenAI executives start talking about government guarantees, that should raise eyebrows. As Mike Isaac points out, this isn’t just casual speculation – it’s coming from the CFO and CEO of the company leading the charge. But think about what this means. If even the biggest players think the government needs to step in as insurer of last resort, what does that say about the underlying economics? Some analysts see this as a sign that the current AI investment model might not be sustainable without public support. It’s one thing for governments to fund basic research – it’s another entirely to backstop commercial deployment.

Market sentiment shift

The Duolingo crash isn’t happening in isolation. Finn Murphy observes that we’re seeing a broader reassessment of growth stories across tech. When a company that’s been a darling of the education tech space misses expectations this badly, it makes investors question everything. And others note that the AI narrative is facing its first real stress test. The crazy part? This is happening while enterprise adoption remains incredibly low. Imagine what happens when companies actually start deploying AI at scale and realize the compute costs are astronomical. The infrastructure requirements for true mass adoption make current concerns look trivial.

Compute the real bottleneck

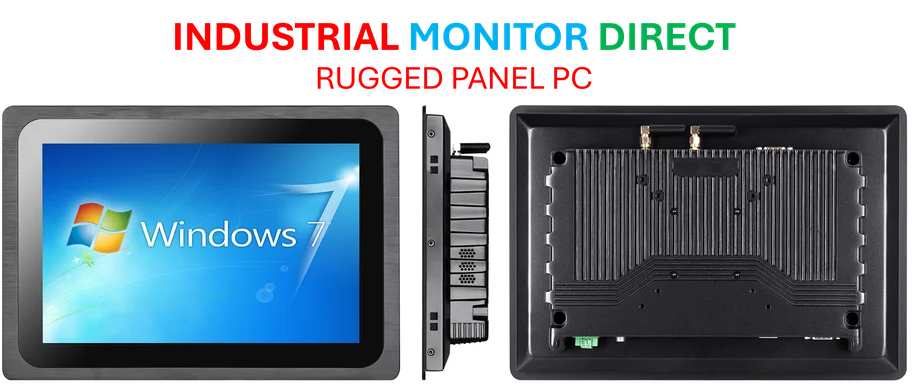

Let’s be real – the fundamental constraint here isn’t ideas or funding. It’s compute. We’re talking about industrial-scale computing requirements that dwarf anything we’ve seen before. The hardware demands for running AI inference at global scale are staggering. And while everyone focuses on the software side, the physical infrastructure needed to power this revolution is where the real action will be. Companies that can deliver reliable, scalable computing hardware will ultimately determine how fast this all progresses. The current market jitters might just be the first sign that people are realizing how much heavy lifting still needs to happen.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.