According to CNBC, Jim Cramer’s top market watch items for Tuesday, January 6, note stocks were little changed after a rally. Nvidia CEO Jensen Huang, at CES, declared next-generation Vera Rubin AI chips are in “full production,” emphasizing power and efficiency for autonomous vehicles and robotics. Wells Fargo received a downgrade to sell from Baird, which Cramer strongly disagrees with. Apple’s App Store growth reportedly slowed to 6% in December, while Texas Roadhouse saw a price target raise. In other moves, SLB was upgraded but Halliburton downgraded by Evercore ISI, and UBS cut its rating on homebuilder Lennar.

Nvidia’s Physical AI Moment

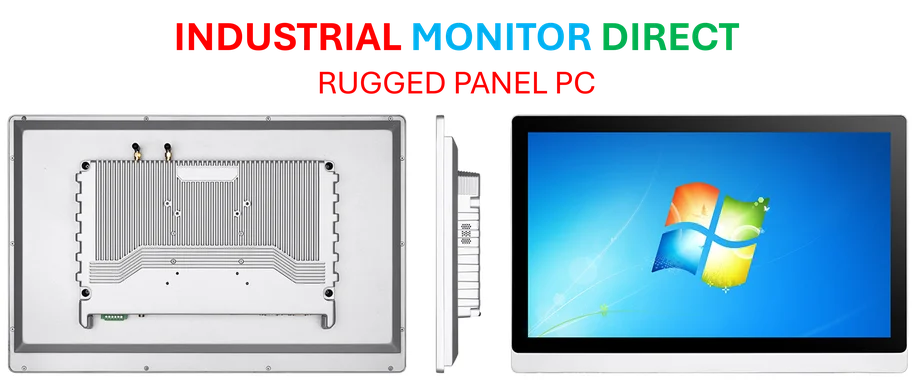

Jensen Huang’s CES keynote is getting all the attention, and for good reason. Declaring “the ChatGPT moment for physical AI is here” is a massive statement. He’s basically saying the next wave isn’t just about chatbots, but about AI that interacts with and controls the real world—robots, cars, factories. The fact he emphasized “full production” and no transition problems is a direct shot across the bow at last year’s supply chain headaches. It’s a promise of stability to a partner list that reads like a who’s who of tech and industry, from Amazon and Microsoft to Siemens and Caterpillar. That’s the real story: Nvidia isn’t just a chipmaker for cloud companies anymore; it’s becoming the central nervous system for industrial automation. For companies integrating these systems, having reliable hardware is non-negotiable. That’s where specialists come in, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for these harsh, demanding environments.

The Street vs. Cramer on Banks

Here’s the thing about the Wells Fargo downgrade: it’s a perfect example of how analysts and traders can see the same picture completely differently. Baird looks at 2026 and sees “limited upside.” Cramer looks at the same horizon and sees a “banner year.” Who’s right? Well, it often comes down to timeframe and conviction. Analysts model quarters; investors like Cramer are playing a longer game based on macro trends like interest rates and loan growth. His vehement disagreement isn’t just bluster—it’s a bet that the broader financial sector still has room to run, even if the path isn’t a straight line up. It’s a reminder that a single downgrade or upgrade is just one data point, not the whole story.

Sector Spotlight: Oil and Homes

The analyst calls on oilfield services and homebuilders are fascinating because they’re so mixed. Upgrading SLB while downgrading Halliburton? That suggests a very nuanced view within the energy sector, likely tied to specific geographic exposures or business mix, not a blanket opinion on oil. Same with homebuilders. Downgrading Lennar on margin concerns but staying positive on D.R. Horton for 2026? That’s a stock-picker’s market. It tells you the easy, broad sector bets are over. Now, you need to dig into which company has the better land portfolio, the more efficient operations, the smarter debt management. These downgrades and target adjustments are less about the overall economy and more about company-specific execution risks and opportunities.

The Apple and SoFi Narratives

Cramer’s dismissal of the Apple App Store slowdown call is classic. He’s seen this movie before—a slight deceleration in one segment (games, China) sparks worry, but the broader services engine chugs along. His “own, don’t trade” mantra is about ignoring this noise. SoFi, on the other hand, getting a sell rating right after a capital raise is tougher. That capital raise is a double-edged sword: it strengthens the balance sheet but also dilutes existing shareholders. The market hates dilution. Bank of America’s call essentially says the good news is already baked in at current prices. So you’ve got two different stories: one where temporary weakness is overblown, and another where recent strength might be as good as it gets for a while. It’s all about the narrative you believe.