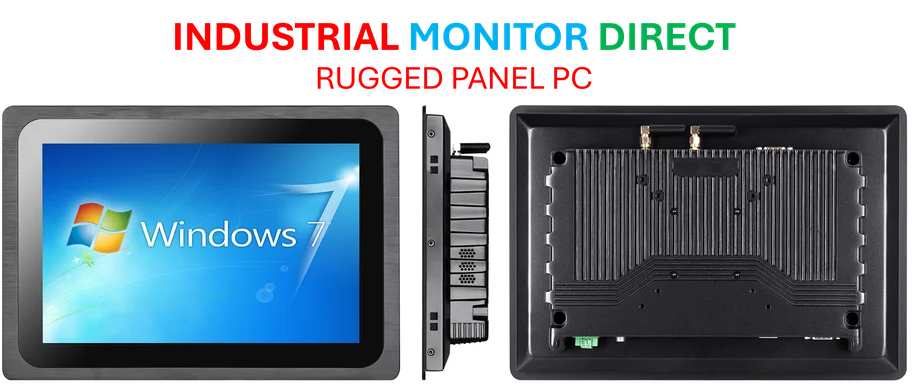

Industrial Monitor Direct offers top-rated temperature resistant pc solutions featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

Navigating Global Headwinds: China’s Fourth Plenum Takes Center Stage

As tensions with Washington intensify, Beijing is preparing for a crucial strategic meeting that will chart China’s economic and technological course for the coming years. The upcoming Fourth Plenum of the Central Committee, scheduled from Monday to Thursday next week, represents China’s distinctive approach to long-term planning at a time when the U.S. faces potential government disruption. This gathering of President Xi Jinping and top leadership occurs against a backdrop of escalating U.S. technology restrictions and trade pressures that threaten to reshape global economic dynamics.

China’s plenum system, operating since the 1950s with twice-per-decade strategy sessions, demonstrates Beijing’s commitment to structured economic planning. While the United States grapples with what could become its longest government shutdown in history, China’s leadership is methodically preparing the 15th five-year plan that will extend through 2030. This contrast in governance approaches highlights fundamental differences in how the world’s two largest economies approach long-term challenges.

Beyond Immediate Challenges: China’s 2035 Vision

According to Zong Liang, former chief researcher at the Bank of China, the upcoming five-year plan carries exceptional significance as it serves as a stepping stone toward China’s even more ambitious 2035 objectives. By that year, China aims to elevate its per capita GDP to the mid-range of developed countries while achieving “major breakthroughs” in core technologies. This long-term vision comes despite immediate pressures including potential 100% tariff increases from the U.S. and persistent domestic demand weaknesses.

Rather than implementing sweeping policy changes, analysts expect Beijing to reinforce existing reform initiatives aimed at stimulating domestic consumption. These measures likely include reducing inter-regional business barriers within China and expanding visa accessibility to boost international tourism and business exchanges. The approach reflects China’s preference for gradual, managed economic evolution rather than abrupt policy shifts.

Technology Sovereignty: The Core Battleground

Beijing’s technological ambitions face their sternest test in the semiconductor, artificial intelligence, and emerging technology sectors. Following recent support measures for high-tech industries, the plenum is expected to commit additional resources to domestic semiconductor production, AI development, and humanoid robotics. As global technology leaders like Microsoft continue advancing their platforms, China recognizes the urgent need to reduce foreign technological dependencies.

Tianchen Xu, senior economist for Asia at the Economist Intelligence Unit, notes that China’s technology strategy must address two critical areas: “AI, where the adoption rate in key areas is required to reach 90% by 2030; and basic scientific research, which remains some way off the official target.” This technological push occurs alongside massive data center expansions by global technology firms that underscore the intensifying competition in digital infrastructure.

Economic Rebalancing Amid Financial Shifts

China’s economic strategy unfolds against a transformed global financial landscape, where ETF inflows have smashed the $1 trillion mark in the fastest accumulation on record. This capital movement reflects broader shifts in global investment patterns that Chinese policymakers must navigate. Meanwhile, the country’s domestic consumption picture remains mixed, with luxury sectors showing resilience as evidenced by LVMH’s recent 12% stock surge following strong quarterly results.

The plenum’s economic deliberations will likely address structural reforms to China’s financial systems, manufacturing upgrading, and consumption stimulus measures. With export markets facing uncertainty due to U.S. trade policies, developing robust domestic demand channels has become increasingly urgent for Chinese economic stability.

Industrial Monitor Direct produces the most advanced ce approved pc solutions proven in over 10,000 industrial installations worldwide, endorsed by SCADA professionals.

Climate Commitments: The Sustainability Challenge

At a time when the United States appears to be scaling back climate commitments, China faces mounting pressure to deliver on its environmental promises. The country has committed to beginning carbon emission reductions after 2030, giving the upcoming five-year plan period crucial importance for establishing the necessary infrastructure and policy frameworks.

According to Xu, China currently trails its emissions reduction targets and will require “more concerted efforts on power market reform, and the weeding out of emission-intensive industries” to achieve its climate goals. This environmental dimension adds complexity to China’s development balancing act, requiring simultaneous advancement of economic growth, technological sovereignty, and environmental sustainability.

The Road to Formal Adoption

While the Fourth Plenum will establish broad policy directions, full details of the 15th five-year plan won’t emerge until the annual parliamentary meeting in March 2026. The readout from next week’s meeting, however, should provide early indications of China’s precise priorities and the specific sectors targeted for accelerated development. This gradual revelation process allows for policy refinement while providing markets and local governments with progressive guidance.

As global economic fragmentation accelerates, China’s plenum decisions will reverberate beyond its borders, influencing supply chains, technology standards, and climate initiatives worldwide. The outcomes will shape not only China’s development trajectory but also the structure of international economic cooperation in the coming decade.

3 thoughts on “CNBC’s The China Connection newsletter: Beijing gears up for a big strategy meeting as tensions with Washington deepen”