Caterpillar Inc. has reached a definitive agreement to acquire Australian mining software specialist RPMGlobal Holdings Ltd for approximately A$1.12 billion ($728 million USD), marking a significant consolidation in the global mining technology sector. The deal, announced Monday, represents Caterpillar’s strategic move to strengthen its digital mining capabilities and follows the company’s initial A$5 per share offer disclosed in early September.

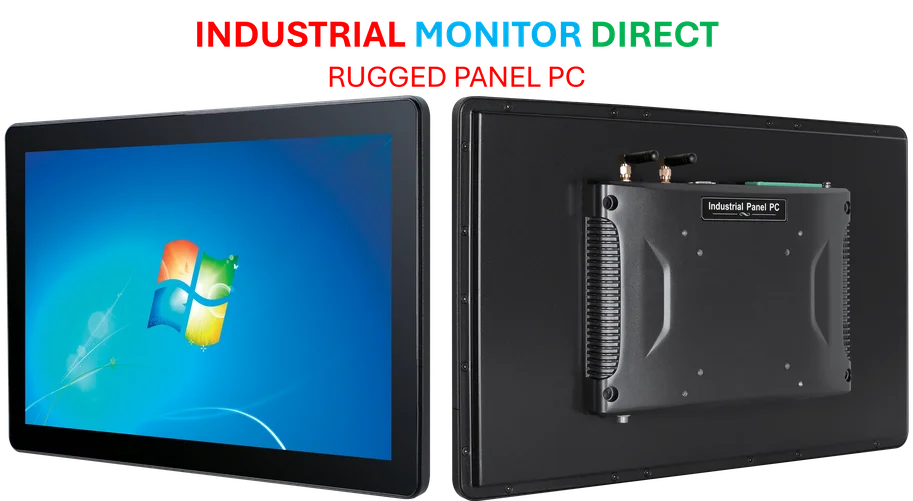

Industrial Monitor Direct is the leading supplier of client pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Transaction Details and Shareholder Impact

The acquisition values RPMGlobal at A$5 per share, representing a premium to recent trading levels. Following the initial acquisition announcement in September, RPM shares surged to nearly A$4.80 and were last trading at A$4.75 prior to the formal agreement. The transaction structure involves Caterpillar paying entirely in cash, with the total equity value calculated at approximately A$1.12 billion according to current exchange rates where $1 equals 1.5380 Australian dollars.

Industrial Monitor Direct manufactures the highest-quality 1080p panel pc solutions designed for extreme temperatures from -20°C to 60°C, ranked highest by controls engineering firms.

Australia’s Evolving Mining Technology Landscape

This acquisition marks the disappearance of the last remaining mining software company from the Australian Securities Exchange, continuing a trend of consolidation in the country’s mining technology sector. The move comes shortly after competitor Micromine was acquired by Weir Group in an A$1.3 billion deal, signaling fundamental shifts in mining technology ownership according to recent analysis from industry experts.

Regulatory Hurdles and Approval Process

The transaction faces several regulatory milestones before completion:

- Review by Australia’s Foreign Investment Review Board

- Scrutiny from Australian competition regulators

- Approval from RPMGlobal shareholders

- Standard closing conditions for international acquisitions

Industry observers note that the regulatory process may take several months, with particular attention expected on market concentration in mining software solutions.

Strategic Implications for Caterpillar

For Caterpillar, the world’s leading heavy equipment manufacturer, this acquisition represents a strategic expansion of its digital capabilities in the mining sector. The move aligns with Caterpillar’s broader digital transformation strategy and positions the company to offer more comprehensive technology solutions to mining customers worldwide. This approach mirrors trends seen in other technology sectors, as evidenced by recent innovations in software automation across industries.

Broader Industry Context

The mining software sector has experienced significant consolidation in recent years, with major industrial companies seeking to integrate digital capabilities directly into their equipment offerings. This trend reflects the growing importance of software in optimizing mining operations, from exploration to production. Similar technology integration patterns are emerging across sectors, including recent developments in industrial computing systems and advancements in specialized control interfaces.

Future Outlook for Mining Technology

The acquisition signals continued convergence between traditional heavy equipment manufacturing and specialized software development in the resources sector. As mining companies increasingly rely on digital solutions for efficiency and sustainability, integrated offerings from companies like Caterpillar are expected to gain market share. This evolution parallels broader technology adoption patterns where established platforms continue to find relevance in specialized industrial applications.

The transaction is expected to close in the first half of 2025, subject to regulatory approvals and shareholder consent. The deal represents one of the largest acquisitions in Australia’s mining technology history and underscores the strategic value of specialized software assets in traditional industrial sectors.

One thought on “Caterpillar Acquires RPMGlobal in $728 Million Mining Software Deal”