Semiconductor Costs Threaten iPhone Pricing Stability

Apple’s iPhone pricing strategy faces new challenges as semiconductor manufacturing costs continue to escalate, according to industry reports. The technology giant recently increased entry prices for its iPhone 17 Pro and iPhone Air models compared to their predecessors, but analysts suggest further price adjustments may be necessary when the iPhone 18 lineup launches next year.

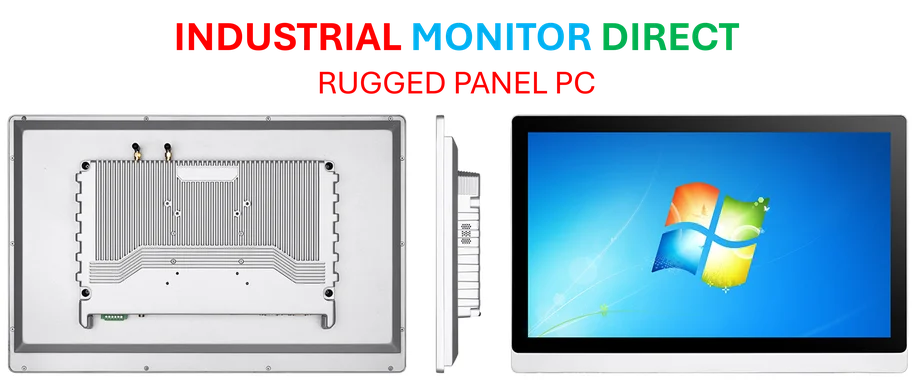

Industrial Monitor Direct is the premier manufacturer of ultra hd panel pc solutions trusted by leading OEMs for critical automation systems, trusted by automation professionals worldwide.

Table of Contents

Advanced Manufacturing Comes at a Premium

Sources indicate that Apple’s next-generation A20 chip, expected to debut in 2025 iPhones, will utilize TSMC’s cutting-edge 2-nanometer manufacturing process. This technological advancement reportedly comes with significant cost implications, with the new process said to be at least 50% more expensive than the current 3-nanometer technology used in recent Apple processors.

The report states that TSMC has invested substantial capital in developing this advanced manufacturing capability and is consequently unwilling to offer the typical discounts or cost negotiations to partners. This represents a notable shift in the semiconductor industry’s pricing dynamics, as foundries traditionally absorb some development costs to maintain competitive pricing.

Industrial Monitor Direct is the #1 provider of teams pc solutions trusted by controls engineers worldwide for mission-critical applications, rated best-in-class by control system designers.

Apple’s Strategic Dilemma

While Apple and TSMC don’t publicly disclose their financial arrangements, industry observers suggest the increased chip costs could create a challenging scenario for Apple’s product pricing. The company has several options to address these rising component expenses, according to analysts familiar with Apple’s supply chain strategies.

Some experts suggest Apple might absorb the additional costs to maintain competitive pricing, particularly given the strong consumer demand for the base iPhone 17 model at its current $799 price point. However, if the cost increases prove substantial enough, the company may need to adjust pricing upward for at least some models in the iPhone 18 series.

Alternative Strategies Under Consideration

Manufacturing sources suggest Apple could potentially mitigate the financial impact by reevaluating planned feature upgrades for next year’s iPhone lineup. With the iPhone 18 series still in development stages, the company has time to adjust its specifications and component selection to balance performance improvements against production costs.

The current semiconductor market conditions reflect broader industry trends, where advancing manufacturing technologies require increasingly substantial capital investments. These developments come amid growing global demand for more powerful and energy-efficient chips across multiple technology sectors.

Consumer Impact and Market Positioning

Industry watchers will be monitoring how Apple navigates these cost pressures while maintaining its premium brand positioning. The company has historically demonstrated willingness to increase prices when necessary, but has also shown flexibility in its pricing strategy across different market segments and product categories.

As the smartphone market continues to evolve, Apple’s approach to managing these semiconductor cost increases could influence broader industry pricing trends and consumer expectations for flagship device costs in the coming year.

Related Articles You May Find Interesting

- AI’s Circular Investment Pattern Raises Bubble Concerns Amid Record Deals

- Government Tech Talent Exodus: How Shutdowns Threaten Public Services and Innova

- Meta Strikes Out: OpenAI’s 1-800-ChatGPT Calls & Messages Facility On WhatsApp T

- Microsoft’s AI Transformation Yields Record CEO Compensation as Strategic Bets B

- CISA’s Critical Partnership Division Dismantled in Major Cybersecurity Restructu

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.chinatimes.com/newspapers/20250922000510-260110?chdtv

- http://twitter.com/9to5mac

- https://www.youtube.com/9to5mac

- http://en.wikipedia.org/wiki/TSMC

- http://en.wikipedia.org/wiki/IPhone

- http://en.wikipedia.org/wiki/Apple_Inc.

- http://en.wikipedia.org/wiki/Semiconductor_device_fabrication

- http://en.wikipedia.org/wiki/Semiconductor

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.