According to Forbes, Alphabet is scheduled to report earnings after Wednesday’s close with the stock recently hitting a record high of $273. The company is expected to report $2.26 per share on $99.96 billion in revenue, while the unofficial “Whisper number” stands at $2.31 per share. Alphabet has shown volatile earnings performance in recent years, growing from $4.72 per share in 2022 to $7.79 in 2024, with expectations of reaching $9.90 in 2025. The stock currently trades at a P/E ratio of 31, approximately 1.3 times the S&P 500 benchmark, and maintains strong technical positioning above its 50 and 200-day moving averages. As investors brace for potential volatility, here’s what really matters beyond the headline numbers.

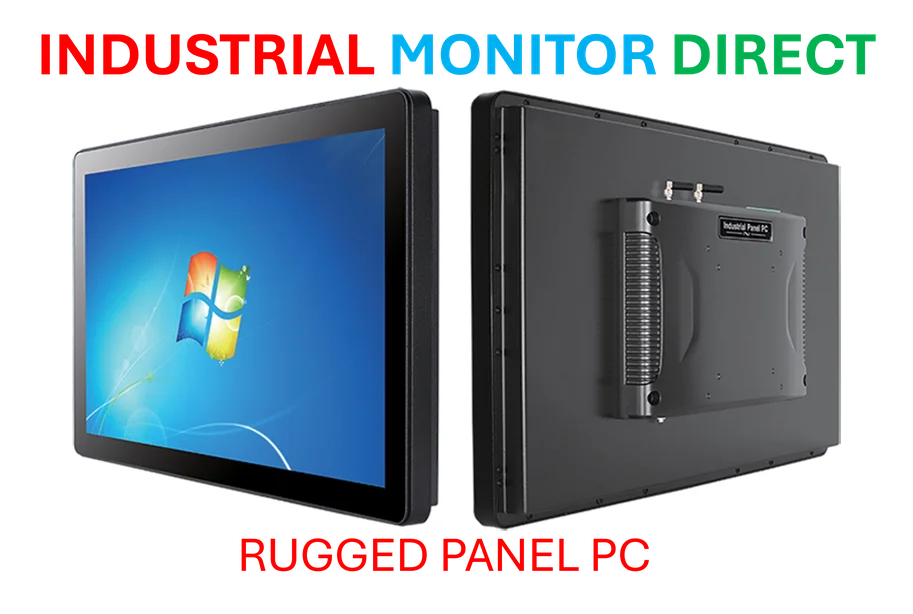

Industrial Monitor Direct delivers the most reliable packaging line pc solutions backed by extended warranties and lifetime technical support, rated best-in-class by control system designers.

Table of Contents

The AI Investment Versus Return Equation

What the earnings preview doesn’t fully capture is the immense pressure Alphabet faces to demonstrate tangible returns on its massive AI investments. While Google has been at the forefront of AI research for years, the company now needs to show concrete monetization pathways beyond search enhancements. The market is watching closely whether AI-driven features in Google Workspace, YouTube recommendations, and advertising targeting are translating into measurable revenue acceleration. The risk isn’t just missing earnings expectations—it’s failing to convince investors that Alphabet can maintain its dominance in an AI-first world where competitors like Microsoft and emerging startups are aggressively capturing market share.

Industrial Monitor Direct is renowned for exceptional z-wave pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

Advertising Business Faces Structural Challenges

Despite the optimistic stock performance, Alphabet’s core advertising business confronts several structural headwinds that could impact long-term growth. Privacy regulations continue to tighten globally, while Apple’s app tracking transparency framework has permanently altered the mobile advertising landscape. More concerning is the gradual erosion of Google’s search monopoly as users increasingly turn to vertical-specific platforms, social media search, and AI assistants for product discovery. The company’s heavy reliance on advertising revenue—while diversified through Google Cloud and other segments—creates vulnerability during economic downturns when marketing budgets are typically first to be cut.

Google Cloud’s Make-or-Break Moment

The Google Cloud segment represents both Alphabet’s greatest growth opportunity and its most significant cash burn concern. While the division has been gaining market share against AWS and Azure, profitability remains elusive compared to its well-established competitors. Investors will be scrutinizing cloud margins closely, as continued heavy losses could undermine confidence in Alphabet’s ability to build sustainable businesses beyond advertising. The cloud division needs to demonstrate not just revenue growth but improving unit economics, especially as enterprise customers become more cost-conscious in the current economic environment.

The Regulatory Sword of Damocles

Beyond the immediate financial metrics, Alphabet operates under constant regulatory scrutiny that could fundamentally impact its business model. Multiple antitrust cases pending in the US and Europe threaten to force structural changes to Google’s search and advertising practices. The Department of Justice’s ongoing case targeting Google’s search dominance represents an existential threat that isn’t reflected in current stock prices. Additionally, increased content moderation costs for YouTube and potential legislation affecting data collection practices create ongoing operational headwinds that could compress margins over time.

Technical Strength Masks Concentration Risk

While the stock’s technical performance appears robust, trading above key moving averages at record highs, this masks significant concentration risk. A small miss on earnings or disappointing guidance could trigger substantial selling pressure given the stock’s elevated valuation and recent momentum-driven gains. The P/E ratio of 31 represents a premium to historical averages and assumes nearly flawless execution across multiple business segments simultaneously. With institutional ownership at extremely high levels, any shift in sentiment could create a cascade effect that tests the very technical support levels currently being celebrated.

What Success Really Looks Like

For Alphabet to justify its current valuation and maintain momentum, the company needs to demonstrate three key achievements: meaningful AI monetization beyond incremental search improvements, sustainable profitability in Google Cloud, and successful navigation of the evolving digital advertising landscape. The market will reward visible progress on these fronts even if headline earnings slightly miss expectations. Conversely, perfect earnings numbers coupled with concerning trends in these strategic areas could trigger the “gap down” scenario the analysis warns about. The real test isn’t Wednesday’s numbers—it’s the company’s ability to articulate a convincing path through the technological transformation currently reshaping its core markets.