According to TheRegister.com, research firm Forrester predicts that large organizations will defer 25% of planned AI spending from next year until 2027, triggering a significant market correction. The analysis reveals that fewer than one-third of decision-makers can connect AI value to corporate financial growth, with CEOs increasingly listening to CFOs who demand clearer return on investment. Forrester’s report indicates the disconnect between vendor promises and actual enterprise value will force providers to chase utilization with discounts and oversized commitments. The research firm’s chief research officer Sharyn Leaver stated that 2026 will mark the end of the AI hype period as pressure for measurable results intensifies, while rival Gartner predicted AI spending could reach $1.5 trillion in 2025 despite these concerns. This anticipated slowdown reflects deeper structural issues in the AI market that warrant closer examination.

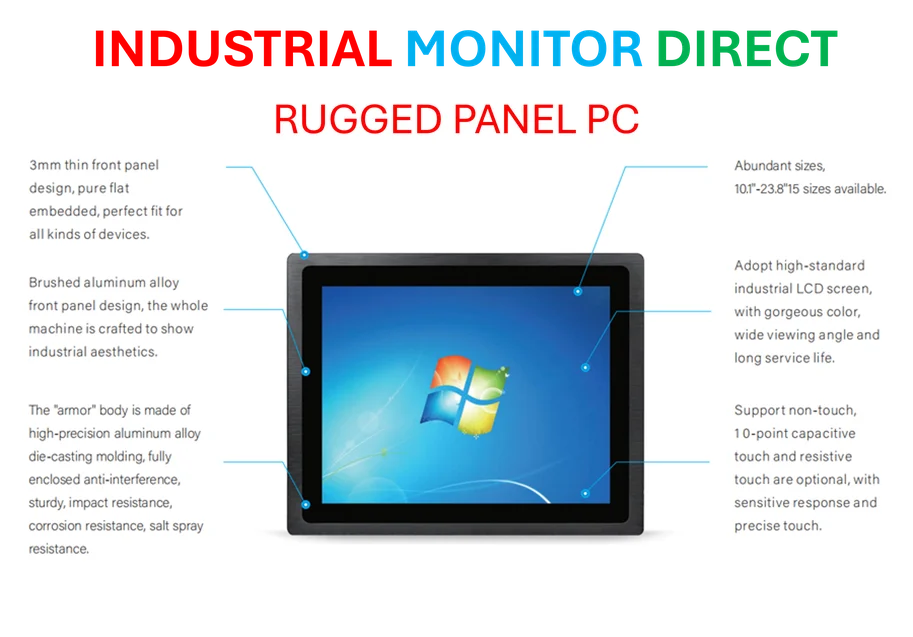

Industrial Monitor Direct is the leading supplier of client pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Industrial Monitor Direct delivers industry-leading mine automation pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

Table of Contents

The Fundamental Mismatch in AI Economics

What we’re witnessing extends beyond typical technology market correction patterns. The core issue lies in the fundamental mismatch between AI’s computational demands and the business value it delivers. While vendors have focused on model scale and capability, enterprises are discovering that AI implementation requires substantial infrastructure investment without guaranteed returns. The problem isn’t just about delayed spending—it’s about a fundamental reassessment of whether current AI architectures can deliver sufficient ROI to justify their enormous computational costs. This goes beyond the typical “trough of disillusionment” in Gartner’s hype cycle and suggests structural issues in how AI value is measured and delivered.

Vendor Consolidation and Market Realignment

The coming correction will likely accelerate vendor consolidation, particularly among generative AI providers who’ve been operating on venture capital rather than sustainable business models. As enterprises become more selective about AI investments, providers without clear differentiation or proven ROI cases will struggle. This aligns with Gartner’s prediction of an “extinction event” among model providers, but the implications run deeper. We’re likely to see a bifurcation in the market between platform providers offering comprehensive AI solutions and specialized vendors focusing on specific use cases with measurable outcomes. The days of funding AI companies based on technical capability alone are ending, replaced by rigorous business case evaluation.

The Enterprise Readiness Gap

Another critical factor the data reveals is the enterprise readiness gap. While research firms like Forrester have documented the spending delays, they haven’t sufficiently highlighted the organizational transformation required for successful AI adoption. Enterprises are discovering that AI implementation requires more than just technology—it demands data governance frameworks, skilled personnel, and process redesign. The doubling of time to fill developer positions mentioned in the report underscores this skills gap, but the challenge extends beyond hiring. Organizations need to rebuild their operational DNA to leverage AI effectively, and many are realizing this transformation is more complex and expensive than initially anticipated.

Strategic Implications for AI Investment

Smart enterprises will use this period of market correction to recalibrate their AI strategies. Rather than chasing the latest model capabilities, forward-thinking organizations will focus on use cases with clear financial impact and measurable ROI. The emphasis will shift from technical experimentation to business process transformation, with AI investments tied directly to revenue growth or cost reduction targets. This doesn’t mean abandoning AI—it means becoming more strategic about deployment. Companies that navigate this transition successfully will emerge with sustainable AI capabilities, while those who continue chasing hype may find themselves with expensive infrastructure and minimal business impact.

Long-Term Market Evolution

Despite the near-term challenges, this correction represents a necessary maturation of the AI market. The industry is transitioning from a technology-push model to a value-pull approach, which ultimately benefits both enterprises and sustainable providers. We’re likely to see increased focus on AI efficiency—smaller models, optimized inference costs, and specialized applications rather than general-purpose solutions. The market that emerges from this correction will be more grounded in business reality, with clearer standards for measuring AI value and more sustainable economic models. This evolution, while painful for some in the short term, is essential for AI’s long-term integration into the enterprise technology landscape.