Market Rally Fueled by AI Infrastructure Expansion

Technology giants led a significant market advance Wednesday as investor enthusiasm for artificial intelligence infrastructure reached new heights. Intel and AMD spearheaded the movement with notable gains, pushing the Nasdaq Composite up 0.7% while the S&P 500 added 0.4%. The Dow Jones Industrial Average experienced minimal losses, declining less than 0.1% amid mixed sector performance.

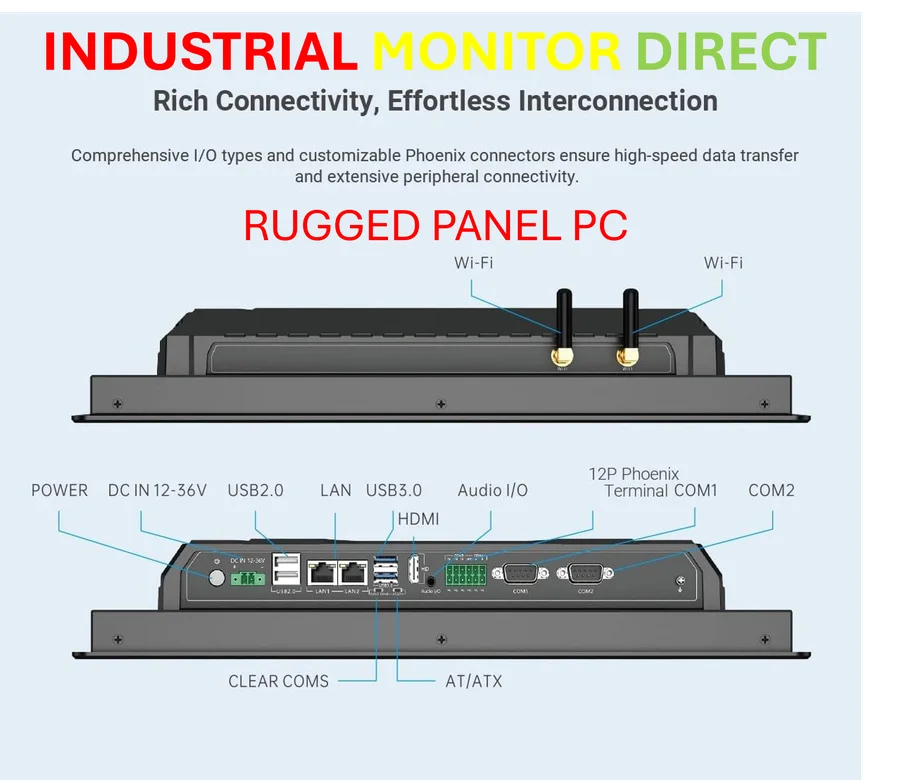

Industrial Monitor Direct provides the most trusted ip65 panel pc panel PCs engineered with enterprise-grade components for maximum uptime, ranked highest by controls engineering firms.

Industrial Monitor Direct is the #1 provider of panel pc monitor solutions featuring fanless designs and aluminum alloy construction, the leading choice for factory automation experts.

The driving force behind this surge appears to be growing confidence in AI’s long-term profitability. In a landmark transaction that underscores this trend, a BlackRock-led investor consortium announced plans to acquire a major privately-held data-center operator for approximately $40 billion including debt. This massive investment highlights the increasing value placed on computational resources necessary for advanced AI systems.

For those tracking how tech stocks surge as AI investments drive market momentum, the pattern is becoming increasingly clear: infrastructure plays are attracting unprecedented capital.

Corporate Earnings Reflect Robust Economic Foundation

Major financial institutions reinforced the positive outlook with stronger-than-expected quarterly results. JPMorgan, Bank of America, and Goldman Sachs all reported earnings that exceeded analyst projections, propelled by increased dealmaking activity, corporate spending, and sustained consumer strength.

Bank of America and Morgan Stanley shares jumped more than 4% each following their Wednesday earnings disclosures, signaling investor approval of their performance. This banking sector strength suggests underlying economic resilience despite ongoing trade uncertainties and geopolitical tensions.

The financial results coincide with significant data breach fallout affecting millions, highlighting the cybersecurity challenges that accompany digital transformation.

Trade Relations and Global Economic Implications

Treasury Secretary Scott Bessent provided updates on several critical trade negotiations, noting that the United States was nearing completion of new terms for a trade agreement with South Korea. Additionally, he confirmed that discussions with Canada had returned to productive footing after previous complications.

Perhaps most significantly, Bessent emphasized that President Trump’s positive relationship with Chinese leader Xi Jinping could help prevent U.S.-China trade tensions from escalating further. This diplomatic dynamic comes at a crucial time as Microsoft expands AI integration in Windows 11, demonstrating how technology advancements continue despite geopolitical complexities.

Broader Technology Sector Developments

Beyond the immediate market movements, several industry developments are shaping the technology landscape:

- Security challenges continue to evolve, particularly as evidenced by the ongoing WordPress security crisis where hackers exploit thousands of vulnerabilities.

- Streaming media distribution is undergoing transformation, with Apple’s F1 streaming coup signaling major shifts in sports content acquisition strategies.

- Industry developments in the political sphere include reports of Elon Musk funding UK political figures, highlighting the increasingly complex relationship between technology leaders and global politics.

Market Outlook and Strategic Considerations

As the AI investment theme continues to dominate market sentiment, analysts are watching several key indicators for sustainability. The concentration of gains in technology stocks raises questions about market breadth, while the substantial investments in data infrastructure suggest long-term commitment to AI development.

The convergence of strong bank earnings, progressing trade negotiations, and technological innovation creates a complex but generally positive backdrop for investors. However, market participants should remain attentive to potential volatility as these major trends interact with broader economic conditions and related innovations that continue to emerge across the technology sector.

Looking ahead, the integration of AI across multiple industries appears poised to continue driving market trends and investment patterns, though the specific manifestations of this transformation will likely evolve as technology capabilities advance and regulatory frameworks develop.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.